Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Following the recent Bitcoin halving, a notable trend has emerged on the crypto market, drawing attention to the actions of undisclosed entities. In the aftermath of the halving event, which reduced the rate of new Bitcoin issuance by half, unidentified actors have executed significant transactions, prompting speculation regarding their motives and influence on the market.

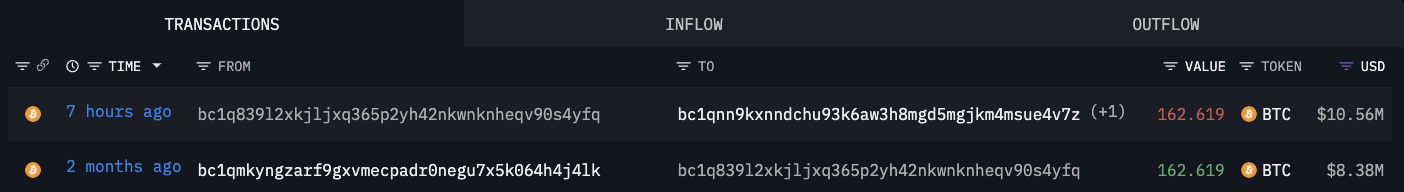

One such transaction involved the transfer of 162,419 BTC, valued at approximately $10.56 million, between addresses “bc1q839” and “bc1qnn.” Of particular interest is the lack of transaction history associated with the latter address, indicating its recent establishment, while the sender’s address has been involved in previous transactions but with unknown origins.

Despite these sizable transfers, the overall market response has been relatively stable, with Bitcoin maintaining a trading price exceeding $66,000. This resilience suggests a cautious approach among investors, awaiting further developments before making significant market moves, but with a slight bullish bias.

Bitwise has provided historical data indicating a pattern of short-term volatility following halving events, coupled with long-term price appreciation, albeit to varying degrees. This trend reflects Bitcoin’s evolving status as a mature asset, with each halving event contributing to a gradual reduction in market volatility.

As speculation continues regarding the motives behind these transactions, market participants remain on alert, monitoring for any potential shifts in the cryptocurrency market.

Credit: Source link