McDonald’s (NYSE: MCD) recently announced that it was ditching its artificial intelligence (AI)-powered voice ordering technology powered by International Business Machines (NYSE: IBM). Instead, the fast food giant will look to replace the technology with an alternative solution by the end of the year.

Let’s look closer at McDonald’s decision and what impact it could have on SoundHound AI (NASDAQ: SOUN), whose voice-powered AI technology has been making a lot of inroads in the restaurant space lately.

A potential McDonald’s replacement

McDonald’s decision to end its partnership with IBM for automated order-taking technology after a two-year trial comes as a surprise, as the restaurant chain sold IBM the technology powering the solution back in the fall of 2021. McDonald’s originally purchased an AI voice start-up called Apprente in 2019 and integrated it into a venture called McD Tech Labs, which it later sold to IBM. Since that deal, it has been testing the technology, which it has deployed at more than 100 locations.

The voice-ordering technology will be shut off at all locations by July 26 of this year. When the technology was first rolled out, McDonald’s said it was about 85% accurate and that it could take 80% of orders. However, with social media, some of the tech’s larger screw-ups became viral, such as it adding ketchup packets and butter to a sundae and water order.

McDonald’s chief restaurant officer Mason Smoot told franchisees the company was happy with the trial but that there was “an opportunity to explore voice ordering solutions more broadly.”

SoundHound is a potential logical choice as a replacement for IBM, as the company has gained a lot of traction in the restaurant space with its AI-powered drive-thru voice ordering technology and other industry-specific applications. These include its Smart Ordering platform, which takes orders and answers questions from inbound phone calls, as well as its Employee Assist solution, which acts as a copilot across an employee’s headset to help answer questions they may have, such as how to clean the ice cream machine.

SoundHound has struck deals with a number of large quick-service restaurant (QSR) chains, including White Castle, Jersey Mike’s, Five Guys, Noodles & Company, and Chipotle Mexican Grill, along with top restaurant fintech companies such as Toast, Olo, and Square. As such, it is certainly a viable contender to replace IBM as McDonald’s new voice AI-powered ordering technology partner.

However, SoundHound is not the only candidate. Wendy’s is using Alphabet’s Google Cloud to power its Fresh AI platform that it is testing at some of its drive-thrus. Meanwhile, QSRs such as Del Taco, owned by Jack in the Box, Rally’s, Checker’s and CKE have used solutions from companies such as Presto Automation, Hi Auto tech, OpenCity, and Valyant AI.

In fact, Alphabet could be the favorite to win the deal, as McDonald’s and Google Cloud struck an agreement last December to apply generative AI solutions across its restaurants worldwide. However, even with the Wendy’s deal, voice AI is still not Google’s core competency, and if SoundHound has the better solution, it could still win the McDonald’s deal.

Time to buy SoundHound stock?

Given McDonald’s recent deal with Google Cloud, SoundHound likely isn’t considered the favorite to win the deal, but if it does, it would help validate the company as the leader in the voice AI space, and the stock would certainly pop on the news. The fact that McDonald’s isn’t rushing into a new deal right away and looking to explore alternatives is thus good news, and SoundHound will likely get a chance to show off its technology to the fast-food giant.

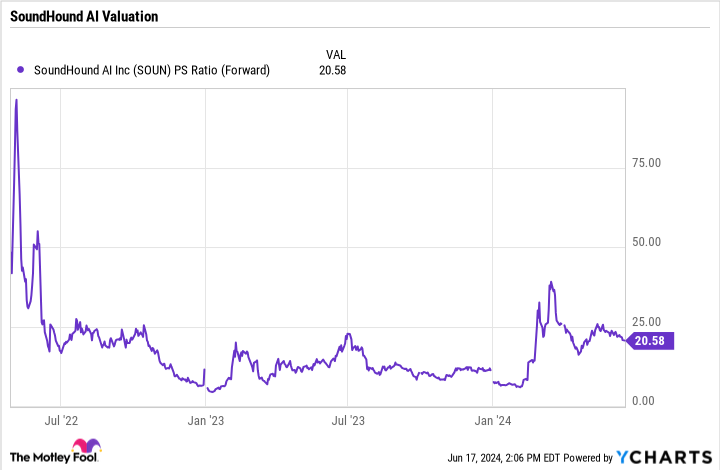

Trading at an over 20 times forward price to sales (P/S) multiple, shares of SoundHound are not cheap. However, the company has been growing its revenue rapidly, and it has built up a large backlog of business. Meanwhile, a McDonald’s super-sized catalyst could be down the road.

Opportunities like McDonald’s and the inroads it’s making into other industries and devices outside its core automobile and restaurant verticals can help the stock move from here. While SoundHound has a lot of potential, it still remains a speculative investment, given its valuation and the fact that it is still in the early innings of its growth phase. As such, any investments in this growth tech stock should be sized accordingly, given the risk.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet, Block, and Toast. The Motley Fool has positions in and recommends Alphabet, Block, Chipotle Mexican Grill, Olo, and Toast. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

McDonald’s Ditches AI Drive-Thru Voice Technology. What Could This Mean for SoundHound AI Stock? was originally published by The Motley Fool

Credit: Source link