Generative artificial intelligence (AI) technology is expected to positively impact multiple industries in the long run, creating a massive annual revenue opportunity worth $1.3 trillion in 2032, according to Bloomberg Intelligence.

Nvidia has been the go-to stock for investors looking to capitalize on this lucrative market. Shares of the company have jumped 205% in the past year as the solid demand for its graphics cards has led to a terrific increase in its revenue and earnings. That’s not surprising as Nvidia’s graphics processing units (GPUs) form the basic building blocks for training AI applications because of their immense computing power.

As it turns out, the demand for Nvidia’s graphics cards is so strong that customers are reportedly waiting for as long as a year to get their hands on the company’s hardware. Not surprisingly, Nvidia is expected to deliver another year of terrific growth and its stock could keep rising thanks to the company’s dominant share of the fast-growing AI chip market.

However, certain investors may think that they have missed the Nvidia gravy train because of the expensive valuation it trades at. The company’s price-to-sales ratio of 37 and the trailing earnings multiple of 87 are not in value territory. However, investors can buy chipmaker Skyworks Solutions (NASDAQ: SWKS), which is known for supplying chips for Apple‘s iPhones, at a much cheaper valuation.

Let’s see how AI could supercharge Skyworks stock.

Skyworks Solutions is sitting on a red-hot AI opportunity

Skyworks Solutions sells radio frequency (RF) semiconductors that are deployed in multiple markets ranging from automotive to aerospace to defense, but smartphones are its bread and butter. Apple is Skyworks’ biggest customer as the iPhone maker produced 66% of its total revenue in the previous fiscal year.

Too much reliance on a single customer isn’t a good thing, which is evident from the tepid top- and bottom-line performance Skyworks delivered in fiscal 2023 (ended Sept. 29, 2023). Apple’s smartphone shipments increased just 3.7% in 2023 in a tough smartphone market, and Skyworks bore the brunt of this modest growth as its fiscal 2023 revenue fell 13% during the year to $4.77 billion.

Skyworks’ performance in the first quarter of fiscal 2024 (which ended on Dec. 29, 2023) wasn’t great either. Its revenue fell 10% year over year to $1.2 billion. The chipmaker’s non-GAAP diluted earnings were down to $1.97 per share from $2.59 per share in the preceding year. Additionally, Skyworks’ revenue guidance of $1.02 to $1.07 billion for the current quarter points toward a 10% drop from the year-ago quarter at the midpoint.

All this explains why Skyworks stock has dropped almost 11% in the past year, underperforming the broader semiconductor sector by a wide margin. However, the adoption of generative AI-enabled smartphones could turn out to be a tailwind for Skyworks Solutions and help turn the company’s business around.

Various estimates suggest that the generative AI smartphone market is set to gain impressive traction. Market research firm Counterpoint Research forecasts that sales of generative AI smartphones could reach 100 million units this year. By 2027, the size of this market is predicted to increase to 522 million units. In all, a total of 1 billion generative AI smartphones are anticipated to be sold during this period.

On the other hand, investment bank UBS expects generative AI smartphone shipments to increase from 50 million units last year to 583 million units in 2027. It is worth noting that UBS says that generative AI smartphone penetration will stand at 46% in 2027, which means that this market will still have a lot of room for growth.

Apple, which was the top smartphone original equipment manufacturer (OEM) globally last year with a 20.1% market share, is in a solid position to make the most of this fast-growing opportunity. Apple sold just over 234 million smartphones last year. The company’s annual shipments could jump significantly to 460 million units in 2027 if it manages to increase its share of the smartphone market to 25%, driven by the integration of AI features into its upcoming iPhone.

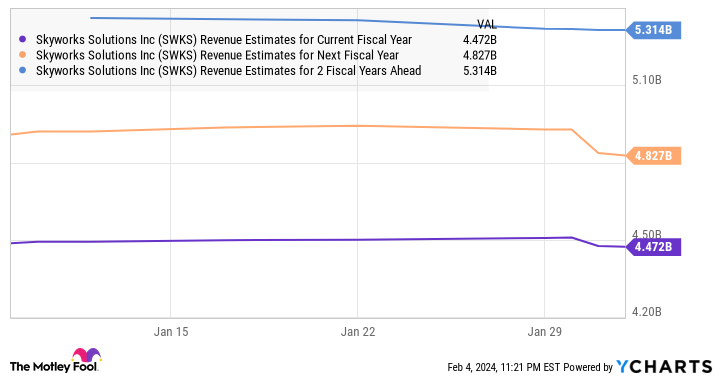

Given Skyworks’ tight relationship with Apple, the chipmaker could ride the coattails of its largest client and return to growth. This is exactly what analysts anticipate from Skyworks over the next fiscal years.

A couple of solid reasons to buy the stock

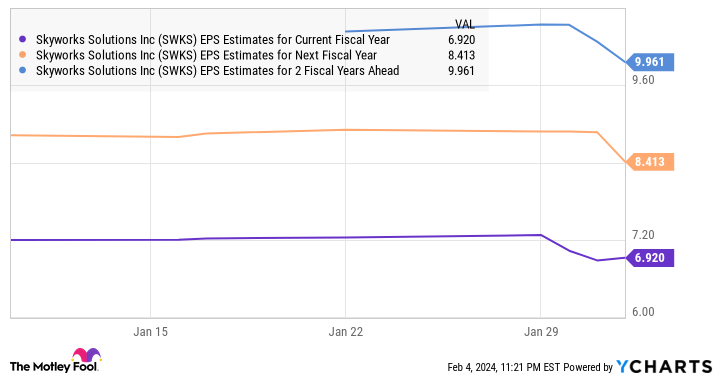

As the chart above indicates, Skyworks’ revenue is anticipated to start growing from fiscal 2025, followed by an acceleration in fiscal 2026. The top-line improvement is expected to lead to stronger earnings growth as well.

Skyworks sports a five-year average earnings multiple of 19. Assuming a similar earnings multiple in 2026, Skyworks’ stock price could jump to $189 if it indeed hits the $9.96 earnings-per-share estimate seen in the chart above. That would be an 87% increase from current levels.

Given that Skyworks stock is currently trading at just 18 times earnings right now, savvy investors would do well to buy this potential AI winner before it starts soaring.

Should you invest $1,000 in Skyworks Solutions right now?

Before you buy stock in Skyworks Solutions, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Skyworks Solutions wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 5, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool recommends Skyworks Solutions. The Motley Fool has a disclosure policy.

Missed Out on Nvidia? Buy This Incredibly Cheap Artificial Intelligence (AI) Stock That Could Jump 87% Thanks to a Red-Hot Opportunity was originally published by The Motley Fool

Credit: Source link