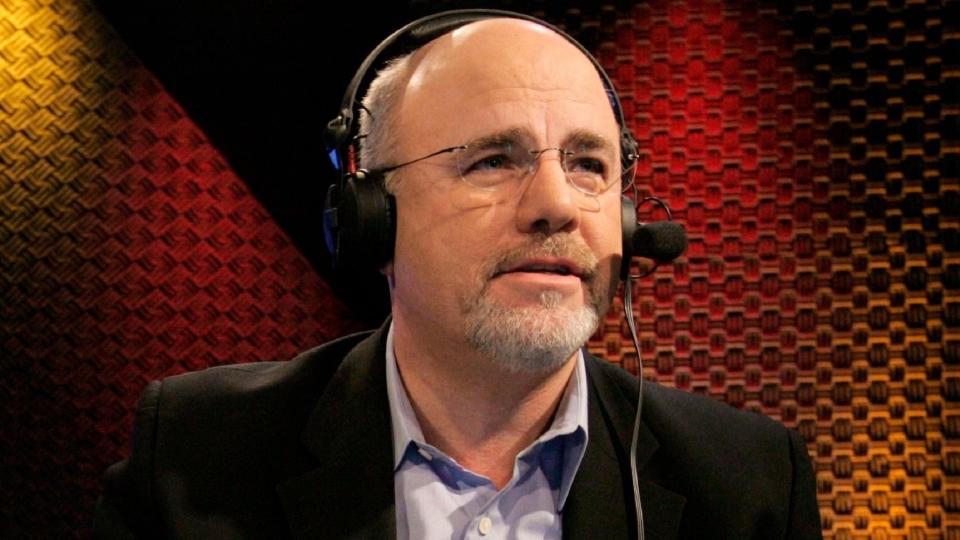

Based on data from the U.S. Bureau of Labor Statistics and the National Center for Education Statistics, the average tuition inflation for four-year institutions was 12% per year between 2010 and 2020. This significantly exceeded the annual inflation rates ranging from 0.1% to 8% over that time. The financial expert and radio host Dave Ramsey attributes this to the availability of federal student loans.

See: Student Loan Pause Officially Ends in October — Are You Ready To Start Making Average $503 Payments Again?

Discover: All of the States That Will Pay Off Your Student Loans

In an Oct. 3 post on the X platform, formerly known as Twitter, Ramsey said, “College and university prices have been rising faster than the rate of inflation for many years. If student loan money was no longer available, colleges and universities would be forced to lower their prices, because they wouldn’t have students willing or able to pay what they’re charging.”

Ramsey’s idea is that eliminating student loans would lower demand for postsecondary education, so institutions would need to rethink their tuition charges to draw in students. This relates to a hypothesis that the former Secretary of Education William Bennett shared in a 1987 New York Times article. He proposed that institutions will charge more when there is more federal student aid available.

A 2022 Federal Reserve Bank of Richmond study found the Bennett hypothesis likely valid back when students had access to more limited financial aid, including no unsubsidized loans. However, it indicated less of a connection between tuition rate increases and the most recent student loan limit changes.

It’s yet to be seen if institutions would actually lower their tuition rates, since they heavily rely on the money to cover the many costs to operate. For example, institutions would still need to cover increasing salaries for staff, spend money on marketing and recruiting students and invest in their facilities to stay competitive. While public institutions do get government funding to help, they often face cuts that make tuition proceeds increasingly important.

Student Loan Forgiveness: 10 Expenses To Cut From Your Budget When Payments Resume

Unless institutions find ways to significantly cut costs or get additional funding sources, lowering tuition can be challenging. Additionally, some colleges and universities may actually feel pressured to raise their tuition rates if enrollment drops significantly and they struggle to cover their costs.

Students would also face barriers to a college education if federal student loans were no longer an option. They would need to pay out of pocket or seek private financing if they don’t have access to sufficient grants and scholarships. Therefore, fewer people may pursue college degrees, and those who borrow privately may still end up with costly debt.

If you’re concerned about high tuition, you can take steps to reduce your costs and reliance on student loans. In a YouTube video, Ramsey recommended using your savings, working while studying and taking advantage of grants and scholarships. He also emphasized doing your research to find an affordable school and considering organizations and programs that will cover your college costs.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: How Ending Student Loans Would Lower the Price of a College Degree

Credit: Source link