Two of the most talked-about drugs in the U.S., obesity treatment Wegovy and diabetes medication Ozempic, are made by the same company: Denmark-based Novo Nordisk (NYSE: NVO). There wouldn’t be so much chatter if these drugs weren’t flying off pharmacy shelves these days, particularly in the case of Wegovy.

Solid evidence of this was provided early this week by the company, which released highly encouraging quarterly and annual results featuring plenty of high-growth figures. Let’s pick these apart a little to see if the popular stock is still worthy of a buy.

Weight loss is Novo Nordisk’s gain

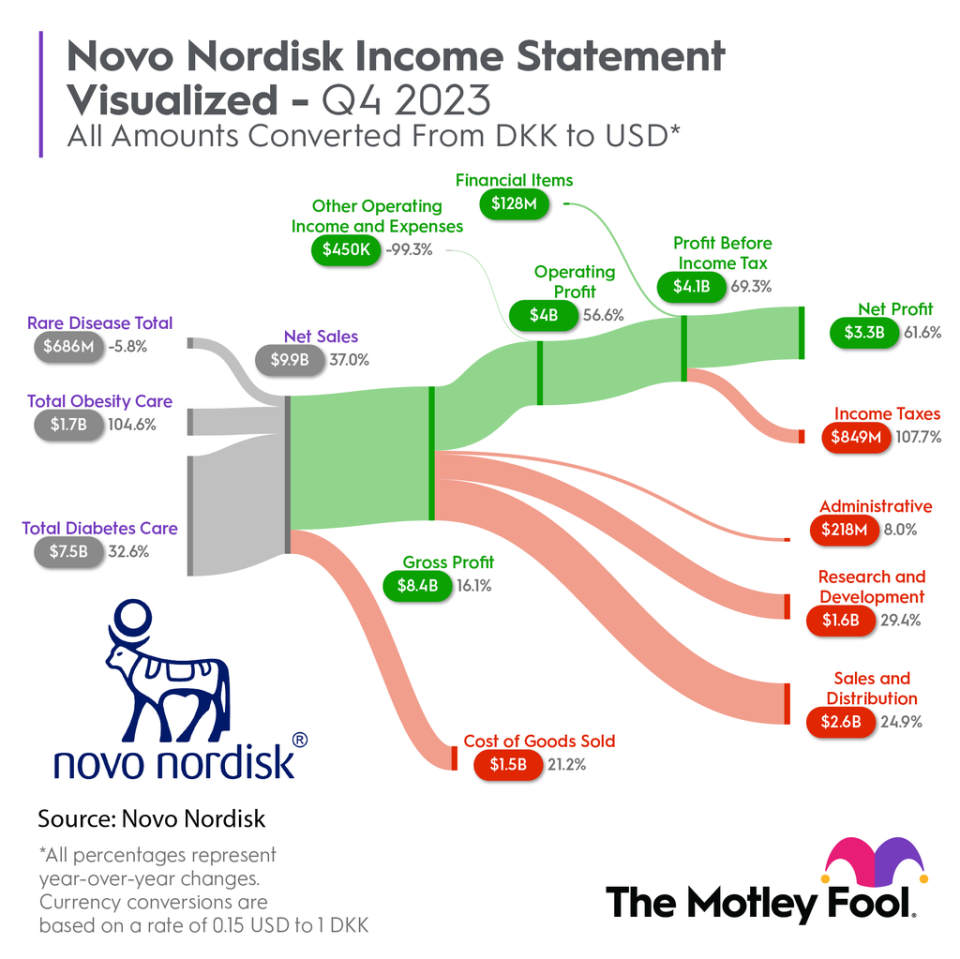

Among the many eye-catching numbers in the quarterly income breakdown graphic below is the net sales growth figure; this was far in the double digits at 37% year-over-year, climbing to a U.S. dollar equivalent of $9.9 billion. Edging into the $10 billion club alone makes Novo Nordisk an important player throughout the world.

No one who’s followed Novo Nordisk’s fortunes even casually will be surprised by this circumstance. Take a look at the growth rates for the company’s three categories. Which one stands out the most? Obesity care, of course, sales for which more than doubled over the year-ago quarter. This was powered by a nearly four-fold rise for Wegovy, to a bit over $1.4 billion in greenback dollar terms.

The drug has really tapped into a want and need in this country, where poor diets, high food intake, and unhealthy lifestyles result in a populace that as a whole is notoriously overweight.

This also explains the geographic disparity in Novo Nordisk’s sales growth. For the quarter, the rapidly emerging pharmaceutical powerhouse booked a 60% gain in its North American take (to the equivalent of almost $6.4 billion). There was growth in the company’s collection of international markets as well, but this paled in comparison, with a rise of 8% to less than $3.5 billion.

With the snowballing Wegovy front and center in its product lineup, overall sales growth easily outpaced that of costs and expenses. Note how that 37% rise in net sales topped the increases of nearly every expense in the graphic; all told, those items in red rose by what’s tantamount to $1.6 billion, against the nearly $2.7 billion advancement of net sales.

That shook out to a very meaty 62% increase in headline net profit to about $3.3 billion, putting the cap on a very strong quarter.

Here comes the competition

The high-stakes pharmaceutical industry has more than a few major companies with bulging coffers. So you can bet that if one product category takes off, competitors will ramp up their efforts to grab a meaningful piece of that action.

It’s no different with Wegovy. Last November, Eli Lilly won U.S. Food and Drug Administration (FDA) approval for Zepbound, essentially its commercialized diabetes drug Mounjaro used at different doses to treat obesity (much like the relationship between Wegovy and Ozempic).

This is concerning at first glance. Eli Lilly is a titan of the domestic pharmaceutical industry, and has a much firmer grip on this market than its European peer. Yet Wegovy and Ozempic have become totemic in their respective product categories, and even the most deep-pocketed companies face challenges when going up against established and hotly popular brands.

Novo Nordisk also has the advantage of being a more focused company with a tighter product lineup. It can marshal its nicely growing resources to keep pushing up sales of Wegovy/Ozempic; Eli Lilly has to spread its wealth among a sprawl of therapeutic areas and commercialized products (not to mention a more extensive pipeline).

I think the weight-loss market is only at the beginning of its ascent, and even if Eli Lilly puts a dent in it, there will still be plenty of revenue to go around. Novo Nordisk is obviously determined to fight for share, and I think it’ll be largely successful. Even with the recent run-up in share price, I think the Danish company is well worth considering as a buy.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 29, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Is Novo Nordisk a Hot Stock to Buy Now After its Spectacular Q4? was originally published by The Motley Fool

Credit: Source link