Chipmaker Advanced Micro Devices (NASDAQ: AMD) has flourished over the past eight years thanks to several industries blossoming, including gaming, data center and cloud, and personal computing.

Had you invested just $1,000 in AMD stock in December 2015, it would have grown to $58,960 today, a remarkable 59-fold return in under a decade.

The world relies on technology more than ever, but the competitive landscape is also different than it was just a few years ago. So what can investors expect next from AMD?

Data center growth should continue

The key to AMD’s ascension was its successful breakthrough into the data center business. Years ago, AMD’s focus on the gaming and personal computer markets limited it to playing a backseat role to Intel. In a November 2022 interview, AMD CEO Lisa Su described how she decided some six years or so ago that she wanted to shift the company’s strategy to focus on high-computing data center applications.

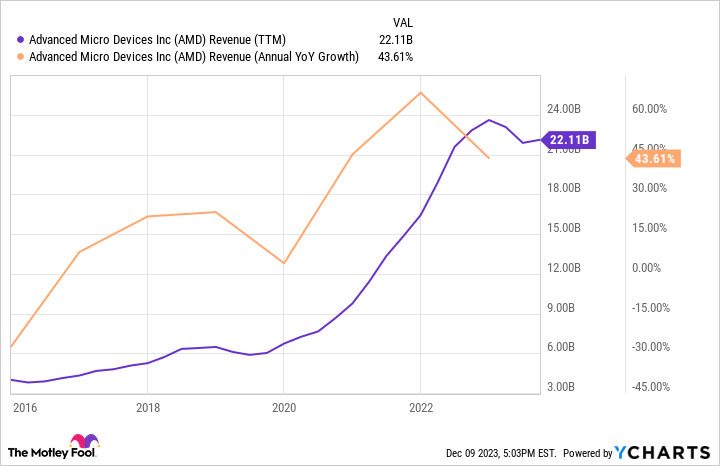

That successful pivot to higher-end chips has reaped rewards for AMD. Its revenue has risen roughly five-fold over the past eight years.

How it extends its data center growth from here will be a crucial factor in AMD’s investment returns. Rival Nvidia has won the early battle for market share in AI chips, but AMD is not sitting on its hands. The company recently unveiled its Instinct MI300X, a GPU chip designed for AI-purposed servers.

The chip’s specifications are allegedly better than those of Nvidia’s H100 chip, but the lead will likely shift back and forth as each vendor’s new chips outshine the prior versions over the coming years. Importantly, AMD has made early progress with some key customers. Microsoft and Meta Platforms have agreed to use the MI300X.

Su believes the AI chip market could grow to over $400 billion within five years. And as was the case when it was vying with Intel years back, AMD doesn’t have to dominate Nvidia. All it must do is carve out a solid piece of a massive market, and AMD could handsomely reward long-term investors.

Can AMD replicate its massive share price gains?

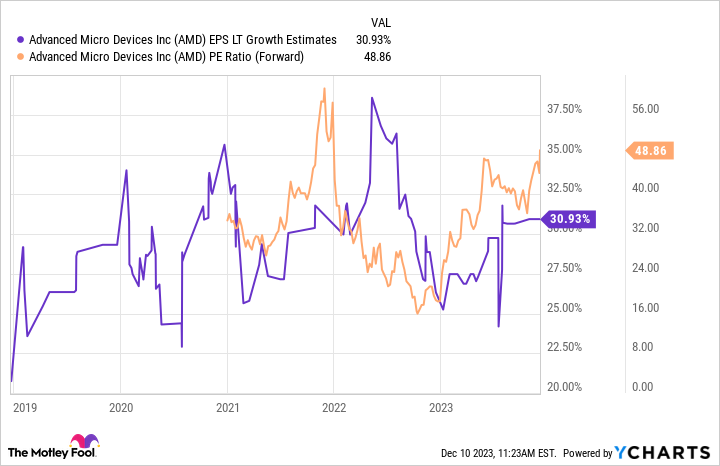

Those previous 59x returns pushed AMD’s market cap above $200 billion, into the rarefied realm of the megacap stocks. Such a massive company can’t be expected to expand at anywhere like that prior pace. However, it can still be a potential market-beating investment. Analysts believe AMD’s earnings can grow at a compound annual rate of roughly 30%.

Its shares trade at a forward price-to-earnings ratio of 49, which isn’t a crazy valuation given AMD’s growth potential. Its price/earnings-to-growth ratio of 1.5 isn’t a bargain, but the business can grow into it over the next few years if AMD hits these growth estimates.

A Citi Bank estimate pegged AMD’s long-term market share as high as 10% of that forecast $400 billion AI chip market. That would be $40 billion — double the company’s total sales over the past year. That’s a wide-open opportunity for AMD to grow from here, and the stock’s reasonable valuation means that a good chunk of that growth would be reflected by share price gains.

While AMD’s period of delivering life-changing returns to long-term investors is probably behind it, the company could still help shareholders achieve some serious gains — if it’s up to the task of competing in the rapidly growing AI chip market.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 7, 2023

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

If You Invested $1,000 in Advanced Micro Devices in 2015, This Is How Much You Would Have Today was originally published by The Motley Fool

Credit: Source link