Inflation ‘remains too high’

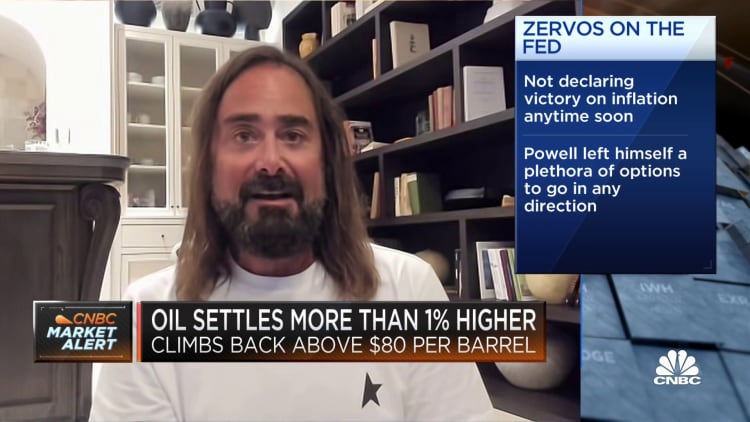

But in recent remarks, Federal Reserve Chair Jerome Powell said inflation “remains too high” despite those positive indicators, and warned that more interest rate hikes are still possible.

Central bank officials have already raised rates 11 times, pushing the Fed’s key interest rate to a target range of 5.25% to 5.5%, the highest level in more than 22 years.

Already, four out of five consumers’ spending habits have been affected by inflation, according to TD Bank’s annual consumer spending index.

“Consumers are undoubtedly continuing to feel the impact of inflation and rising interest rates,” said Chris Fred, TD Bank’s head of credit cards and unsecured lending.

Lower-income workers have been the hardest hit by higher prices, particularly for food and other necessities, since those expenses account for a bigger share of the budget, studies show.

Now, 78% of consumers earning less than $50,000 a year and 65% of those earning between $50,000 and $100,000 were living paycheck to paycheck in July, both up from a year ago, LendingClub found. Of those earning $100,000 or more, only 44% reported living paycheck to paycheck.

Financial stress all around

Credit: Source link