Investor Insight

Sarama Resources offers a compelling investment opportunity fueled by a multi-million dollar, fully-funded arbitration claim and two new gold projects encompassing 1,000 sq km of the Cosmo Newbery and Mt Venn Greenstone Belts in Western Australia’s Eastern Goldfields.

Overview

Sarama Resources (TSXV:SWA,ASX:SRR) is a gold-focused Australian mineral exploration and development company. Sarama has two core components to its business, one being a significant and fully funded arbitration claim, and the other being two highly prospective gold projects totaling 1,000 sq km in area in the Eastern Goldfields of Western Australia. Individually, each component significantly derisks the company and together they present significant value and upside optionality for investors.

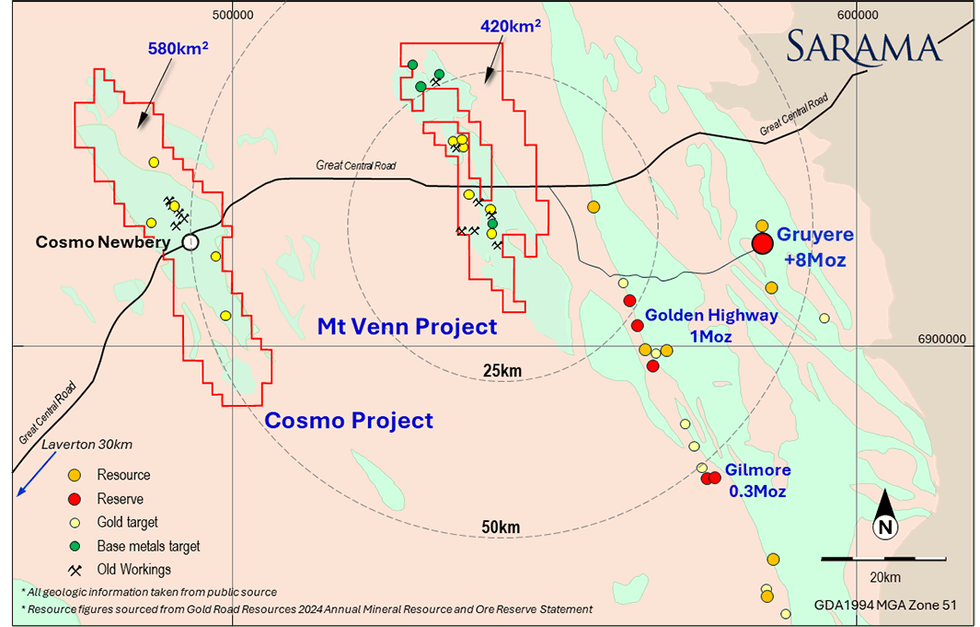

Sarama recently acquired the Cosmoand the Mt Venn gold projects which cover 580 sq km and 420 sq km, respectively, and encompass most of the greenstone belts in which they are situated. These greenstone belts are located in the Eastern Goldfields of Western Australia, and both have historical gold workings and strong geological and structural similarities to the adjacent Dorothy Hills greenstone belt which hosts the +8 Moz Gruyere gold deposit.

The Cosmo and Mt Venn gold projects offer a unique and promising opportunity for exploration in a region known for its prolific gold endowment.

The company is also pursuing a significant arbitration claim which is fully funded through a non-recourse loan facility. Boies Schiller Flexner who have an excellent track record of securing large settlements has been appointed to assist with the claim. The damages being sought are not less than cAU$200 million plus interest, and have the potential to be significantly more.

Sarama is led by an experienced board and management team with more than 30 years of individual experience and a proven track record of discovery and development of large-scale gold deposits including the +25 Moz world-class Kibali Gold Mine (formerly Moto Gold), and the +3 million ounce Sanutura gold project.

The Cosmo Gold project is an underexplored, belt-scale gold asset in Western Australia’s Eastern Goldfields. The project spans 580 sq km covering the entirety of the Cosmo-Newbery Greenstone Belt, a large and prospective system with gold first being discovered in the area in the 1890s and where rock chip sampling has returned grades up to 52 g/t gold. Cosmo Gold comprises seven contiguous exploration tenements and is located approximately 85 km northeast of Laverton in a region known for its prolific gold endowment.

Project Highlights

- Promising Geology: Whole greenstone belt with good structural setting in a prolific gold-producing region

- Scale: Tenure is contiguous over 583 sq km and covers the entire +50 km of greenstone belt

- Old workings: Gold was discovered in the 1890s highlighting its potential, but the area has remained unexplored for decades

- Limited exploration: The belt has seen virtually no modern exploration and no drilling of merit

- Location: Situated 95 km west of +8 Moz Gruyere gold mine (Gold Road) and 85 km from Laverton which sits in a greenstone belt hosting over 35 Moz of gold

Mt Venn Project

The Mt Venn Gold project has many similarities to the nearby Cosmo gold project and the company views it as an underexplored, belt-scale gold asset. The project spans 420 sq km and covers a large portion of the Mt Venn Greenstone Belt, a large and prospective system with gold first being discovered in the area in the 1890s. Limited drilling has returned multiple intersections of merit, and the project has a 35km long gold corridor marked by semi-contiguous gold-in-soil anomalism, old workings and drill intercepts. Mt Venn comprises three contiguous exploration tenements and is located approximately 35 km west of Gold Road’s 8 Moz, +300,000 oz/yr Gruyere gold mine and 40 km east of the company’s Cosmo gold project.

Project Highlights

- Promising Geology: Project covers a significant part of the Mt Venn greenstone belt, it has a good lithological and structural setting, including a regional shear zone approximately 50 km long and 1 to 3 km wide, extending full length of the greenstone belt.

- Scale: Tenure is contiguous over 420 sq km and covers a large portion of greenstone belt

- Old workings: Gold was discovered in the 1890s highlighting its potential, but the area has remained unexplored for decades

- Limited exploration: A lot of exploration potential remains in the belt with historical exploration work delineating a 35km anomalous gold trend coincident with a major regional structure and favorable lithologies

- Gold intercepts in drilling at Three Bears Prospect on Mt Venn project extend over 4 km trend to maximum 8.5 g/t gold

- Location: Situated 40 km west of Gold Road’s 8 Moz, +300,000 oz/yr Gruyere gold mine, 20 km west of Gold Road’s 1 Moz Golden Highway deposit and 40 km east of the company’s Cosmo gold project

Management Team

Andrew Dinning – Executive Chairman

Andrew Dinning is a founder, managing director and CEO of Sarama Resources. Dinning is committed to development in Africa and recently retired as a board member of The Australia-Africa Minerals and Energy Group (AAMEG) after eight years of service. AAMEG is a peak body representing Australian companies engaged in the development of Africa’s resource industry.

Dinning has over 35 years of experience in the international mining arena and has worked in the Democratic Republic of Congo, West Africa, the UK, Russia and Australia. He has extensive mine management, operations and capital markets experience and has spent most of his career in the gold sector. Dinning was a director and president of the Democratic Republic of Congo-based Moto Goldmines Ltd from 2005 to 2009. He oversaw the development of the company’s Moto Gold Project (Kibali Gold) from two million to more than 22 million ounces of gold. Dinning took the project from exploration to pre-development. The Moto Gold project was later taken over by Randgold Resources and AngloGold Ashanti for $600 million in October 2009. Dinning has an MBA, a first-class mine managers certificate in Western Australia and South Australia and a Bachelor of Engineering in Mining degree.

John (Jack) Hamilton – Vice-president of Exploration

Jack Hamilton is a founder and the vice president of exploration at Sarama Resources. Hamilton has 35 years of experience as a professional geologist. Hamilton has worked around the world for international resource companies. Before Sarama, he was the exploration manager for Moto Goldmines. in the Democratic Republic of Congo. At Moto Goldmines, he led the team that discovered the main deposits and resource at the world-class Moto Gold Project (now Kibali Gold) which has a resource of more than 22 million ounces.

Hamilton specializes in precious metal exploration in Birimian, Archean and Proterozoic greenstone belts. He has worked and consulted in West, Central and East Africa for the past 20 years with various companies, including Barrick Gold Corporation, Echo Bay Mines, Etruscan Resources Inc, Anglo American, Geo Services International and Moto Goldmines. Whilst at Moto Goldmines, he led the exploration team that took the Moto gold deposit from discovery to bankable feasibility. The Moto gold deposit was later sold to Randgold Resources and AngloGold Ashanti in October 2009.

Paul Schmiede – Vice-president of Corporate Development

Paul Schmiede is a major shareholder and the vice president of corporate development at Sarama Resources. He is a mining engineer with over 25 years of experience in mining and exploration. Before joining Sarama Resources in 2010, Schmiede was vice president of operations and project development at Moto Goldmines. At Moto Goldmine, he managed the pre-feasibility, bankable and definitive feasibility study for the more than 22 million-ounce Democratic Republic of Congo-based Moto Gold Project (now Kibali Gold). Whilst at Moto Goldmines, he also managed the in-country environment, community studies and pre-construction activities. Before joining Moto Goldmines, he held senior operational and management positions with Gold Fields and WMC Resources. At these companies, Schmiede was responsible for underground and open-pit operations as well as project development and planning.

Schmiede holds a first-class mine managers certificate in Western Australia and a Bachelor of Engineering in Mining degree. He is also a fellow of the Australasian Institute of Mining and Metallurgy.

Lui Evangelista – Chief Financial Officer

Lui Evangelista is Sarama’s chief financial officer with 35 years of experience in accounting, finance and corporate governance with public companies. He has more than 20 years of experience in the mining industry –– 10 years of which have been at the operational and corporate level with companies operating in Francophone Africa.

Evangelista held the positions of group financial controller and acting CFO at Anvil Mining. which operated 3 mines in the DRC. He was an integral part of the senior management team that saw Anvil’s market capitalization grow from C$100 million in 2005 to C$1.3 billion upon takeover by Minmetals in 2012.

Evangelista holds a Bachelor of Business in Accounting degree, a graduate diploma in business administration and a graduate diploma in applied corporate governance.

Simon Jackson – Non-executive Director

Simon Jackson is a founder, shareholder and non-executive chairman of Sarama Resources. Simon is a Chartered Accountant with over 25 years of experience in the mining sector. He is the chairman of Predictive Discovery and non-executive director of African gold producer Resolute Mining. He has previously held senior management positions at Red Back Mining, Orca Gold and Beadell Resources.

Jackson specializes in M&A, public equity markets management and corporate finance. His career has included corporate transactions in Canada, Australia, Africa and Indonesia. He holds a Bachelor of Commerce degree from the University of Western Australia and is a fellow of the Institute of Chartered Accountants in Australia.

Adrian Byass – Non-executive Director

Adrian Byass has more than 25 years of experience in the mining industry. He has focused his career on the economic development of mineral resources. He is skilled in economic and resource geology. Byass has experience ranging from production in gold and nickel mines to the evaluation and development of mining projects with listed and unlisted entities in several countries. He has also held several executive and non-executive board roles on both ASX and AIM-listed companies.

Byass presently operates in a corporate and market-focused capacity on a national and international basis. He has board-level experience in mine development, capital raising and M&A in Australia and on overseas stock exchanges. Byass has played key roles in a range of exploration and mining projects in Australia, Africa, North America and Europe. These projects were based on a suite of commodities including gold, base and specialty metals.

Byass holds a Bachelor of Science in Geology and a Bachelor of Economics. Byass is a member of the Australian Institute of Geoscientists, a fellow of the Society of Economic Geology and a competent person for the reporting of mineral resources (JORC 2012).

Byass is currently on the board of multiple ASX-listed companies, including Galena Mining, Kaiser Reef, Kingwest Resources and Infinity Lithium.

Michael Bohm – Non-executive Director

Michael Bohm is a seasoned director and mining engineer in the resources industry. His career spans roles as a mining engineer, mine manager, study manager, project manager, project director, and managing director.

He has been directly involved in the development of multiple mines in the gold, nickel, and diamond industries, and made significant contributions to Ramelius Resources during its formative years. This experience is particularly important as Sarama is currently in the process of rebuilding its operations in the Eastern Goldfields region of Western Australia.

He is a current director of ASX-listed Riedel Resources and has previously been a director of ASX listed Perseus Mining, Ramelius Resources, Mincor Resources NL and Cygnus Metals.

Credit: Source link