Liquity’s stablecoin has seen its market capitalization dwindle by half in the past six months as investors seek higher DeFi yields.

LUSD, an Ethereum-based stablecoin, jumped to $1.03 this week after trading slightly below its intended dollar peg since July.

Sam Lekhak, head of growth at issuer Liquity, told The Defiant that a likely reason for the rally is a wealthy investor paying off $20M in LUSD-denominated debt since Jan. 5. He added that the borrower bought LUSD through DEX aggregators to pay back the loans, leading to its increase in price.

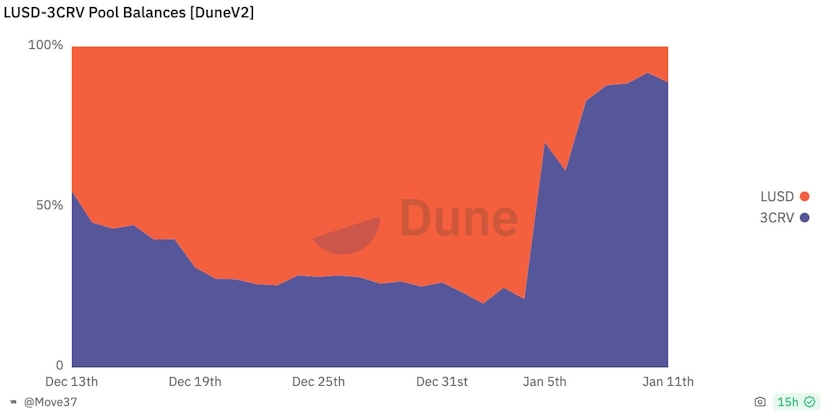

The trades were routed through Curve Finance, a leading DeFi exchange which regularly processes over $1B in volume per week — the biggest LUSD pool saw its reserves of the stablecoin nearly depleted this week, according to a Dune Analytics dashboard.

LUSD has since settled to $1.01, according to CoinGecko. As it’s still trading above its peg, Lekhak thinks that redemptions of LUSD may slow. This is because when the stablecoin was trading below $1, it became cheaper in dollar terms for borrowers to repay their loans.

If LUSD stays above $1, that incentive goes away.

Liquity launched in 2021 and drew praise for its design, which minimized involvement from governance. This contrasts with MakerDAO, another major lending protocol which issues the dollar-pegged DAI stablecoin. Maker has been a nearly constant source of confusion and drama as it looks to scale as a decentralized organization.

Still, some advantages of being able to adapt to new market trends, like real-world assets (RWAs), are apparent — Maker was able to generate substantial revenue through the crypto bear market by deploying some of its collateral in US Treasuries.

Maker also pushed forward an initiative in August 2023 to offer an 8% yield on DAI. Bojan Peček, head of operations at Liquity, cites this as the beginning of LUSD’s move to trade below peg. The stablecoin’s price action over the last year supports that theory.

Liquity charges a one-time fee to borrowers, which fluctuates between 0.5% and 5%, according to the protocol’s documentation. With other stablecoins offering higher yields, traders would borrow LUSD cheaply and swap the asset for more lucrative ones.

Peček added that other factors, like arbitrage bots and less demand for stablecoins overall, also kept LUSD below its peg during the second half of 2023.

He noted that LUSD held up despite the selling pressure. “LUSD regained its peg autonomously, without any human interference,” he said. “Borrowing demand is picking up.”

Sam MacPherson, co-founder at Pheonix Labs, which develops the DAI-focused lending protocol Spark, is skeptical that rigid interest rate models can work over the long term. “Hardcoded interest rates don’t work as people will swap to higher-yielding assets,” he told The Defiant. MacPherson formerly worked at Maker.

Before August 2023, LUSD actually traded above its $1 peg. Some community members cited the perceived safety of the stablecoin as a reason for the premium.

Meanwhile, the market capitalization of LUSD has been cut in half over the past six months.

Credit: Source link