Nvidia (NASDAQ: NVDA) has been one of the hottest stocks on the market in 2024, with shares of the chipmaker registering stunning gains of 70% so far this year as its artificial intelligence (AI)-fueled growth shows no signs of stopping.

Nvidia’s revenue and earnings are topping Wall Street expectations. Even better, Nvidia is expected to sustain its impressive growth going forward thanks to its 90%-plus share of the AI chip market and an aggressive product roadmap. The company is set to launch even faster AI graphics cards that will allow its customers to train even bigger large language models (LLMs).

The stock’s terrific surge also goes some way toward explaining why it is now trading at 74 times trailing earnings. That’s substantially higher than the Nasdaq-100‘s trailing earnings multiple of 30 (using the index as a proxy for tech stocks). Still, there is a good chance that Nvidia will be able to justify its valuation thanks to the solid growth opportunities it is sitting on. The stock looks cheap when we consider the projected growth that it may deliver.

Even then, value-oriented investors are likely to look for alternatives to Nvidia so that they can capitalize on the AI chip’s market growth without having to pay an expensive valuation. This is where Broadcom (NASDAQ: AVGO) comes in. Let’s see why this chipmaker could turn out to be a solid Nvidia alternative for investors looking to benefit from the AI boom.

Broadcom’s AI-related revenue is growing at a faster-than-expected pace

In the first quarter of fiscal 2024 (which ended on Feb. 4), Broadcom reported total revenue of $11.9 billion, an increase of 34% from the year-ago period. Excluding the revenue contribution from VMware, which Broadcom fully acquired in November 2023, the company’s revenue increased 11% year over year on an organic basis.

That points toward an acceleration in Broadcom’s growth, considering that it ended fiscal 2023 with organic revenue growth of 8%. AI played a key role in accelerating Broadcom’s growth last quarter. The company sold $2.3 billion worth of AI chips in Q1 of fiscal 2024, a 4x increase over the prior-year period. Broadcom’s AI revenue displayed a significant jump from $1.5 billion in the fourth quarter of fiscal 2023.

The company now forecasts at least $10 billion in AI revenue in fiscal 2024, which would represent a quarter of its estimated revenue of $50 billion for the full year. Analysts were originally expecting Broadcom to end the year with $8 billion in AI-related revenue this year. However, the company seems to be benefiting from an increasingly strong demand for custom AI chips.

Major cloud computing companies are opting to make application-specific integrated circuits (ASICs) for powering their AI servers in a bid to reduce costs and boost efficiency. These companies are turning to Broadcom to make those custom chips. Meta Platforms and Alphabet are already its customers, and Broadcom recently revealed that it has won an additional customer for its custom AI processors.

According to Morgan Stanley, custom chips could make up for 30% of the overall AI chip market by 2027 and produce an estimated $55 billion in annual revenue. This explains why Japanese investment bank Mizuho is forecasting Broadcom’s AI-related revenue to increase to $20 billion a year by 2027. That won’t be surprising as, according to JPMorgan, Broadcom enjoys a 35% share of the high-end market for ASICs.

Healthy bottom-line growth could send the stock higher

Broadcom stock has jumped nearly 19% in 2024. However, investors who haven’t bought the stock yet should consider doing so soon, as it seems built for more upside considering the potential earnings growth it could deliver.

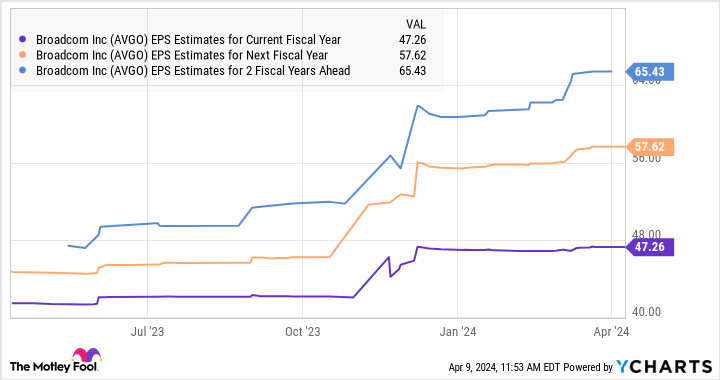

The chip stock is currently trading at 29 times forward earnings, which is lower than the Nasdaq-100’s earnings multiple of 30. Assuming Broadcom trades at 30 times earnings after three years and achieves $65.43 per share in earnings, as the chart indicates, its stock price could jump to $1,963. That would be a 48% increase from current levels.

However, Broadcom could deliver even stronger gains, as its earnings could increase at a faster pace thanks to the growing demand for custom AI chips. That’s why investors looking for an attractively valued AI stock that could deliver healthy appreciation should consider buying it before it jumps higher.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, JPMorgan Chase, Meta Platforms, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Missed Out on Nvidia? 1 Artificial Intelligence (AI) Growth Stock to Buy Before It Jumps 48%, at Least. was originally published by The Motley Fool

Credit: Source link