Overview

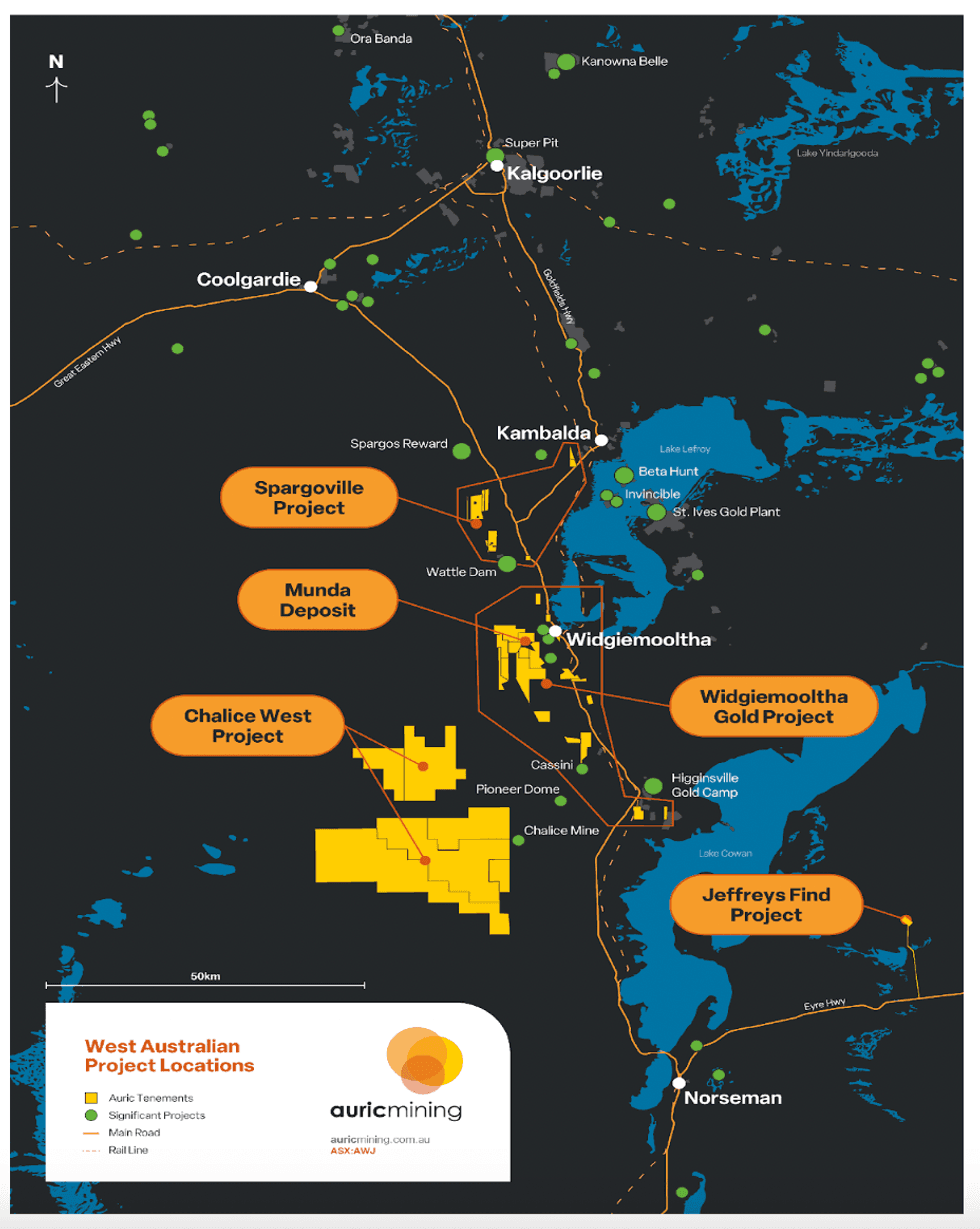

Auric Mining Limited (ASX:AWJ) is a gold exploration and mining company based in Western Australia. In less than three years since its ASX listing, Auric has become a gold producer in this premier jurisdiction, commencing production at its Jeffreys Find Project in May 2023.

Since floating, it has moved from zero to 250,000 ounces of gold resources and zero to 640 square kilometers of tenements. Auric Mining is in the company of some of the biggest gold projects in the Goldfields, including the St Ives Gold Mine, Karora Resources’ Higginsville Operations & Beta Hunt Mine, all multi-million-ounce mines.

Besides gold, there are numerous precious metals being mined in the area with world-class deposits of nickel, lithium and rare earths. Auric is gold-focused and has the potential to become the next major gold producer in the region.

First blasting at Jeffreys Find in May 2023. Gold mining is underway.

Over the coming months 100,000 – 150,000 tonnes of ore will be hauled to the Greenfields Mill at Coolgardie, where it will be toll treated. Gold produced will be forwarded to the Perth Mint for final refining and sale.

Partnering with Auric in the venture is BML Ventures of Kalgoorlie (BML), a well-known and adept Kalgoorlie contractor. After completing the initial pit, the partners will subtract all costs before splitting the surplus proceeds on a 50:50 basis. This will provide Auric with a substantial cash boost.

Gold ore on the ROM Pad at Jeffreys Find. Ore is now being hauled to Coolgardie for refining.

Once the first phase is complete, BML will move to a deeper open-pit mine in 2024. The project life is short and final mining will be completed within 12 to 15 months of commencement. The two parties are partially exploiting the gold deposit of nearly 50,000 ounces with an anticipated total free cash flow surplus from the project of between $15,000,000 and $20,000,000. Auric’s share is 50 percent.

Effectively, this means the company will be self-funding for the next 18 to 24 months and able to sustain a substantial exploration program without need for additional capital raising.

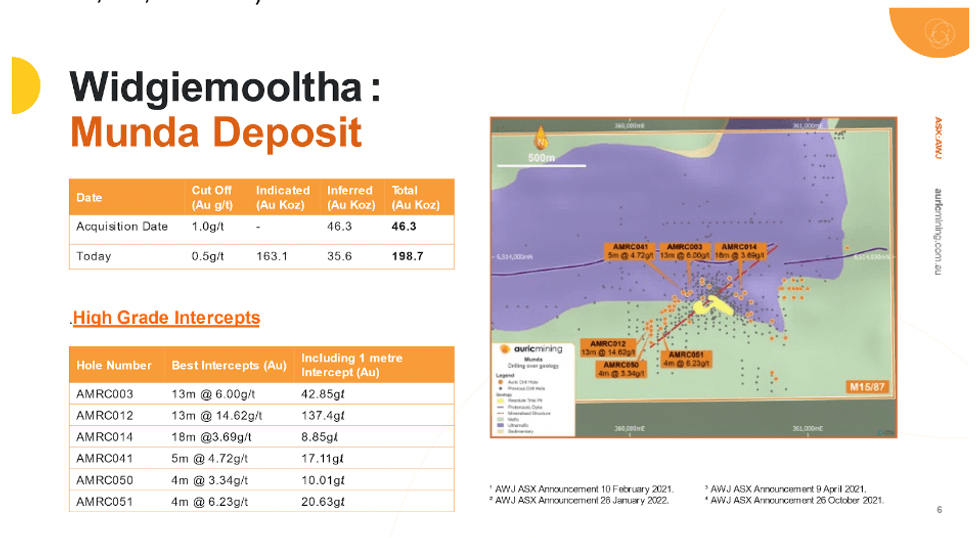

Auric’s primary focus, however, remains on the company’s flagship asset – The Widgiemooltha Gold Project, which includes the Munda Gold Deposit.

To date, almost 200,000 ounces of gold resources have been identified. The asset is part of the Widgiemooltha Gold Project, which encompasses 20 tenements.

Munda has the potential to become a major gold project. To that end, the company has just released to the ASX an independent third-party scoping study on the economics and potential of open-pit mining.

The scoping study highlights the mining of up to 120,000 ounces of gold over a three-year mine life. It is envisaged gold ore would be mined at a nearby gold mill. The study projects profits of between $50 million and $100 million, based on various gold prices. Mining could occur as early as 2025.

Auric Mining has been very active on the exploration front, conducting an inaugural drilling program at The Chalice West Project, highly prospective for gold, nickel and rare earths, in the Widgiemooltha-Higginsville area. In all, 227 holes were drilled as the company further defines the gold imprint of the tenement. Final results also indicate widespread, thick clay-hosted mineralization of rare earth elements.

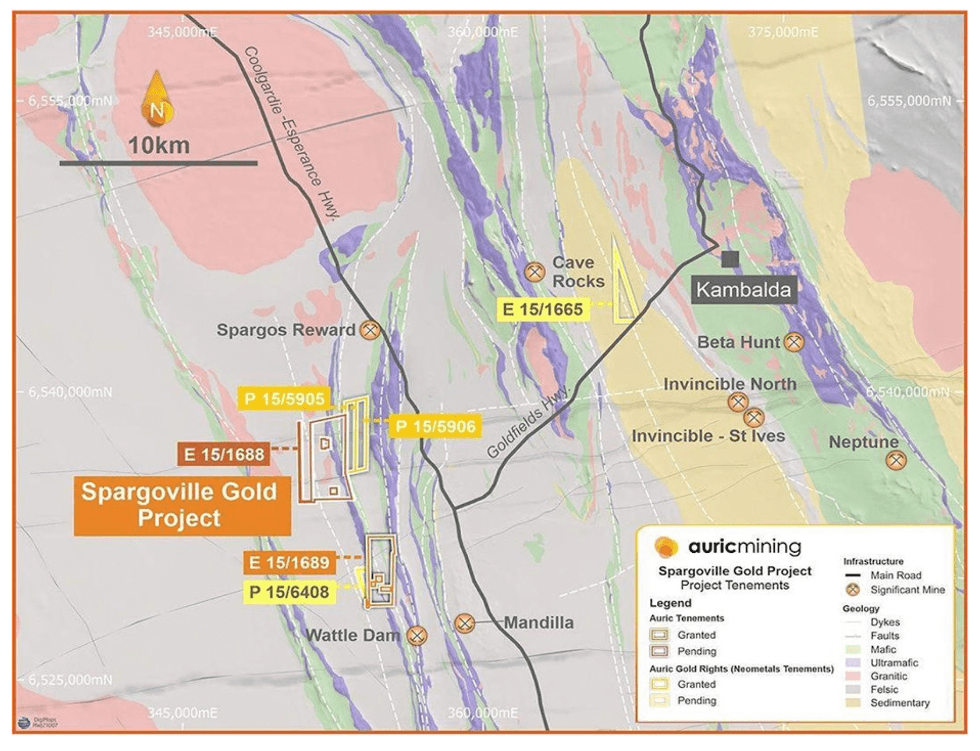

Auric is also progressing with its Spargoville Project, where it has tenements ideally positioned along strike from the Wattle Dam gold mine, which produced 268,000 ounces at 10 g/t gold between 2006 and 2013.

An experienced and savvy management team leads Auric Mining towards its vision of becoming a significant gold producer in Western Australia. With the directors owning 16 percent of the company, they are focused and motivated for success.

Auric Mining’s board of directors: Mark English, Managing Director; Steve Morris, Chair; and John Utley, Technical Director

Steve Morris, non-executive chairman, has more than 25 years of experience in financial and natural resources markets. Mark English, managing director, has a 40-year career as a chartered accountant and is at ease with all facets of running a junior explorer on the ASX including major equity and debt raisings. John Utley, technical director, has 35 years of experience in gold exploration and development. This range of expertise offers a high level of confidence that the company will achieve its goals.

Company Highlights

- Auric Mining is a publicly listed company that has current gold resources of 250,000 ounces – with 200,000 ounces at its flagship asset, The Munda Gold Deposit, near Widgiemooltha, 600 kilometers from Perth.

- Elsewhere, it has commenced mining at its Jeffreys Find Gold Mine, near Norseman, where it is partially exploiting nearly 50,000 ounces of gold resources and hopes to recover around 20,000 ounces over the coming 12 to 18 months.

- The first gold ore will be processed through the mill at Coolgardie in July 2023 and cash flow is expected shortly.

- In the first stage of mining, 120,000 to 150,000 tonnes of ore will be sent for milling where it is expected to yield around 1.7g/t.

- The Company aims to be self-funding through the end of 2024.

- Risk is mitigated at the Jeffreys Find Gold Mine with Auric’s JV partner, BML Ventures of Kalgoorlie bearing all mining and day to day operational costs and working capital expenses.

- As the first phase of mining the initial pit comes to an end in the third quarter of 2023, both Auric and BML have agreed to a cash split of surplus funds, after costs and a retention of working capital for the final pit, on a 50:50 basis.

- As an explorer, Auric has accumulated 640 square kilometers of tenure as it searches for a million ounces of gold between Kalgoorlie and Norseman.

- The area hosts some of the richest mineral deposits and mines in the world. In addition to gold, Auric also has opportunities for discovery of rare earths and nickel.

- Auric has four main projects: The Widgiemooltha Gold Project, which incorporates the Munda Gold Deposit; Jeffreys Find Gold Mine; The Chalice West Project, and The Spargoville Project.

- The company has a board and leadership team with a track record of delivering success for shareholders, particularly in discovering and bringing to production gold projects.

Key Projects

Widgiemooltha Gold Project

Just released scoping study projects the mining of 100,000+ ounces from the Munda Gold Deposit. The study projects profits above $50 million through to $100 million.

Progression to open-pit mining is gathering momentum.

This flagship asset contains 20 tenements of highly prospective gold country near Widgiemooltha and includes the Munda Gold Deposit. Since acquiring the Munda tenement drilling results confirm indicated and inferred gold resources of almost 200,000 ounces (4.48 mt @ 1.38 g/t with 0.5 g cut off).

The tenements have substantial coverage at the north end of the Widgiemooltha Dome.

Even with the extensive mining history in the area, considerable exploration prospectivity remains. Several significant gold projects discovered or developed in the past ten years, including:

- Karora Resources (TSX:KRR); Higginsville Gold Operations (resources of 38.08 Mt @ 1.7 g/t for 2,015,000 ounces gold);

- Karora Resources; Beta Hunt (resources of 29.32Mt at 2.5g/t for 2,403,000 ounces gold); and

- Astral Resources (ASX:AAR); Mandilla Project (resources of 30.0Mt @ 1.1g/t for 1,030,000 ounces gold).

Auric Mining is now fast-tracking development opportunities at Munda and has just released to the ASX an independent scoping study on open pit mining. With a number of gold processing mills in the vicinity, the move to production is a realistic prospect. Further drilling is in the works as the company looks to increase the size of the resource.

According to the scoping study at gold prices from AUD$2,400 to AUD$2,800/oz, the Production Target for the Project ranges from approximately:

• 1.67Mt at 2.2g/t producing 112.0koz gold, to

• 2.18Mt at 1.9g/t producing 129.1koz gold.

The Production Target generates an undiscounted accumulated cash surplus after payment of all working capital costs, but excluding pre-mining capital requirements, of approximately $54.7 million to $101.4 million.

Mining is contemplated over an approximately 3-year period (13 calendar quarters).

Pre-mining capital and start-up costs are estimated to be approximately $0.8 million to $1.7 million.

Working capital requirements of approximately $3.9 million to $8.1 million were estimated based on a Stage 1 starter pit design which would have a mine life of less than 3 months.

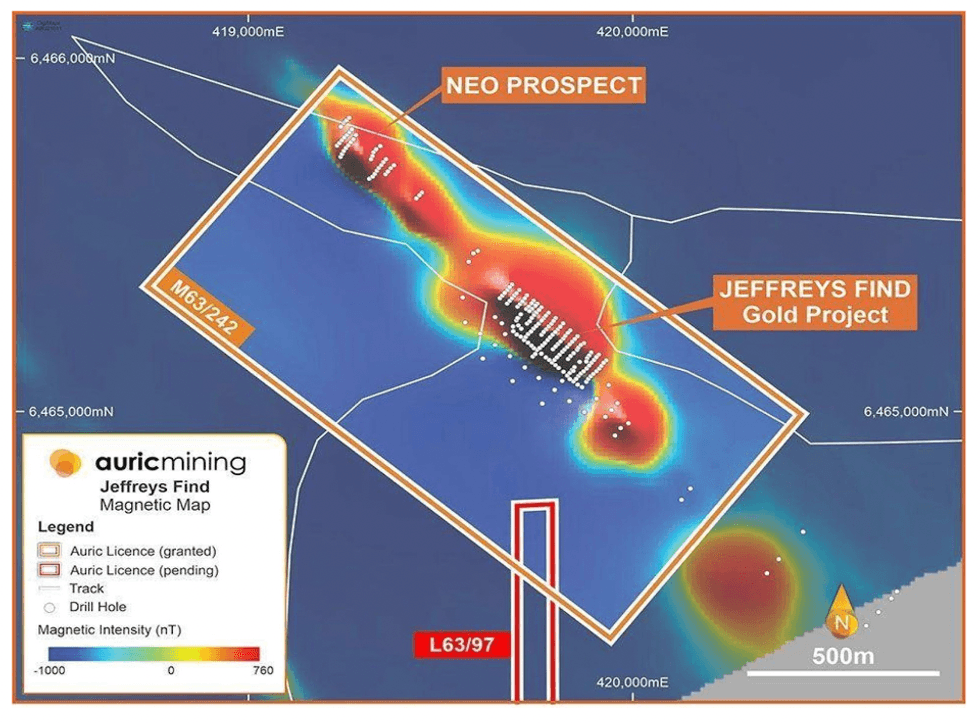

Jeffreys Find Gold Mine

Gold mining underway as partners look to recover 6,000 to 8,000 ounces in first-phase pit with maiden gold pour expected towards the end of July 2023.

The Jeffreys Find Gold Mine is located approximately 45 kilometers northeast of the town of Norseman and 12 kilometers off the main Eyre Highway.

Jeffreys Find is a short life mine with a total gold resources estimate of nearly 50,000 ounces.

Work on the project has steadily advanced during the past year and gold mining is now underway making it a world-class progression to production.

The project is a joint venture undertaking between Auric and well-known Kalgoorlie contractor BML Ventures (BML).

BML will initially be mining and hauling 100,000 to 150,000 tonnes of ore from Jeffreys Find to Coolgardie, where it will be toll treated at the Greenfields Mill. Gold produced will be forwarded to the Perth Mint for final refining and sale. Around 6,000 ounces to 8,000 ounces of gold will be produced from the initial pit.

An independent scoping study conducted in the middle of 2022 projected a gold yield of 1.3g/t to 1/7g/t with gold thickest near the surface.

Sizeable cash flow will be generated from the project with estimates ranging from 19,000 to 22,000 ounces of gold to be produced during an 18 to 24 months mine life.

The initial pit takes shape at Jeffreys Find Gold Mine

Magnetic image of the gold resource at Jeffreys Find

As mining progresses at Jeffreys Find, operations remain on plan and on budget. The company expects to have the first 30,000 tons of ore to the Greenfields Mill in Coolgardie for processing by the end of July 2023.

As the first phase of mining the initial pit comes to an end in the third quarter of 2023 both Auric and BML have agreed to a cash split of surplus funds, after costs and a retention of working capital for the final pit, on a 50:50 basis.

Looking forward after the first phase is completed, both Auric and BML will move to a larger and deeper final pit in 2024.

A surging gold price has made the project highly attractive. The independent scoping study originally estimated a gold price of $2,600/oz in July 2022. It now sits around $2,850/oz and this uplift in prices adds further profits and cashflow to the project.

Auric’s Managing Director Mark English on site at Jeffreys Find

Spargoville Project

Drilling program planned as company looks for gold on strike to Wattle Dam

Located approximately 35 kilometers southwest of the mining town Kambalda, the Spargoville Project is an underexplored asset with partially tested or entirely untested nickel and gold anomalies.

The asset sits north of the Wattle Dam gold mine. The Wattle Dam gold mine produced 268,000 oz of gold at an average grade of 10 g/t between 2006 and 2013.

While only partially drilled, initial exploration results from the Fugitive Prospect include an intercept at 14 meters with a grade of 2.51 g/t gold, indicating the asset’s promising potential.

A drilling program will take place at The Spargoville Project in the second half of 2023.

The Chalice West Project

Gold and rare earth elements remain focus of exploration on 540 square kilometers of tenements.

In 2022, Auric Mining executed an option agreement to acquire The Chalice West Project. Since then, the Company has been actively exploring gold and precious minerals including nickel and rare earths.

At the end of 2022, a total of 227 holes were drilled, and another eight holes were drilled early in 2023.

The Chalice West Project is adjacent to The Chalice Mine

The inaugural program saw 145 aircore holes targeting an analogue or analogues to the Chalice Mine only 8 kilometers to the northeast which produced around 700,000 ounces of gold over seven years from 1995 at an average grade of 5.2 g/t.

The company has now expanded the definition of greenstones on the tenement and determined widespread gold anomalism potentially mirroring that of the Chalice Mine.

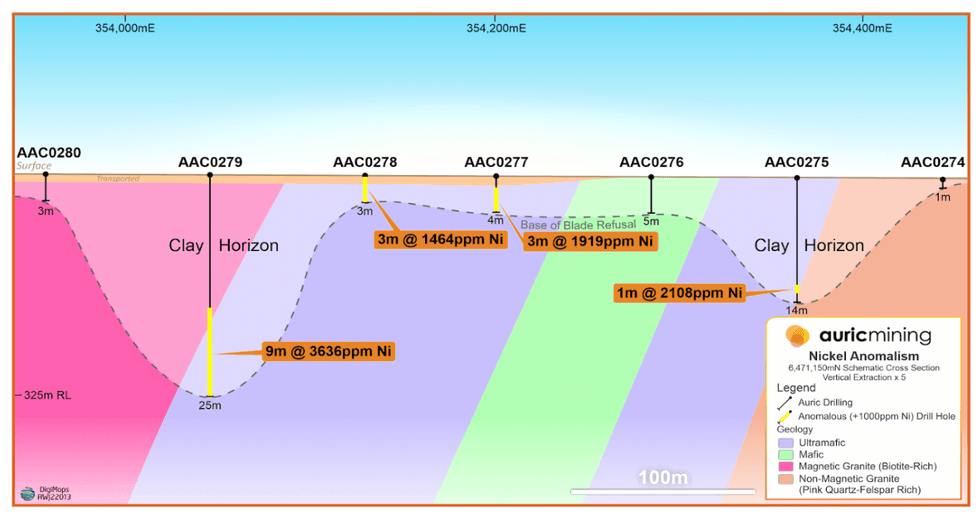

Nickel anomalies at Chalice West

Significant REE intercepts were returned for both individual 1m samples and BOH composite samples representing 25 holes.

Management Team

Auric Mining’s Management and Board of Directors have a wealth of experience in gold discovery, in mine operations and across the full spectrum of finance and administration. That experience stretches to all parts of the globe.

Board of Directors

Steve Morris – Non-executive Chairman

Steve Morris is a well-known financial markets executive with more than two decades experience at a senior level. He garnered industry respect as head of private clients for Patersons Securities, now Canaccord Genuity, and has also been managing director of Intersuisse. Mr. Morris has served as a senior executive of the Little Group. From 2014 to 2019, Morris was a non-executive director of De Grey Mining (ASX:DEG), a gold company now with a $2.4 billion market capitalization. Mr. Morris is well connected in finance circles and is vice-chairman of the Melbourne Football Club.

Mark English – Managing Director

Mark English is a Chartered Accountant with more than 40 years’ experience in business. English was the founding director of Bullion Minerals Ltd, now DevEX Resources (ASX:DEV) a company he managed for seven years before taking it to an IPO. Mr. English has considerable experience with major equity and debt raisings. He currently sits on the Board of WA integrated agricultural company Moora Citrus Group, one of the nation’s largest citrus producers and processors.

John Utley – Technical Director

John Utley has a 35-year career in mining and exploration with a dominant focus on gold assets. He holds a master’s degree in Earth sciences from the University of Waikato in New Zealand. Utley has worked in Australia, South America, Papua New Guinea and most recently in Canada where he was the Chief Geologist for Atlantic Gold Corporation, a company now owned by St Barbara (ASX:SBM). He spearheaded exploration and development of the Touquoy Gold Mine in Nova Scotia, Canada, prior to being acquired by St Barbara. Utley previously worked with Plutonic Resources (ASX:PLU) and was head of the exploration team at the Darlot Gold Mine during the discovery and development of the 2.3-million-ounce Centenary gold deposit.

Credit: Source link