Chinese electric car company Nio Inc. (NYSE:NIO) would really like to become the Tesla (NASDAQ:TSLA) of China one day. But if this week’s earnings report is any guide, Nio still has miles to go before it reaches its destination.

Reporting its Q2 2023 financial results Tuesday morning, Nio managed to miss pretty much every goalpost that Wall Street had set for the company. On sales, Street analysts had hoped Nio would report RMB9.2 billion, but the most Nio could scratch together was RMB8.8 billion — $1.2 billion, or 4% short of the mark. On earnings likewise, Wall Street was looking for Nio to report RMB2.41 per share in losses — but Nio reported a loss of RMB3.70 per share — $0.51, or 53.5% worse than expected.

Rounding out the bad news, Nio reported a 15% year over year decline in quarterly revenue, and an 18% sequential decline from Q1 2023. When you consider how all-around bad Nio’s news was, it’s actually pretty surprising that stock is down just 0.5% since the earnings report.

So, were investors just in a forgiving mood this week? Or was there something else than Nio said, that set their minds at ease, and caused them to give Nio a pass on its Q2 results?

Turns out, it was the latter.

Nio’s news on profit margins gave some encouragement. While total gross profit margins (including both profit from new vehicles sold, from used car sales, and from services such as “power solutions”) inched lower sequentially from Q1 2023 (down 50 basis points to 1%), margins on vehicle sales moved up a bit, from 5.1% to 6.2%.

Vehicle sales in July (i.e. one month after quarter-end) also showed improvement, with Nio reporting 104% year over year growth in shipments to 20,462 units moved. That was nearly as many sales in this single month, as Nio sold in all of the Q2 just reported on (23,520 vehicles). For the month of July at least, Nio briefly became “the top [seller of] premium electric … vehicles priced above RMB300,000” in China, as CEO William Bin Li pointed out.

Investors may be weighing the hope that Nio will retain this title, against the weak Q2 numbers, and deciding to give the stock a bit more time before selling it off wholesale. And encouraging that hope, Li confirmed that Nio is looking forward to “solid growth in vehicle deliveries in the second half of 2023.”

So what exactly will “solid growth” look like in terms of dollars and cents (or renminbi?). Well, Nio is guiding towards 55,000 to 57,000 total vehicle deliveries in Q3 for example. That works out to 74% to 80% year over year growth — not quite 104%, but better than a decline. Nio expects to generate somewhere between RMB18.9 billion and RMB19.5 billion ($2.6 billion and $2.7 billion) in revenue from these sales and other revenue sources — 45% to 50% growth.

So what’s the upshot of this report for Nio? Assuming things work out as the company is hoping they will work out, sales growth is back at Nio, and that gives investors some room for hope that the company’s stock will fare better going forward.

That being said, don’t fail to notice that revenues are projected to rise significantly slower than unit sales. That right there tells you that the price war on EVs in China is continuing to rage, limiting pricing power and disadvantaging Nio relative to larger car companies with greater scale of production, such as BYD and Tesla.

As a still small fish in a very large pond, there’s still real risk that Nio will end up getting fried.

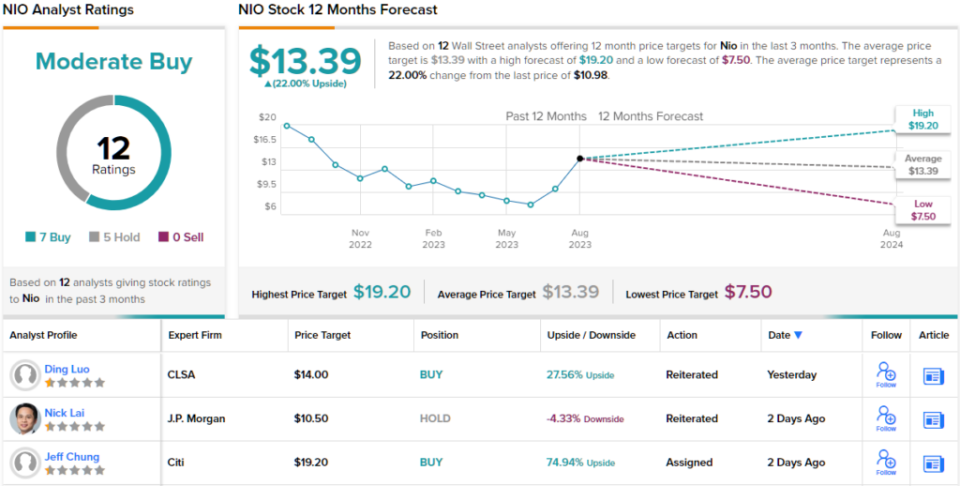

Overall, NIO has a Moderate Buy rating from the Wall Street consensus, based on 12 analyst reviews that include 7 Buys and 5 Holds. The $13.39 average price target implies ~22% upside from the trading price of $11. (See NIO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link