Holders Of 294 Nouns NFTs Choose To Redeem Treasury Stakes After Breaking Away From NounsDAO

Nouns, a highly influential and well-funded NFT project, has been cleaved in half, with many large holders opting to leave the project completely after a series of governance maneuvers.

First came a fork, which was completed on Friday — 472 Nouns, NFTs which grant membership to the NounsDAO, voted to split off and create a new decentralized organization with a pro-rata share of the project’s nearly $50M treasury.

Then, over the last three days, over 60% of the defectors redeemed their NFTs for nearly $50,000 worth of assets per token. That’s well over $14M in total which left the new fork’s treasury, leaving it with nearly $11M.

The original DAO’s treasury is worth $22.8M as of Sept. 19. It also holds the original Nouns NFTs. Holders who opted to leave were required to leave the tokens in the treasury in exchange for a new Nouns token. Unlike the new DAO, NounsDAO doesn’t offer a ‘rage quit,’ option.

It’s a confusing shuffle.

At the end of the day, however, this could be considered a favorable outcome for most stakeholders, Maria Shen, general partner at venture firm Electric Capital, told The Defiant.

“Allowing people to fork is really kind of beautiful,” she said. “No one’s being held hostage.” The investor added that the fork functionality makes it so those who chose to stick around the original DAO are likely to be more aligned in terms of the organization’s direction.

It’s also noteworthy that the majority of members chose to stick with the original DAO, with the fork pushed forward by a few large Nouns holders. Indeed, just five people redeemed 152 Nouns, representing over half the defections.

Toady Hawk, another Noun who decided to stick with the original DAO, said they were optimistic about the organization’s post-fork direction. “I think it’s a great opportunity for the DAO,” they said on friend.tech.

“The clickbait titles say ‘50% of the DAO left,’ but that’s not really the truth of the matter. 50% of the Nouns tokens did get forked, but two-thirds of original holders remain.”

Nouns launched in 2021 with distinct mechanics — instead of a drop of 10,000 tokens as was typical at the time, one Noun would become available for bidding each day. The ETH from the winning bid would go into the NounsDAO treasury and the auction winner would gain voting rights over that treasury.

The Nouns treasury has been one of the most active in crypto — NounsDAO has funded 158 initiatives, according to Nouns.center. These projects range from an episodic movie to an analytics dashboard and augmented reality filters.

Profligacy Concerns

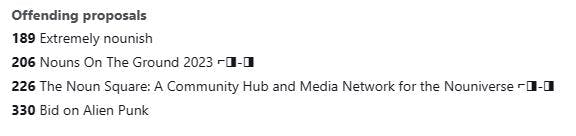

Many of those who elected to leave the DAO consider the spending to have gone too far. On a page listing Nouns which decided to fork, many cited proposals to buy an Alien CryptoPunk, costing millions of dollars, as “offending proposals.”

0xhindsight.eth, who joined the fork with Noun 501, says that many of the most engaged members of the DAO are leaving thanks to the organization’s lack of direction.

“70%-plus of Nouns that are active and have contributed to the treasury are being forked,” they claim. “This is not great. And yet despite this strong signal, there is no recognition, nevermind concrete discussion, of what led us here…You can’t spell cryptoeconomics without economics and any network or organization needs to provide value to those participating in it.”

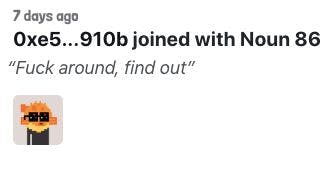

Some other forkers were more succinct.

Picking Sides

The Nouns fork is different from blockchain forks like the ones that created Bitcoin Cash and Ethereum Classic because users had to make a choice — when Bitcoin forked into Bitcoin Cash users got to keep both BTC and BCH — with the Nouns fork, users can only choose one side.

Support from at least 20% of Nouns is required to initiate a fork.

Forking is also different from a ‘rage quit’ in crypto, which generally refers to someone leaving an organization with a pro-rata share of the treasury.

“The nature of rage quitting and selling is very different,” Shen said, saying that by directly removing assets from the treasury, rage quitters hurt the organization they’re leaving from. Rage quitting also means a person doesn’t need to find a buyer for their assets, as the treasury is programmed to accept redemptions.

While both DAOs are grappling with reduced treasuries, one major takeaway from the fork is that Nouns’ relatively simple mechanics have given rise to a complex system.

Applications which serve as building blocks for other projects have tended to cement themselves in the crypto space — Uniswap has attracted a myriad of projects and strategies built on top of its decentralized exchange.

The Nouns fork may be another example of the growing functionality of the Nouns ecosystem.

Policy Differences

Shen pointed out that there’s a distinct difference between the two DAOs.

“Even though you had the majority of Nouns decide to join the fork you actually had the majority of wallets decide to stay with the original DAO,” she said. Chen characterized the forking DAO as more fiscally conservative than the original DAO but added that nuances exist within both organizations.

The pseudonymous Noun 40 steadfastly maintains that the original NounsDAO has received a good return on its spending.

Credit: Source link