The stock market soared in the first half, but the movement wasn’t exactly broad-based. A certain type of company led the S&P 500 to its increase of more than 14%.

I’m talking about technology players, especially those with a focus on artificial intelligence (AI). In fact, just four of these stocks — Nvidia, Microsoft, Alphabet, and Amazon — accounted for more than half of the index’s first-half gain, according to JP Morgan Wealth Management. Among those four, Nvidia registered the best performance by far, soaring nearly 150%.

But another AI stock actually topped the AI chip giant in the period, advancing 188%. Thanks to this company’s rising earnings and excellent performance, it recently was invited to join the S&P 500 and the Nasdaq 100.

It entered the S&P 500 in March and the Nasdaq 100 index this month. Let’s meet this new index member that topped Nvidia in the first half, and find out whether it could do the same in the second half.

Joining the S&P 500

First, it’s important to note that joining these indexes is a big deal as they include companies that power today’s economy. The S&P 500 tracks the performance of the 500 largest listed companies, while the Nasdaq 100 includes the biggest non-financial companies on the Nasdaq. If a company is invited to join these indexes, it suggests it’s done well — and should continue to play a key role in growth moving forward.

What stock am I talking about? Top performer Super Micro Computer (NASDAQ: SMCI), an equipment maker that sells servers, workstations, and full rack scale solutions needed in AI data centers.

Demand for Supermicro’s equipment has soared in recent years as companies launch AI projects and build out their platforms. Just to illustrate how far Supermicro has come, we should take a look at quarterly earnings. A few months ago, the company reported its first $3 billion quarter — as recently as 2021, this was the revenue level for an entire year.

This revenue momentum isn’t likely to stop as it’s the early days of the AI boom, and Supermicro has what it takes to keep customers coming back. Analysts predict that today’s $200 billion AI market may surpass $1 trillion by the end of the decade. In addition, Supermicro has delivered a growth rate that’s five times faster than the industry average over the past 12 months, thanks to its ability to quickly serve its customers’ needs.

Working closely with Nvidia

Supermicro’s products share many similar parts, making it easy to customize a specific piece of equipment for a particular customer. The company also works closely with the world’s top chip designers — including Nvidia — to immediately integrate its latest releases into its equipment.

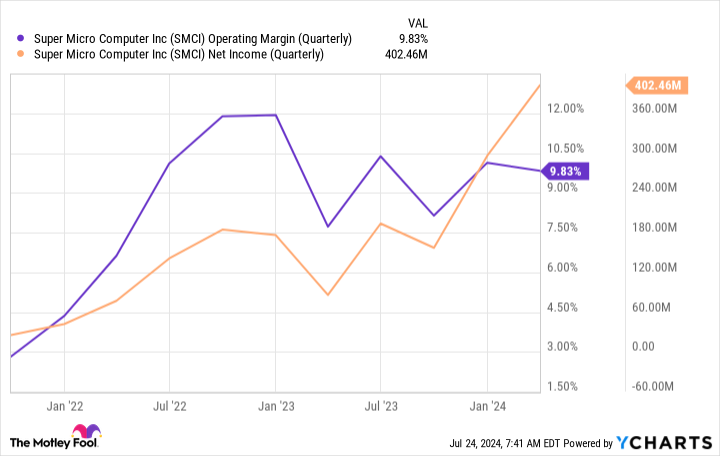

Meanwhile, Supermicro is ramping up its production capabilities by, for example, adding a new facility in Malaysia to focus on lower costs and higher volume. The company says the Malaysia factory should help boost both operating margin and net income over time, metrics that already have grown over the past few years.

All of this could keep Supermicro ahead of its rivals. On top of this, its expertise in the cooling of computational systems should serve as a new growth driver.

Supermicro makes a direct liquid cooling (DLC) system that can be added to its equipment. This technology wasn’t sought after a few years ago, but today, with AI workloads producing tremendous heat in data centers, the company’s DLC is set to take off. The company predicts liquid-cooled data centers will grow from less than 1% in the recent past to as much as 30% of all data centers within the coming two years.

Could Super Micro soar in the second half?

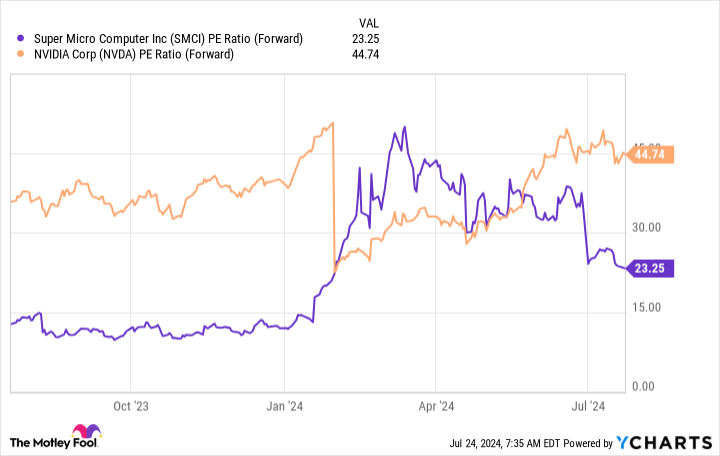

Let’s get back to our question: Could Supermicro repeat its performance and beat Nvidia in the second half of the year? It’s possible. After all, the stock is considerably cheaper than Nvidia from a forward price-to-earnings perspective, so investors looking for a bargain AI bet could favor Supermicro.

It’s impossible to accurately predict near-term share movement, and the good news for long-term investors is that it’s OK. What’s most important is a particular stock’s performance over time, such as the coming five to 10 years. And here, whether Supermicro beats Nvidia or not, it’s likely the company’s earnings will continue to climb — and that could lead to a victory for investors who buy the stock now and hold on to watch the growth story unfold.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $700,076!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, JPMorgan Chase, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the New Nasdaq 100 and S&P 500 Artificial Intelligence Stock That Topped Nvidia in the First Half was originally published by The Motley Fool

Credit: Source link