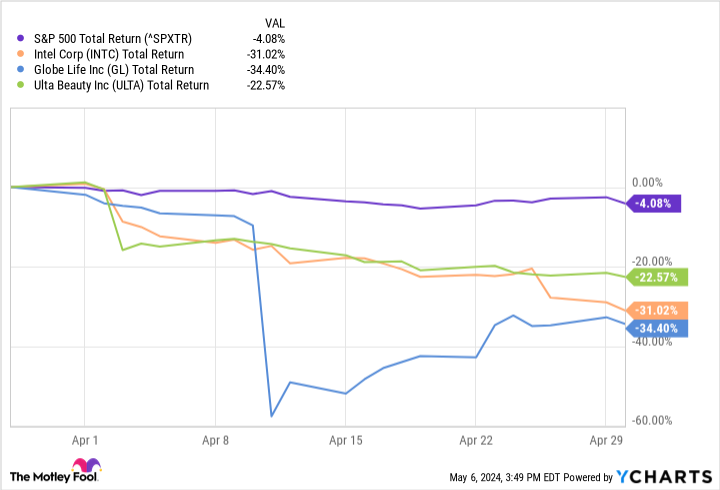

The S&P 500 is headed higher once again, but in April, the index lost roughly 4% of its value. Nearly every sector experienced weakness, erasing hundreds of billions of dollars in value.

If you’ve been searching for bargains, the following three stocks might be your ticket.

Warren Buffett just made a move in this underperformer

The worst performer in the S&P 500 this April was Globe Life (NYSE: GL). This stock lost nearly 35% of its value last month. In fact, shares lost half of their value in a single day, although the share price has recovered a bit since.

What happened? Fuzzy Panda Research, a short-seller, accused the insurer of “extensive” and “obvious” fraud. This report came on top of various legal claims against several of the company’s subsidiaries — American Income Life Insurance Co. and Arias Agencies — including accusations of rampant drug use and sexual abuse. Investment firm Evercore believes shares now have “significant uncertainty.” There’s so much uncertainty, in fact, that Warren Buffett’s Berkshire Hathaway recently sold its stake in the company.

Is Globe Life stock on sale? Yes, at least according to its previous trading levels. But there’s just too much uncertainty here to make an informed bet. While catching a falling knife can be enticing, it’s likely best to follow in Buffett’s footsteps and avoid this complicated stock.

This iconic stock is priced right for value investors

The second-worst performer in the S&P 500 last month is an iconic business: Intel (NASDAQ: INTC). In April, Intel stock shed nearly one-third of its value.

This isn’t Intel’s first bad month. Over the last three years, the company has lost nearly half of its total value. The issues are many. Revenue levels have been falling, its share of the chip market has been shrinking, and last month the stock nosedived after management released weak guidance for the quarter ahead.

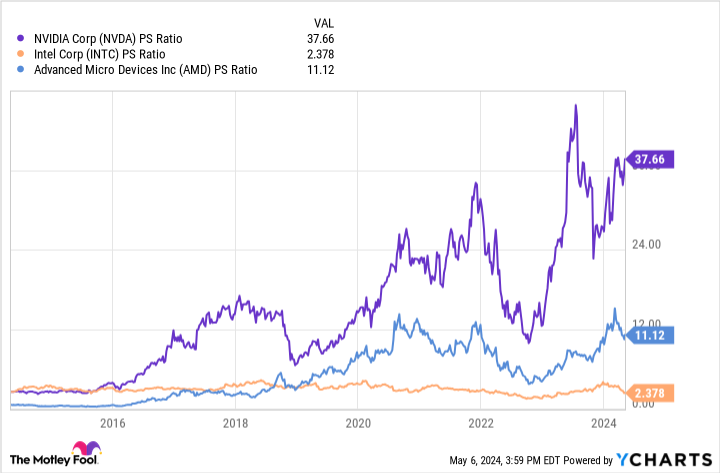

Has April’s slide made Intel worth looking into? Fool writer Dani Cook thinks so. The company isn’t without its problems, but shares are attractively priced versus competitors like AMD and Nvidia. “[S]hares are potentially the best-valued option in the chip market,” she says, and adds: “As a result, anyone looking to add a chip stock to their portfolio would probably do well to make a long-term investment in Intel now while they wait for Nvidia and AMD to come down to a more attractive price point.”

Wall Street thinks this 1 stock is a buy

The final stock on this list is Ulta Beauty (NASDAQ: ULTA), which lost around 23% of its value last month. This is not the company’s first time experiencing extreme monthly swings. Over the past six months, shares have zoomed from $400 to nearly $600, only to give up the gains entirely.

Ulta’s struggles mirror those of Intel. Namely, it’s facing a slowdown in sales, with management issuing weaker-than-expected guidance. The company’s CEO, David Kimbell, couldn’t pinpoint an exact reason for the sales slowdown. Rather, he pointed to weakness in the consumer discretionary sector in general.

“Despite the downbeat commentary,” Fool writer Jeremy Bowman explains, “several analysts reaffirmed buy ratings on Ulta stock, showing that Wall Street believes the headwinds are just short term.” The last time Ulta stock reached the $400 level, shares popped in value by nearly 50% over a handful of months. If you’ve been looking for market bargains, Ulta is a great stock to dig deeper into.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $553,959!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Berkshire Hathaway, Nvidia, and Ulta Beauty. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Is It Time to Buy April’s Worst-Performing S&P 500 Stocks? was originally published by The Motley Fool

Credit: Source link