Lithium’s critical importance to the global green energy transition is expected to continue for the foreseeable future. In fact, the growth in demand would be so exponential industry that some analysts believe the world could face supply shortages as early as 2025 if more lithium production does not come online.

In the face of this, one question remains on everyone’s mind — where do we find enough lithium to stave off the shortage?

In recent years, Northern Canada has emerged as a new frontier for lithium exploration. Politically and economically stable and with a well-established mining sector, the region has all the right ingredients to support a thriving lithium exploration and development sector. But Northern Canada is not without its challenges, either.

To make informed decisions, investors need to understand both the challenges presented by Northern Canada’s unique climate, the opportunities its mining sector represents and the value of recent lithium spodumene discoveries.

A critical mineral in short supply

Recent years have seen lithium’s emergence as a lynchpin for both electrification and the clean energy transition. As the core ingredient in many types of rechargeable batteries, lithium is essential for the electric vehicle industry. It’s also used extensively in energy storage systems, which are themselves crucial components for both wind and solar power.

As governments around the world continue to commit to carbon neutrality and climate action plans, lithium has understandably experienced a meteoric rise in demand. Unfortunately, lithium production is struggling to keep pace. Between staffing shortages, supply chain interruptions and permitting issues, lithium mining and exploration companies often face a veritable gauntlet of challenges and delays.

This has led to what RK Equity Partner Howard Klein refers to as an oversupply of investment opportunities. Alongside ongoing delays, this overabundance of incomplete projects has caused automakers to become considerably more involved in the lithium sector. Rather than waiting for others to establish a lithium supply chain, original equipment manufacturers have begun taking matters into their own hands by signing deals with multiple junior mining and exploration companies.

These partnerships will only increase the automotive sector’s influence on the lithium market, which at present is heavily impacted by demand from the electric vehicle and industrial sectors. Although lithium prices hit a floor in late 2022, that same year saw them increase by nearly 500 percent. In light of this, we can expect the cost of lithium to continue its upward trajectory.

Here’s where Northern Canada comes in. Areas such as Québec’s Nunavik and Eeyou Istchee James Bay regions, as well as Northern Ontario, not only house considerable lithium reserves but are also largely underexplored. This makes them an incredibly valuable opportunity for both mining companies and investors.

This is perhaps best exemplified by the Whabouchi project, which is owned by Nemaska Lithium and Livent (NYSE:LTHM) and located in Eeyou Istchee James Bay. Nemaska describes the project as “one of the largest high-purity lithium deposits in North America and Europe,” as it hosts roughly 27.3 million metric tons of proven and probable reserves. The site will host an open pit and underground spodumene mine as well as a lithium hydroxide plant, and already has an 11 year supply deal inked with Ford Motor Company (NYSE:F).

For context, hard-rock lithium projects, which host lithium-bearing spodumene pegmatites, typically contains significantly higher lithium concentrations than either brine or clay. Its abundance and high lithium content make spodumene deposits ideal for large-scale lithium production, which is essential for supplying the growing requirements of battery manufacturers and other industries. Northern Canada is home to extensive reserves of spodumene, resulting in many potentially viable project sites in the region.

Eeyou Istchee James Bay also hosts Patriot Battery Metals’ (TSXV:PMET,ASX:PMT,OTCQX:PMETF) Corvette property, located within an emerging spodumene pegmatite district in which Patriot has already identified more than 70 lithium pegmatite outcrops to date.

It’s not just mineralogy that makes Northern Canada an attractive exploration target. Although mining regulations vary by province, as a whole, Canada is recognized as one of the world’s most stable mining jurisdictions. Many provinces have long histories with the mining industry, which translates to favorable government attitudes and access to a highly skilled workforce.

There’s one other factor at play here, as well. Eeyou Istchee James Bay, which in recent years has been a lithium exploration hotbed in Northern Canada, has largely been claimed. As a result, exploration companies are looking to other areas of Canada’s north to find prospective ground.

Yet for all its promise, the vast and underexplored region suffers from one potentially crippling drawback — the cold.

Exploring Canada’s northern frontier

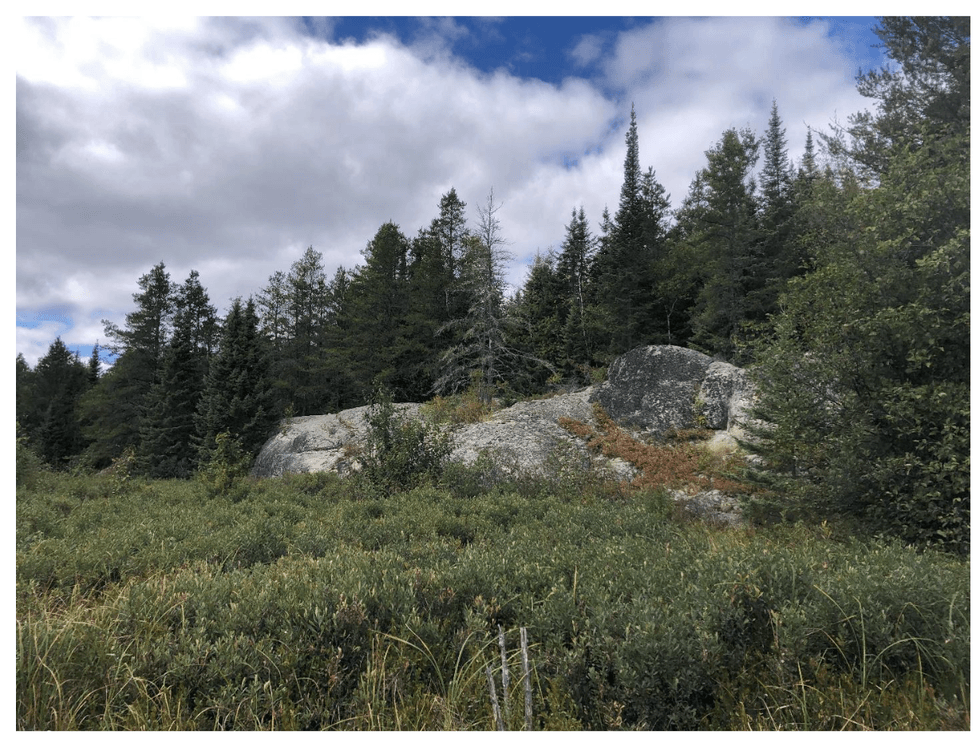

Northern Canada is largely characterized by harsh, cold, long winters and subarctic permafrost. Winter temperatures in the area can frequently drop below minus 50 degrees Celsius. Work conditions at mining and exploration projects during the winter can be hazardous to both workers and equipment.

When done correctly and safely, however, exploration work that continues through the winter season can provide companies a competitive advantage over their peers. For one thing, access to winter roads is significantly easier with less activity during the winter season, allowing ease of transport of equipment, materials and personnel to and from a project site. It also enables on-foot exploration and surveying to a much greater extent than would be possible during warmer months.

Working year round rather than suspending operations during winter also provides a considerable advantage for both a company and its shareholders, as it means fewer delays and a shorter timeline for the establishment of a fully operational mine. There is also less risk of upsetting the permafrost layer or causing environmental damage — a big gain for sustainability.

Additionally, a resource company with the capability to conduct exploration activities through the winter will benefit from sustained momentum driven by regular news flow on drill results.

Key players in Northern Canadian lithium exploration

Although much of Northern Canada remains underexplored, there have nevertheless been some incredibly promising lithium discoveries in the region.

In October, Patriot Battery Metals announced the discovery of a new high-grade spodumene pegmatite zone at its Corvette property. The zone is part of the existing CV13 spodumene pegmatite trend, which extends over a strike of roughly 2.3 kilometers in length and is open at both ends. Patriot has already made plans for further drilling after the holidays in January 2024.

That same month, North Arrow Minerals (TSXV:NAR) discovered several new spodumene mineralized pegmatites at its LDG and MacKay lithium projects in the Northwest Territories. To date, more than 17 simple and spodumene-bearing pegmatites have been identified between the two properties. Because both projects display similar geology to the Yellowknife Pegmatite Province, North Arrow asserts they have the potential for similar size and scale.

Brunswick Exploration (TSXV:BRW,OTCQB:BRWXF), meanwhile, announced the discovery of an undocumented spodumene-bearing pegmatite at the Elrond project, part of the company’s Mythril option agreement with Midland Exploration (TSXV:MD,OTC Pink:MIDLF). Brunswick is currently planning additional drill programs to take place in winter 2024.

Lastly, Beyond Lithium (CSE:BY,OTCQB:BYDMF) discovered promising new spodumene-bearing pegmatite zones at two of its projects in Ontario: the Ear Falls project and the Victory project. Both projects are accessible by major highways and a network of well-maintained logging roads.

Following Beyond’s spodumene discoveries in September, the company has continued its exploration, launching a follow up stripping and drilling program at Ear Falls in October that will inform a more substantial upcoming drill program. This continued work throughout the winter and the company continuing to receive assay results from its recent drill programs have created a consistent news flow for Beyond.

Other companies with recent spodumene discoveries in the region include Volta Metals (CSE:VLTA), Tearlach Resources (TSXV:TEA,OTCQB:TELHF) and Quebec Precious Metals (TSXV:QPM,OTCQB:CJCFF).

Investor takeaway

Lithium demand has increased exponentially over the past several years, and there is every indication that it will continue to do so. As production struggles to keep pace, we’ve seen the emergence of multiple lithium mining and exploration companies. Many of these organizations are laser-focused on Northern Canada — potentially the site of the next major lithium rush.

Investors would do well to be aware of both these companies and the investment opportunities they represent.

This INNSpired article is sponsored by Beyond Lithium (CSE:BY,OTCQB:BYDMF). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Beyond Lithiumin order to help investors learn more about the company. Beyond Lithium is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Beyond Lithium and seek advice from a qualified investment advisor.

Credit: Source link