Restaurant chain Chipotle Mexican Grill (NYSE: CMG) capped an amazing run up in its share price this year with a 50-for-1 stock split in June. It was one of the largest stock splits in the history of the New York Stock Exchange.

Explaining why the company did it, CFO Jack Hartung said, “We believe the stock split will make our stock more accessible to our employees as well as a broader range of investors.”

With its historic stock split complete, is now the time to invest in Chipotle? Here’s a look into the company to answer that question.

Chipotle’s sales success

Chipotle’s share price has already increased substantially over the past several months, nearly doubling from a 52-week low of $35.37 last October to a high of $69.26 in June. This is a testament to the company’s outstanding financial performance.

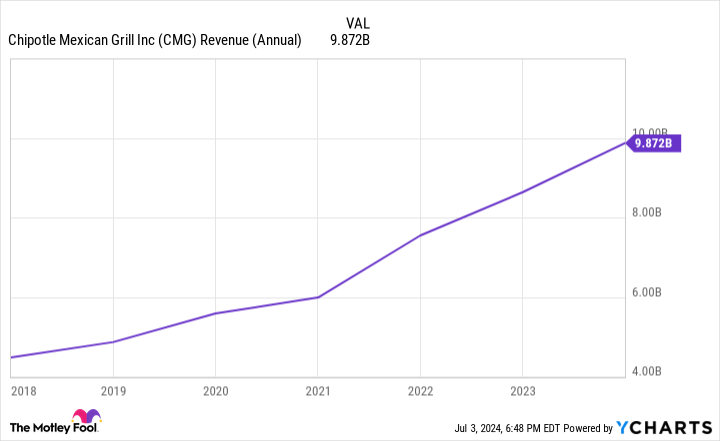

In 2023, Chipotle generated $9.9 billion in revenue, a 14% jump from 2022’s $8.6 billion. In addition, its net income increased a whopping 37% year over year to $1.2 billion. These results propelled Chipotle’s 2023 diluted earnings per share (EPS) to $44.34, a 38% increase from the prior-year’s $32.04.

Last year’s success continued into 2024. Its first-quarter revenue reached $2.7 billion, representing 14% year-over-year growth, while net income rose 23% to $359.3 million from 2023’s $291.6 million. Chipotle’s Q1 EPS rose 24% year over year to $13.01.

To put this performance into context, competitor Yum! Brands, owner of multiple restaurant chains including Pizza Hut and Taco Bell, posted $1.6 billion in sales, $314 million in net income, and an EPS of $1.10 in Q1. Yum! Brands is an interesting rival to compare to because Chipotle’s CEO, Brian Niccol, was once the CEO of Taco Bell.

Chipotle’s sales strategy

Niccol, who took over the CEO spot in 2018, summarized the strategy used to produce Chipotle’s excellent financial results when he said, “Our strong sales trends were fueled by our focus on improving throughput in our restaurants.”

This strategy helped Chipotle’s Q1 sales in its existing stores achieve a 7% year-over-year increase. Growth in same-store sales is critical to the company’s ability to boost revenue, hence the importance in strengthening customer throughput.

Chipotle uses various tactics to increase the number of customers it can drive through each location. For example, the restaurant chain makes it easy for customers to place orders online via its website or mobile app. Digital sales accounted for 37% of the company’s Q1 food and beverage revenue.

Another tactic is Chipotle’s coupling of online orders with a new store format called a Chipotlane. A Chipotlane is a drive-through dedicated specifically for customers to pick up online orders.

This evolution of the traditional drive-through concept makes it quick and easy for customers to get their food, further increasing throughput per location. The Chipotlane was introduced in 2018 under Niccol’s tenure.

The company described the Chipotlane format’s success, stating, “New restaurant openings that feature this digital order pick-up lane have demonstrated higher volumes and greater returns than a traditional Chipotle restaurant format.” The company expects at least 80% of new stores in 2024 to include a Chipotlane.

Deciding on Chipotle stock

New store openings is another factor in Chipotle’s revenue growth. In Q1, the company opened 47 locations and is targeting a total of at least 285 new restaurants in 2024. Last year, it added 271 stores.

Chipotle’s goal is to reach 7,000 locations in North America. At the end of Q1, it was about halfway to this goal with nearly 3,500 restaurants.

Thanks to the opening of new locations and rising same-store sales, Chipotle’s revenue has grown substantially with Niccol at the helm, more than doubling since the start of his tenure.

Niccol’s leadership, Chipotle’s success increasing customer throughput, and its store-expansion plans position the company for sustained revenue growth, which can boost its stock’s potential to increase in value. In fact, the current consensus among Wall Street analysts is an overweight rating with a median share price of $67.69 for Chipotle stock.

With shares down from June’s 52-week high after the historic stock split, now is a good time to buy shares in Chipotle.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Robert Izquierdo has positions in Chipotle Mexican Grill. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Is Chipotle Stock a Buy After Its Historic Stock Split? was originally published by The Motley Fool

Credit: Source link