As the world accelerates its transition to a low-carbon economy, high-purity alumina (HPA) has emerged as a crucial material underpinning this transformation, driving not just market expansion but an investment landscape rife with opportunities.

This advanced form of aluminum oxide, characterized by its exceptional purity levels of 99.99 percent or higher, is becoming increasingly indispensable in the production of cutting-edge technologies that are driving sustainable development.

The sector presents compelling opportunities for financial returns, driven by surging market demand and significant technological advancements.

Understanding high-purity alumina

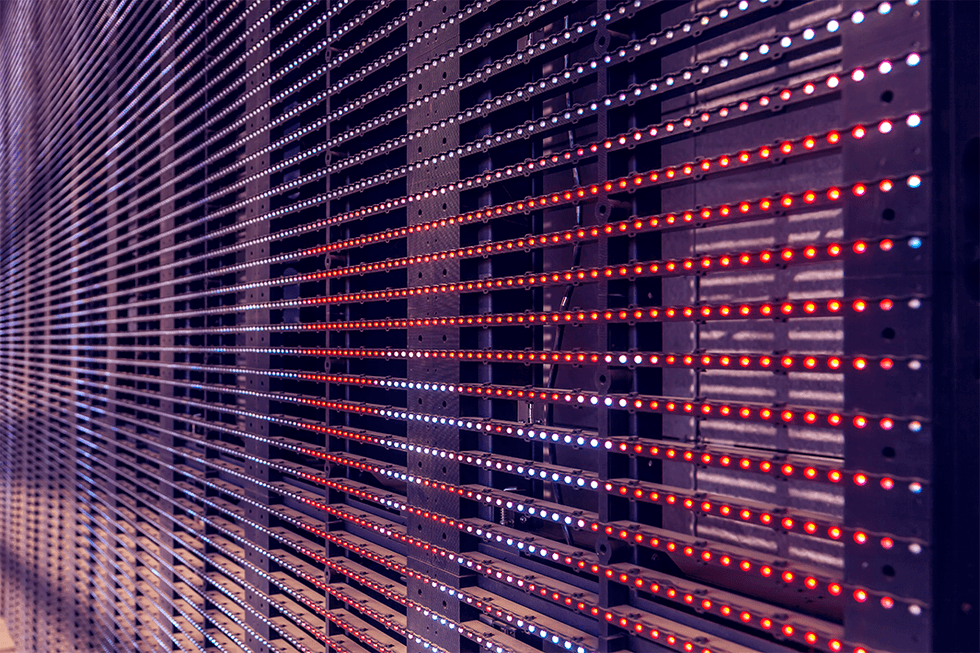

HPA is a versatile compound with unique properties that make it invaluable across various industries. Its high thermal conductivity, excellent electrical insulation and remarkable hardiness have positioned HPA as a critical component of LED lighting, lithium-ion batteries and synthetic sapphire for electronic displays.

These applications are at the forefront of energy-efficient technologies, playing a pivotal role in reducing carbon emissions and enhancing global energy conservation efforts.

- LED lighting: HPA is used as a substrate in LED production, enabling the creation of more efficient and longer-lasting lighting solutions that consume significantly less energy than traditional incandescent bulbs.

- Lithium-ion batteries: As a key component in battery separators, HPA enhances the safety and performance of lithium-ion batteries, which are crucial for electric vehicles and renewable energy storage systems.

- Electronic displays: Synthetic sapphire made from HPA is used in smartphone screens and other electronic displays, improving durability and energy efficiency.

Market demand and growth projections

HPA is experiencing an unprecedented growth in demand, driven by industries focused on sustainable and efficient technologies. Market analysis reveals a robust trajectory for the HPA sector. From an approximate value of US$3.18 billion in 2022, the global HPA market is projected to grow at a CAGR of 22.22 percent from 2023 to 2030, reaching a valuation of US$12.21 billion, according to data from Horizon Grand View Research.

This remarkable growth is primarily attributed to the rapid expansion of the electric vehicle market and the increasing adoption of LED lighting technologies, highlighting the urgent need for increased production capacity and innovative manufacturing processes.

Challenges and solutions

Despite its critical importance, the production of high-quality HPA faces several challenges:

- Cost effectiveness: Traditional methods of HPA production, such as the hydrolysis of aluminum alkoxides, are often expensive and energy intensive.

- Purity requirements: Achieving and maintaining the high purity levels required for advanced applications is technically challenging and resource intensive.

- Environmental impact: Conventional production methods can have a significant carbon footprint, which is at odds with the material’s role in supporting low-carbon technologies.

In response to these challenges, companies like Impact Minerals (ASX:IPT), a Western Australian exploration and development company, are pioneering innovative approaches to HPA production. Impact Minerals’ Lake Hope project, located 500 km east of Perth, exemplifies this innovation:

- Proprietary low-temperature leach (LTL) process: This method aims to produce high-quality HPA at reduced capital and operational costs compared to traditional techniques.

- Proven effectiveness: The LTL process has successfully produced 99.99 percent aluminum oxide, demonstrating its potential for large-scale application.

- Sustainable production: By utilizing lake clays as a raw material and employing a low-temperature process, the Lake Hope project aligns with sustainable production principles.

Impact Minerals is currently conducting a prefeasibility study for the Lake Hope project, scheduled for completion in early 2025. This study is expected to provide crucial insights into the project’s economic viability and its potential to address the growing demand for HPA in a sustainable manner.

As a validation of its project’s potential, Impact Minerals was recently awarded a $2.87 million federal grant for the commercialisation of its innovative process to produce HPA from the Lake Hope project.

The funding is part of an estimated $6.4 million research and development project to be completed within three years and designed to provide Impact Minerals with the relevant information required to complete a definitive feasibility. The grant will also enable the company to construct a pilot plant, expected to be completed in 2025, which will provide consistent material for offtake and qualification trials.

“We believe that we can produce HPA at the lowest cost globally from what we understand at the moment. And that’s a very important space to be. You’ve got to be in the lowest cost quartile, no matter what commodity you’re in, in order to make it through the cycle,” the company’s CEO Dr Mike Jones told Investing News Network in a recent interview.

Key takeaway

HPA’s critical role in enabling energy-efficient technologies serves as a cornerstone of the transition to a low-carbon economy. As demand continues to surge, driven by the growth of electric vehicles and LED lighting, the need for innovative, cost effective and environmentally friendly production methods becomes increasingly urgent.

Projects like Impact Minerals’ Lake Hope, supported by strategic partnerships and funding programs, represent the future of HPA production. By addressing the challenges of cost, purity and environmental impact, these innovations are paving the way for a more sustainable and efficient HPA industry, and opening up multiple avenues for investing.

This INNSpired article is sponsored by Impact Minerals (ASX:IPT). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Impact Mineralsin order to help investors learn more about the company. Impact Mineralsis a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Impact Mineralsand seek advice from a qualified investment advisor.

Credit: Source link