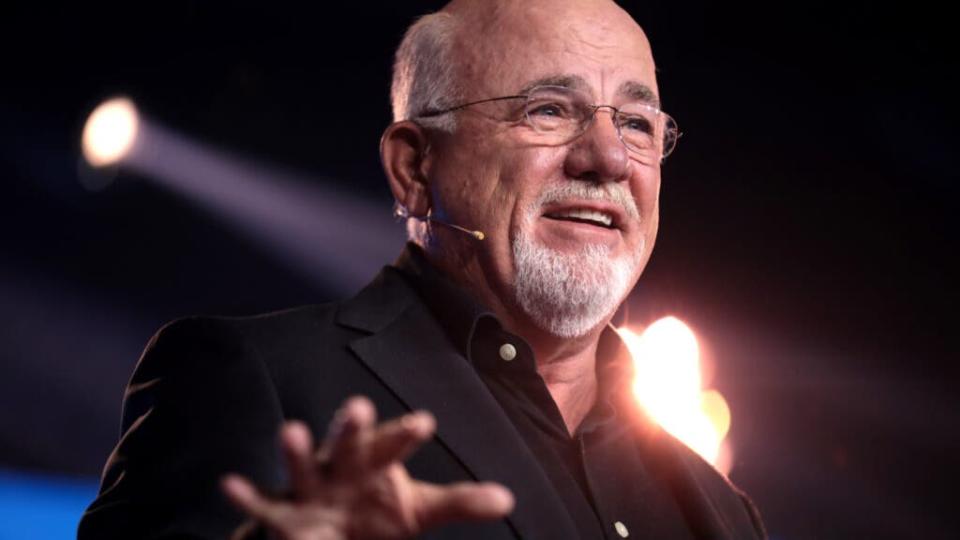

Personal finance guru Dave Ramsey gave tough advice on The Ramsey Show to a woman and her husband living paycheck to paycheck yet making $11,500 a month. Here’s what advice Ramsey gave the couple.

Alyssa called in for guidance from the finance expert because she and her husband were worried about finances. Alyssa tells Ramsey that she’s remarried, and together as a couple, they bring in $11,500 per month, yet they’re unable to contribute to their retirement and only have around $3,000 in their savings.

Don’t Miss:

Earning a combined salary puts the couple at an annual salary of $140,000, much higher than the average annual salary in the U.S. For example, USA Today reported that the U.S. Bureau of Labor released findings that the average American earned $59,384. Even with the amount doubled, Alyssa and her husband earn significantly more. So, why are they living paycheck to paycheck? This is what Ramsey wants to find out.

He starts by finding out how much debt the pair have, and Alyssa reveals that combined, they have $138,000 in debt, with $90,000 of it from Alyssa’s studies to become a mental health care therapist. Her husband has the remaining $40,000 from his time at college, even though he did not want to attend college. But that wasn’t all. They still owed an additional $60,000 on car payments and a mortgage with $240,000 still to go. So, the total debt is more than $130,000.

Ramsey’s co-host, George Kamel, an expert on all things money, questions Alyssa about how quickly they can pay this debt off. He asks if they can throw up to $5,000 per month at the smallest debt. Alyssa’s sigh of hesitance worries Kamel, and he asks her what is holding her back from zapping her debt away.

See Also: How much money will a $200,000 annuity pay out each month? The numbers may shock you.

Alyssa’s fear of taking $5,000 per month to pay off debt is motivated by ensuring her daughter has enough. Because Alyssa is self-employed and her husband works in construction, she reveals that she gets worried about “catastrophic expenses.” But that’s not what Ramsey was worried about listening to her talk.

He tells her, “You know what I’m worried about?” and dishes out some hard truths, “You make $130,000 a year and you’re freaking broke. That’s what I’m worried about.” Ramsey points out that they’re living a lifestyle they can’t afford, and that’s what she must be worried about.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

“You have a lifestyle that’s absolutely asinine, and that’s nothing to do with a nine-year-old,” Ramsey said. Alyssa tells the two finance experts that the money she needs for her daughter is for “just in case,” an emergency savings fund. But Ramsey didn’t buy it and explained, “But you’re not doing anything about it. You got $3,000.” He tells her in disbelief that her $3,000 in savings is just a “red herring” and “you’re doing nothing about that except creating anxiety.”

Ramsey tells Alyssa that she and her husband have no idea where their money goes, so to help them, Ramsey puts them on a detailed written budget. Ramsey tells her that looking objectively at their finances, he could easily see them being able to put aside at least $50,000 a year toward debt and should consider selling a car or two. He then dishes out some tough advice, “You live like no one else so that later you can give and live like no one else.” To get out of debt, which he jokes has been so long it’s like their family pet, Ramsey tells her it’s going to be uncomfortable, but it has to be done.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Dave Ramsey’s Tough Advice For Woman Making $11,500/Month: ‘Live Like No One Else So Later You Can Live And Give Like No One Else’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Credit: Source link