Inflation was flat in October from the previous month, providing a hopeful sign that stubbornly high prices are easing their grip on the U.S. economy.

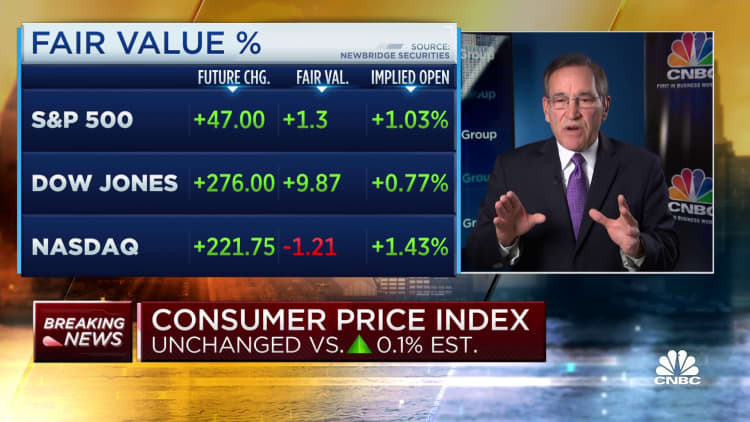

The consumer price index, which measures a broad basket of commonly used goods and services, increased 3.2% from a year ago despite being unchanged for the month, according to seasonally adjusted numbers from the Labor Department on Tuesday. Economists surveyed by Dow Jones had been looking for respective readings of 0.1% and 3.3%.

Headline CPI had increased 0.4% in September.

Excluding volatile food and energy prices, core CPI increased 0.2% and 4%, against the forecast of 0.3% and 4.1%. The annual level was the lowest in two years, down from 4.1% in September, though still well above the Federal Reserve’s 2% target.

Markets spiked on the news. Futures tied to the Dow Jones Industrial Average were up 300 points as Treasury yields fell sharply. Traders also took any potential Fed interest rate hikes almost completely off the table, according to CME Group data.

“The Fed looks smart for effectively ending its tightening cycle as inflation continues to slow. Yields are down significantly as the last of investors not convinced the Fed is done are likely throwing in the towel,” said Bryce Doty, portfolio manager at Sit Fixed Income Advisors.

The flat reading on headline CPI came as energy prices declined 2.5% for the month, offsetting a 0.3% increase in the food index. It was the slowest monthly pace since July 2022.

Shelter costs, a key component in the index, rose 0.3% in October, half the gain in September as the year-over-year increase eased to 6.7%. Within the category, owners equivalent rent, which gauges what property owners could command for rent, increased 0.4%.

Vehicle costs, which had been a key inflation component during the spike in 2021-22, fell on the month. New vehicle prices declined 0.1%, while used vehicle prices were off 0.8% and were down 7.1% from a year ago.

Airfares, another closely watched component, declined 0.9% and are off 13.2% annually. Motor vehicle insurance, however, saw a 1.9% increase and was up 19.2% from a year ago.

The report comes as markets are closely watching the Fed for its next steps in a battle against persistent inflation that began in March 2022. The central bank ultimately increased its key borrowing rate 11 times for a total of 5.25 percentage points.

While markets overwhelmingly believe the Fed is done tightening monetary policy, the data of late has sent conflicting signals.

Nonfarm payrolls in October increased by just 150,000, indicating the labor market finally is showing signs that it is reacting to Fed efforts to correct a supply-demand imbalance that has been a contributing inflation factor.

Labor costs have been increasing at a much slower pace over the past year and a half as productivity has been on the rise this year.

Real average hourly earnings — adjusted for inflation — increased 0.2% on a monthly basis in October but were up just 0.8% from a year ago, according to a separate Labor Department release.

More broadly speaking, gross domestic product surged in the third quarter, rising at a 4.9% annualized pace, though most economists expect the growth rate to slow considerably.

However, other indicators show that consumer inflation expectations are still rising, the likely product of a spike in gasoline prices and uncertainty caused by the wars in Ukraine and Gaza.

Fed Chair Jerome Powell last week added to market anxiety when he said he and his fellow policymakers remain unconvinced that they’ve done enough to get inflation back down to a 2% annual rate and won’t hesitate to raise rates if more progress isn’t made.

“Despite the deceleration, the Fed will likely continue to speak hawkishly and will keep warning investors not to be complacent about the Fed’s resolve to get inflation down to the long-run 2% target,” said Jeffrey Roach, chief economist at LPL Financial.

Even if the Fed is done hiking, there’s more uncertainty over how long it will keep benchmark rates at their highest level in some 22 years.

Credit: Source link