Investor Insights

Blackstone Minerals is well-positioned to leverage a projected nickel supply deficit as it strives to become a vertically integrated producer of low-cost, low-carbon, battery-grade nickel. Key to this is Blackstone’s Ta Khoa project in Vietnam, an emerging hub for the electric vehicle market.

Overview

As the world moves closer to a sustainable net-zero future, the need for battery metals continues to mount and nickel may soon be among the metals to see a supply crunch. Though its roots are in the stainless steel sector, it’s also a critical component of lithium-ion batteries.

Given that many nations are aiming to replace combustion vehicles with electric cars by 2030, the metal is already experiencing a massive spike in demand. Benchmark Minerals expects the need for battery-grade nickel will increase about 950 percent by 2040.

It’s imperative to ramp up global nickel production but the resource sector, for its part, must do so with a much-reduced carbon footprint to influence the sustainability of the entire value chain. Blackstone Minerals (ASX:BSX,OTC:BLSTF,FRA:B9S) recognizes this. As a vertically integrated producer of low-cost, low-carbon nickel, the company aims to become a leading source of low CO2 emission nickel sulphide. Its flagship Ta Khoa project in Vietnam is representative of that goal.

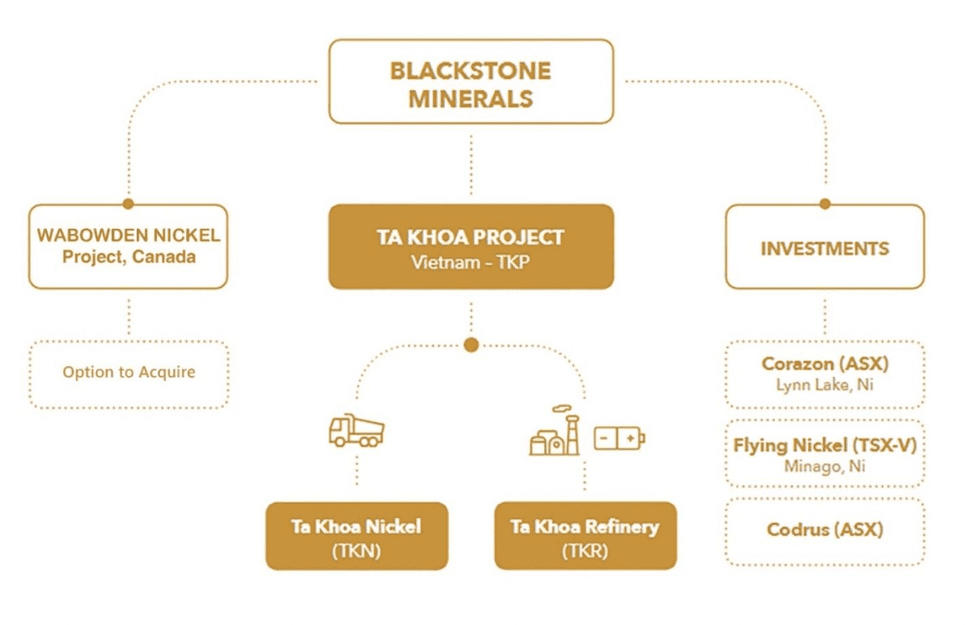

Blackstone Minerals business structure schematic

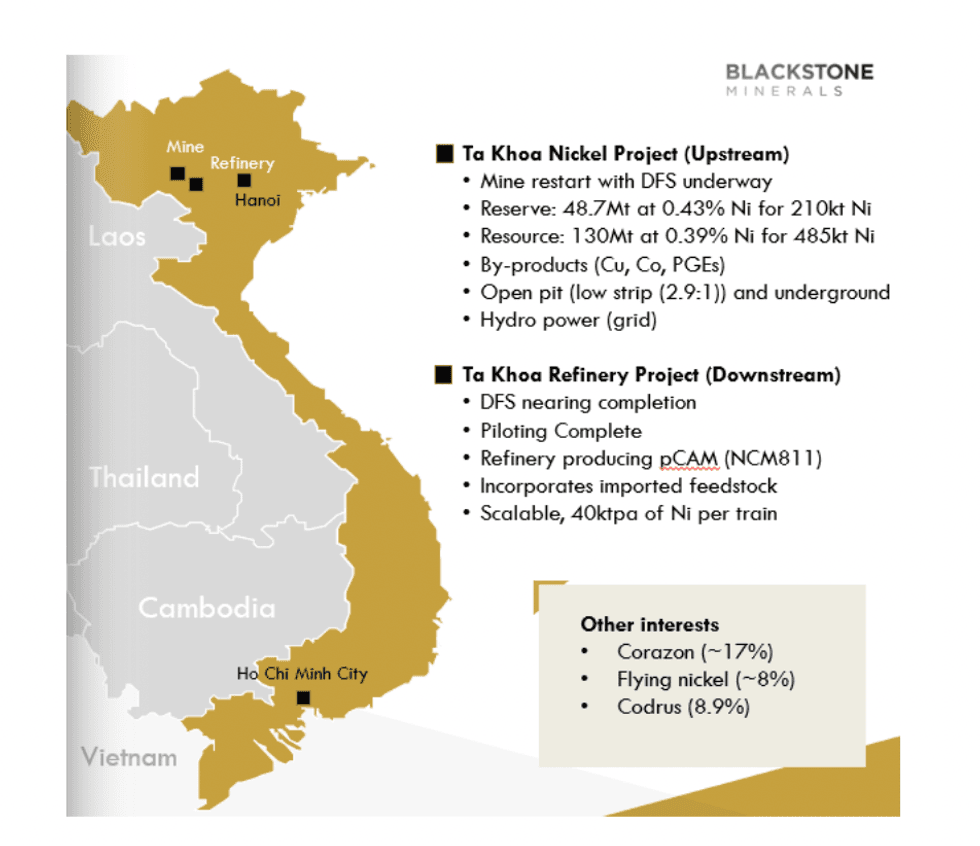

With over 20 active mines and a burgeoning technology sector, Vietnam is on the road to becoming a hub of electric vehicle production and innovation, with low labor costs and regulated electricity pricing further driving its growth. Steadily increasing foreign direct investment in the region is indicative of this as the country seeks to attract $50 billion in new foreign investment by 2030.

Blackstone is uniquely positioned to take advantage of this, thanks to two factors. US President Joe Biden’s Inflation Reduction Act, which came into force in August 2022, represents the largest investment into climate action in United States history. A similar initiative is rolling out in the European Union (EU), which maintains a Free Trade Agreement with Vietnam — something multiple partners of the company have expressed interest in.

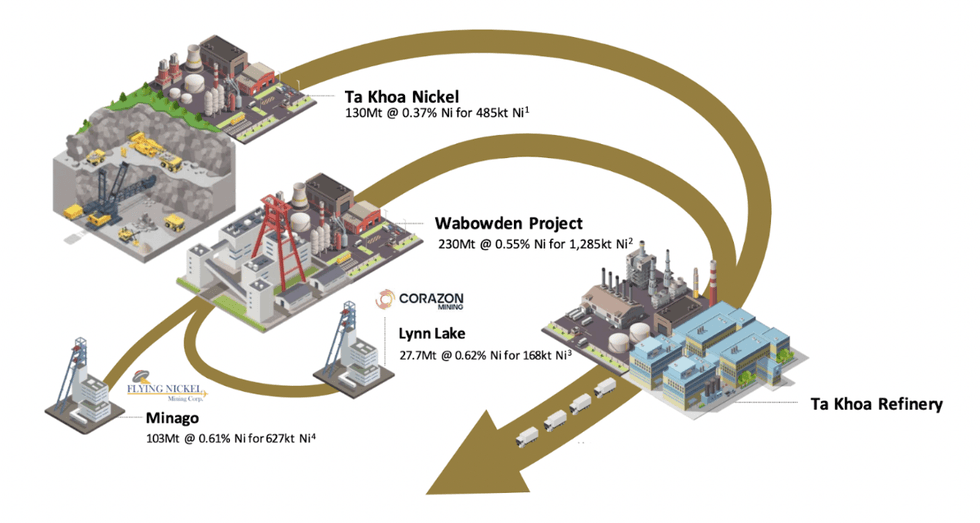

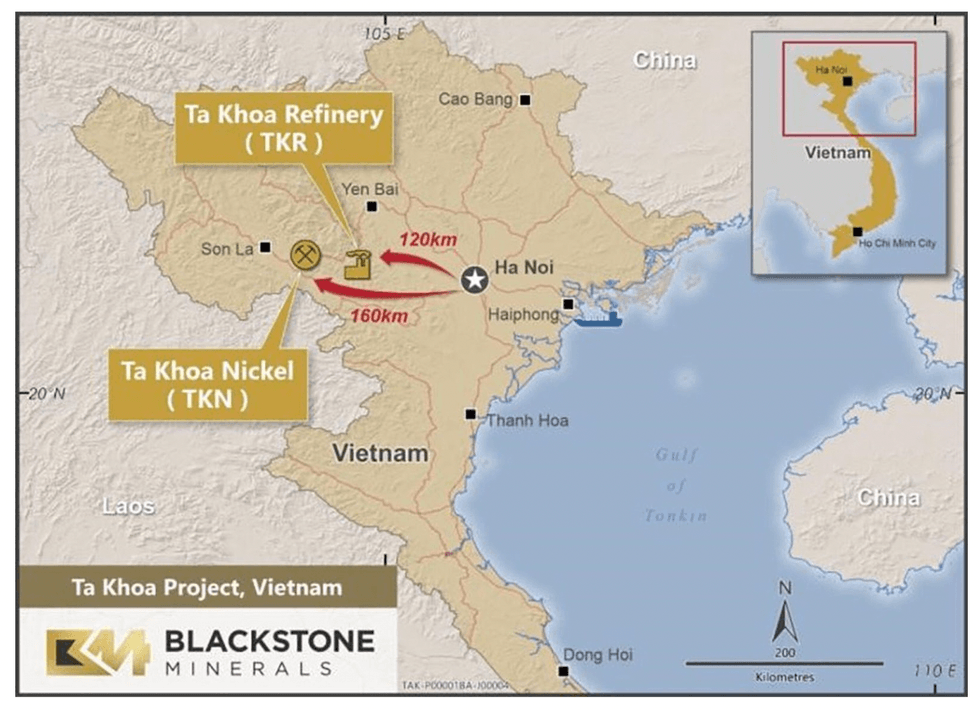

Blackstone’s Ta Khoa Project consists of two streams, the Ta Khoa Nickel Mine and the Ta Khoa Refinery. Recent milestones point to Blackstone’s commitment to advancing this game-changing project.

These milestones include a memorandum of understanding with Cavico Laos Mining to collaborate in a number of areas associated with CLM’s nickel mine in Lao People’s Democratic Republic and supply of nickel products for Blackstone’s Ta Khoa Refinery in Vietnam.

Blackstone also partnered with Arca Climate Technologies to further investigate the carbon capture potential at the Ta Khoa Project through carbon mineralisation, and explore opportunities to utilise Arca’s carbon capture technologies within the project.

In a bid to collaborate on the supply of renewable wind energy to the Ta Khoa Project, Blackstone signed a direct power purchase agreement with Limes Renewables Energy.

Blackstone received AU$2.8 million as an advance from a research & development (R&D) lending fund backed by Asymmetric Innovation Finance and Fiftyone Capital. The advanced payment reflects the significant investment by Blackstone to develop the Ta Khoa Refinery process and Blackstone’s unique strategy to convert nickel concentrate blends into battery products in the form of precursor cathode active material (pCAM).

In December 2023, Blackstone entered into an option agreement with CaNickel Mining to acquire the Wabowden nickel projectlocated in the world-class Thompson Nickel Belt in Manitoba, Canada.

The Wabowden project will have the potential to fill the Ta Khoa Refinery, removing dependence on third party feed sources.

The company has signed a non-binding MOU with the Development for Resources Environmental Technology joint stock company (DRET) to investigate opportunities to repurpose and trade waste material (or residue) from the Ta Khoa Refinery into construction material products. Moreover, it has also progressed the Ta Khoa Refinery byproduct offtake strategy with Vietnam Chemical Group (VinaChem), PV Chemical and Equipment Corporation (PVChem) and Nam Phong Green Joint Stock Company (Nam Phong) to sell Ta Khoa Refinery byproducts, being manganese sulphate (or epsomite) and sodium sulphate.

As the company plans to build a global nickel business, Blackstone signed a non-binding memorandum of understanding with Yulho Co. Ltd (Yulho) and EN Plus Co. Ltd (EN Plus) to establish a collaboration across the businesses including EN Plus and Yulho who are in joint venture on the Ntaka Hill nickel sulphide project in Tanzania, and the Dinagat Island nickel laterite project in the Philippines.

Blackstone holds a 90 percent interest in the Ta Khoa Nickel-Copper-PGE Project, located 160 kilometers west of Hanoi in the Son La Province of Vietnam. It includes an existing modern nickel mine built to Australian Standards, which is currently under care and maintenance. The Ban Phuc nickel mine successfully operated as a mechanized underground nickel mine from 2013 to 2016.

Blackstone intends to complement the existing mine through the installation of a large concentrator, refinery and precursor facility, supporting integrated on-site production of nickel, cobalt and manganese precursor products for the Asia-Pacific market. One of Blackstone’s key Research and Development objectives with Ta Khoa is to develop a flowsheet that will support this production.

To fulfill this goal, Blackstone is focusing on a partnership model, collaborating with groups committed to sustainable mining. It is also working to minimize its carbon footprint and implement a vertically integrated supply chain.

Project Highlights:

- Multiple Massive Sulphide Deposits: The Ta Khoa project features several incredibly promising deposits including King Snake (up to 4.3 percent nickel and 18.2 grams per ton (g/t) PGE), Sui Phong (2.95 meters @ 2.42 percent nickel, 0.52 percent copper, 0.06 percent cobalt and 0.05 g/t PGE), and Ban Chang. The project is also the site of the Ban Phuc nickel mine, which was operated from 2013 to 2016 by Asia Mineral Resources, along with several exploration targets that have yet to be tested.

- Experienced Leadership: Internally, Blackstone’s owners’ team brings over 50 years of experience in leadership roles at major nickel mines and refineries globally. This experience has been complemented by ALS Group, Wood, Future Battery Industries CRC, Curtin University and the Electric Mining Consortium.

- Large Reserve and Mining Inventory: The entirety of Ta Khoa is estimated to contain probable reserves of 48.7 Mt at 0.43 percent nickel for 210 kilotons (kt) of nickel and a mining inventory of 64.5 Mt at 0.41 percent nickel for 265 kt nickel. This excludes Ban Khoa and other developing prospects.

- A Long-lived Project: The Ta Khoa mine is expected to produce a yearly average of 18 kt of annual nickel concentrate over its ten-year lifespan. Blackstone believes the refinery can potentially extend its life past ten years.

- An Established Mining Operation: Existing infrastructure onsite includes a 450 ktpa Mill and mining camp. The mine will also benefit from a highly supportive community and favorable government legislation — Blackstone is committed to collaborating with community stakeholders in the project’s development.

- Feed Flexibility: Ta Khoa’s refinery will offer multiple feed options, including nickel concentrate, mixed hydroxide precipitate, nickel matte and black mass. This flexibility greatly improves the security and greatly reduces the risk of the project overall.

- Valued Partnerships: Blackstone is collaborating with multiple industry leaders and groups in the development of Ta Khoa

- Compelling Pre-feasibility Study: The financial outcomes of a base case pre-feasibility study on the project are promising. Based on a conservative NCM811 precursor price forecast, Ta Khoa displays an exceptional internal return rate on capital invested.

- Integrated Vertical Strategy: Blackstone is constructing both the Ta Khoa mine and refinery against a highly supportive ESG, macroeconomic and fiscal backdrop. This along with Ta Khoa’s low capital intensity gives the company a significant advantage over competitors. Said low intensity is the result of multiple factors, including competitive labor costs, favorable regulations and low-cost renewable hydroelectric power.

- A Leader in Low Emissions: Independent assessments from Digbee, Minviro and Circulor, alongside an audit from the Nickel Institute, have confirmed that Ta Khoa will be the lowest-emitting flowsheet in the industry, at 9.8 kilograms of CO2 per kilogram of precursor with opportunities for even further reduction.

- Promising Pilots: With the support of ALS and process engineering partner Wood, Blackstone recently completed a 12-month programme of work that developed a scaled version of its concentrate to sulphate flowsheet. The refinery, which processed more than 9 tonnes of concentrate and MHP, successfully achieved battery-grade nickel sulphate of 99.95 percent, with a nickel recovery rate of 97 percent.

- Current Roadmap: Blackstone’s next priority is to complete a series of definitive feasibility studies. Once those are complete, it will focus on fully integrating the mine into the electric vehicle consumer supply chain and finalizing its refining partnership structure.

Management Team

Hamish Halliday – Non-executive Chairman

Hamish Halliday is a geologist with over 20 years of corporate and technical experience. He is also the founder of Adamus Resources Limited, an AU$3 million float that became a multimillion-ounce emerging gold producer.

Scott Williamson – Managing Director

Scott Williamson is a mining engineer with a commerce degree from the West Australian School of Mines and Curtin University. He has over 10 years of experience in technical and corporate roles in the mining and finance sectors.

Dr. Frank Bierlein – Non-executive Director

Dr. Frank Bierlein is a geologist with 30 years of technical and corporate experience, focusing on grassroots to mine-stage mineral exploration, target generation, project management and oversight, due diligence studies, mineral prospectivity analysis, metallogenic framework studies and mineral resources market and investment analysis.

Alison Gaines – Non-executive Director

Alison Gaines has over 20 years of experience as a director in Australia and internationally. She has experience in the roles of board chair and board committee chair, particularly remuneration and nomination and governance committees. She is also the managing director of Gaines Advisory P/L and was recently global CEO of international search and board consulting firm Gerard Daniels, with a significant mining and energy practice.

Gaines has a Bachelor of Laws and a Bachelor of Arts (hons) from the University of Western Australia, a Graduate Diploma in Legal Practice from Australian National University and an honorary doctorate of the University and Master of Arts (Public Policy) from Murdoch University. She is a fellow of the Australian Institute of Company Directors and holds the INSEAD certificate in corporate governance. She is currently the governor of the College of Law Ltd, and non-executive director of Tura New Music.

Dan Lougher – Non-executive Director

Daniel Lougher’s career spans more than 40 years involving a range of exploration, feasibility, development, operations and corporate roles with Australian and international mining companies including a period of eighteen years spent in Africa with BHP Billiton, Impala Plats, Anglo American and Genmin. He was the managing director and chief executive officer of the successful Australian nickel miner Western Areas Ltd until its takeover by Independence Group.

Lougher also holds a first class mine manager’s certificate of competency (WA) and is a fellow of the Australasian Institute of Mining and Metallurgy (AusIMM). Lougher is the chair of the company’s technical committee and nomination committee.

Jamie Byrde – CFO and Company Secretary

Jamie Byrde has over 16 year’s experience in corporate advisory, public and private company management since commencing his career with big four and mid-tier chartered accounting firms positions. Byrde specializes in financial management, ASX and ASIC compliance and corporate governance of mineral and resource focused public companies. He is also currently company secretary for Venture Minerals Limited.

Tessa Kutscher – Executive

Tessa Kutscher is an executive with more than 20 years of experience in working with C-Level executive teams in the fields of business strategy, business planning/optimisation and change management. After starting her career in Germany, she has worked internationally across different industries, such as mining, finance, tourism and tertiary education.

Kutscher holds a master’s degree in literature, linguistics and political science from the University of Bonn, Germany and a master’s degree in teaching from Ludwig Maximilian University of Munich.

Andrew Strickland – Executive

Andrew Strickland is an experienced study and project manager, a fellow of the Australian Institute of Mining and Metallurgy, University of WA MBA graduate, with undergraduate degrees in chemical engineering and extractive metallurgy from Curtin and WASM.

Before joining Blackstone, Strickland was a senior study manager for GR Engineering Services where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects. Over his career, he has held a variety of project development roles across both junior to mid-tier developers (including Straits Resources, Perseus Mining and Tiger Resources) and major multi-operation producers (South32).

Graham Rigo – Executive

Graham Rigo is an experienced study manager with over a decade of on-site production experience, holding undergraduate degrees in chemical engineering and finance from Curtin University, WA.

Before joining Blackstone, Rigo was a study manager for Ausenco where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects over a range of different commodities.

Rigo has over 11 years of site experience in nickel and cobalt hydromet production experience, in supervisory/superintendent level roles as well as process engineer experience.

Lon Taranaki – Executive

Lon Taranaki is an international mining professional with over 25 years of extensive experience in all aspects of resources and mining, feasibility, development and operations. Taranaki is a qualified process engineer from the University of Queensland Australia. He holds a Master of Business Administration, and is a fellow of the Australian Institute of Company Directors. Taranaki has established his career in Asia where he has successfully worked (and lived) across multiple jurisdictions and commodities ranging from technical, mine management and executive management roles.

Prior to joining Blackstone in February 2022, Taranaki was the chief executive officer of Minegenco, a renewable-energy-focused independent power producer. Preceding this, he was managing director of his private consultancy, AMG Mining Global, where he was providing services to the mining industry in Singapore, Guyana, Indonesia and Cambodia. Additionally, Taranaki has held various senior positions with Sakari Resources, PTT Asia Pacific Mining, Straits Resources, Sedgmans and BHP Coal.

Credit: Source link