The critical role that Nvidia (NASDAQ: NVDA) plays in the proliferation of artificial intelligence (AI) technology thanks to the massive computing power of its graphics processing units (GPUs) explains why the company witnessed an outstanding surge in its revenue and earnings in recent quarters.

In its recently concluded fiscal 2024, revenue was up 126% to $60.9 billion. In the current fiscal year, analysts expect another stellar revenue gain of 96% to $110.6 billion. Meanwhile, analysts expect the company’s bottom line to double this year, though it could outperform on that front, as it enjoys immense pricing power in the AI GPU market.

All of this suggests that Nvidia should be able to justify its expensive valuations. It trades at 75 times trailing earnings, but the forward earnings multiple of 35 tells us just how rapidly its bottom line is expected to grow. What’s more, Nvidia’s price/earnings-to-growth ratio (PEG ratio) stands at just 0.13. A PEG ratio of less than 1 is viewed as indicating that a stock is undervalued with respect to the growth it is expected to deliver.

However, cautious investors who have doubts about Nvidia’s growth story may not be comfortable buying it at these valuations after the 225% surge that the stock saw in the past year. But for investors looking to buy a value play in the AI space right now, Dell Technologies (NYSE: DELL) looks like an ideal stock pick.

Dell Technologies has a couple of solid AI-related catalysts

Dell’s business consists of two segments. The first is infrastructure solutions, through which the company sells storage and server solutions along with networking products and services. The second segment is client solutions, which includes sales of workstations, personal computers (PCs), and other peripherals.

The good news for Dell investors is that both these segments are on track to win big from the rising adoption of AI.

The company’s infrastructure business is getting a nice bump from sales of AI servers, which are used for mounting chips from Nvidia and others. In the fourth quarter of Dell’s fiscal 2024 (which ended Feb. 2), its infrastructure solutions segment delivered $9.3 billion in revenue. Though that was a drop of 6% year over year, it was a gain of 6% sequentially thanks to the growing demand for AI-optimized servers.

Dell shipped $800 million worth of AI servers during the quarter, and that metric is likely to head higher as orders for AI servers increased 40% sequentially last quarter, boosting Dell’s AI server backlog to $2.9 billion. Its AI server-related order book should keep getting fatter — according to a forecast from Global Market Insights, the AI server market’s revenue will jump from $38 billion in 2023 to $177 billion in 2032.

The company is already witnessing a “strong interest in orders” for next-generation chips from Nvidia and Advanced Micro Devices, which is another indication that its AI-specific server orders are set to move higher.

Similarly, Dell expects the advent of AI to drive a turnaround in its client solutions business as well, which has been under stress thanks to declining PC sales. Client solutions revenue was down 12% year over year in the fiscal fourth quarter to $11.7 billion. However, the sequential decline was just 5%.

“PCs will become even more essential as most day-to-day work with AI will be done on the PC,” Dell COO Jeffrey W. Clarke said on the Feb. 29 earnings call. The company already announced a new lineup of commercial PCs with integrated AI functionalities to capitalize on this opportunity. This is a smart thing to do, as shipments of AI-enabled PCs are expected to take off this year.

Market research firm Canalys predicts that AI-enabled PC shipments will hit 48 million units in 2024, 100 million units in 2025, and 205 million units in 2028. Canalys also points out that AI PCs are likely to carry price premiums of 10% to 15% over traditional PCs. Given that Dell is the third-largest PC original equipment manufacturer and controlled just over 15% of this market in 2023, it is positioned to benefit from this fast-growing niche.

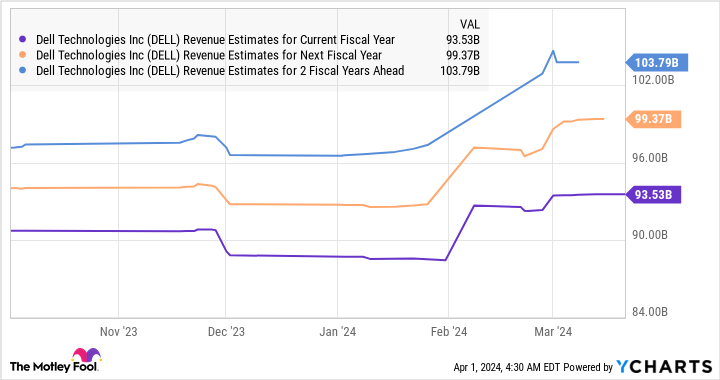

These AI-related catalysts explain why analysts have been significantly raising their revenue growth expectations for Dell of late.

The valuation and the potential upside make this stock a good buy right now

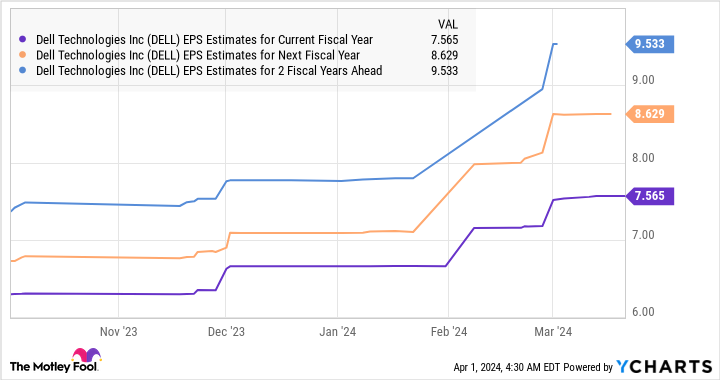

Dell’s top-line performance is anticipated to improve over the next three fiscal years, and that revenue growth is expected to filter down to the bottom line as well.

Dell is currently trading at just under 25 times trailing earnings. Its forward earnings multiple is even cheaper at 15.7. For comparison, the tech-heavy Nasdaq-100 index has a trailing earnings multiple of 31 and forward earnings multiple of 27. Assuming the company does achieve $9.53 per share in earnings in fiscal 2027 and trades at 27 times earnings at that time (using the Nasdaq-100’s forward earnings multiple as a proxy for tech stocks), its stock price could jump to $257 in three years.

That would be a 100% jump from current levels. Dell has already gained 210% in the past year, but don’t be surprised to see this tech stock deliver eye-popping gains in the future as well thanks to its improving AI credentials. That’s why investors looking to buy a growth stock that’s not ridiculously expensive should consider adding Dell Technologies to their portfolios before it surges higher.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 1, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Missed Out on Nvidia’s Incredible Surge? This Could Be the Next Big Artificial Intelligence (AI) Stock, With Potential Gains of 100%, and It Is Incredibly Cheap Right Now was originally published by The Motley Fool

Credit: Source link