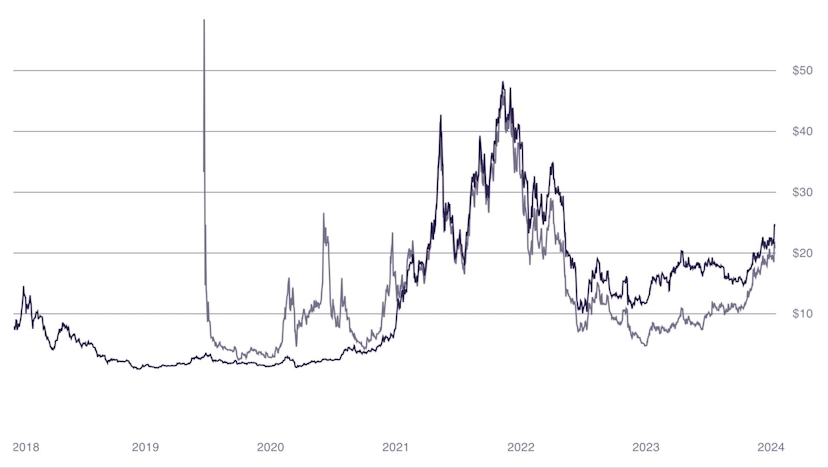

The Grayscale Ethereum Trust has seen its discount to NAV narrow to 15% from 47% a year ago.

After the SEC approved 11 spot Bitcoin ETFs last week, a key indicator points toward investors positioning themselves for a similar outcome for ETH.

The discount for ETHE, a publicly traded investment vehicle which provides exposure to ETH, has narrowed to 15% today after trading at 47% one year ago. The discount refers to the difference between ETHE’s market cap and the value of the underlying Ether held by the fund.

Before its conversion to an ETF last week, GBTC’s discount behaved similarly, suggesting to some that ETHE may ultimately follow the same path.

“Now that we have everybody issuing a Bitcoin ETF, it’s only a matter of time until we see an ETH ETF,” Stefan Rust, CEO of economic data aggregator Truflation, told The Defiant.

Unlike GBTC, ETHE can still trade at a discount —or premium, as was the case for much of the product’s life— because it is a closed-end fund, meaning that shares aren’t issued or destroyed frequently in response to investor demand, as is the case with ETFs.

ETHE has $7.6B in assets under management as of Jan. 15, according to its issuer Grayscale.

With the discount on ETHE narrowing, it’s likely investors are looking to front-run the possible conversion of the product to an ETF, which would cause the discount to close completely.

Grayscale filed to convert ETHE to an ETF last October. That move came just over a month after a U.S. court ruled that the SEC did not provide an adequate explanation for its denial of Grayscale’s application to convert GBTC in late August 2023. The SEC has since postponed the decision date for a potential ETHE conversion to Jan. 25.

To be sure, while the price action indicates investors are betting on an ETHE conversion, there are continuing signs of unrest at Digital Currency Group (DCG) Grayscale’s parent company — Barry Silbert, CEO and founder of DCG, resigned from his role as Grayscale chairman last month.

Start for free

Silbert stepped down after the New York Attorney General filed a complaint in October against Silbert, DCG, and Genesis, another DCG subsidiary which went bankrupt in January 2023. The SEC also charged Genesis with offering unregistered securities that same month and is also probing the subsidiary’s transactions with DCG, per Bloomberg.

Raul Calvo, co-founder of Diva Staking, a liquid staking protocol, noted that the investigation into Barry Silbert and DCG did appear to dampen the market’s interest in ETHE. The co-founder suggested that before GBTC’s conversion, investors weren’t sure whether Grayscale would be approved to launch an ETF representing any asset.

That sentiment changed with GBTC’s conversion last week, Calvo told The Defiant.

In light of the conversion, some have suggested that DCG is selling ETHE, in which the company holds a large stake, to cover liabilities created by the bankrupt Genesis — while the medium-term trend has been for the discount to close, since GBTC’s approval on Jan. 10, ETHE has drifted in the opposite direction.

“Not a TradFi guy, so take with a grain of salt, but ETHE discount to NAV is deepening from DCG paying off its loans with ETHE collateral,” Danger, a pseudonymous investor, said on X.

DCG did not respond to The Defiant’s request for comment about whether it is selling its ETHE holdings.

Danger doesn’t necessarily see the selling as a bad sign for ETHE, calling the alleged transactions “forced selling.”

“If you think an ETH ETF will happen, ETHE may be a way to play ETH + discount close,” he said, adding that he holds ETHE.

Despite the clouds swirling around DCG, those hoping for ETHE’s conversion to an ETF, or at least some sort of open-ended investment product representing Ether, got a boost on Friday — Larry Fink, CEO of Blackrock, said that he sees value in an Ethereum ETF.

Credit: Source link