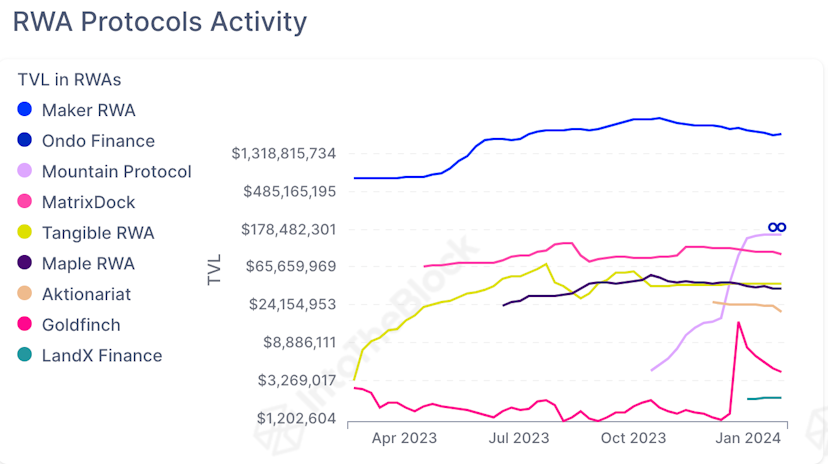

Mountain is also the third-largest RWA protocol by total-value locked.

A new contender has quickly climbed the real-world assets ranks.

Just four months after its September launch, Mountain Protocol’s stablecoin has become the second-largest asset in the U.S. Treasury-backed sector, and the largest Treasury-backed stablecoin, according to rwa.xyz.

Upstart USDM’s market capitalization of $153 million trails only Franklin Templeton’s OnChain U.S. Government Bond Fund, which has a market cap of $331 million. Franklin Templeton is a U.S.-based asset manager with over $1 trillion in holdings.

Mountain Protocol also jumped in terms of Total-Value Locked. In a couple of months it leapfrogged five protocols to become the third-largest RWA platform by TVL after MakerDAO and Ondo Finance, according to IntoTheBlock.

USDM’s key feature is that it currently returns 5% APY to its holders. This yield is generated through short-term U.S. Treasuries, which back the stablecoin.

The quick rise of Mountain Protocol is a sign that DeFi traders continue to look for ways to squeeze the most yield out of their assets. Tokenized versions of U.S. Treasuries are offering a way to do that – at least for now.

Martin Carrica, Mountain Protocol’s co-founder, says USDM provides a new take on the stablecoin, which is better suited towards the current economic environment.

“In every economy with an interest rate, you have a high-yield checking account product and it is a no-brainer to switch into that,” he told The Defiant in an interview. “We started Mountain Protocol to allow for that opportunity in crypto.”

“Real-world assets” are tokenized versions of assets not native to blockchains. A subset of RWAs, assets representing U.S. Treasuries, has done particularly well with a market cap of $859 million, according to rwa.xyz. The subsector grew by a factor of over seven in 2023.

Start for free

Large Incumbents

The largest stablecoins in crypto, USDT, USDC, and DAI, all launched when U.S. interest rates were close to 1%. Together, the three dollar-pegged assets make up 93.5% of stablecoins, according to CoinGecko.

Aside from contending with incumbents like USDT, USDM is also competing with institutions offering non-blockchain-enabled ways to take advantage of higher rates.

Higher interest rates can serve as a magnet pulling people away from crypto, as investors trade their stablecoins to get Treasury-fueled yields from traditional finance.

Mountain Protocol’s USDM aims to reduce that flight by passing on that Treasury yield to users.

Meanwhile, other stablecoin issuers, which also back their tokens with U.S. government notes, keep the return on those bonds to themselves.USDT’s issuer Tether generates hundreds of millions of dollars per quarter in part thanks to its U.S. Treasury holdings.

There are also other stablecoins like USDY from Ondo Finance, which pass on U.S. Treasury yields to holders. With a market capitalization of $4.1M, USDY trails USDM by a significant margin.

Nuts and Bolts

The startup raised an undisclosed amount of venture capital in a seed round led by Nic Carter of Castle Island Ventures, with participation from Coinbase Ventures, New Form Capital and others.

Mountain Protocol has registered with the Bermuda Monetary Authority as a Digital Asset Business, a legal designation the country released in 2018.

Mountain splits its users into two broader buckets, “primary users,” and “secondary Users.” Primary users have an account with Mountain and can interact directly with the project to exchange USDC for USDM. Secondary users can only acquire USDM through DeFi exchanges or through transfers from other holders.

To be sure, interest rates may not remain at highs for long — the Chicago Mercantile Exchange’s popular FedWatch tools shows that traders are betting interest rates begin to fall at the Fed’s meeting on May 1.

Carrica, for one however, believes USDM will be durable even if rates do drop by 100s of basis points. “As long as it’s above 1% we’re good,” he said. The co-founder thinks rates will normalize at between two and four percent.

Future Plans

Looking forward, Carrica is considering many different avenues for USDM’s growth. He mentioned derivatives protocols, which often have a stablecoin used as margin, as a place where USDM could become a go-to option in DeFi.

That said the Mountain co-founder highlighted that DeFi isn’t where most of USDT and USDC is held.

“DeFi is only a very small portion of their holdings of USDC and USDT,” he said, adding that externally owned accounts (EOAs), typically controlled by individual crypto users, and centralized exchanges are the biggest holders of the two largest stablecoins.

Carrica said that a major focal point for USDM is in real world payments, a sector currently dominated by USDT on Tron.

While Mountain is facing strong incumbents, the thesis is straightforward to Carrica.

“I think every dollar that is not earning yield, should earn yield,” he said.

Credit: Source link