Bitcoin ETFs are showing no signs of weakness as they enter the ninth consecutive day of positive inflows, even as the broader market experiences a downtrend.

BlackRock’s spot Bitcoin ETF IBIT led with the most inflows over the past day.

Bitcoin ETFs Extend the Bullish Momentum

According to the data from SoSoValue, Bitcoin ETFs extended their winning streak after recording the ninth consecutive day of positive inflows on December 10. Last week, all 12 funds recorded the second-largest weekly inflow at $2.73 billion. Despite wider liquidation in the market this week, ETF investors seem highly bullish on the funds.

The ETFs attracted a significant amount of $439.56 million on Tuesday as BlackRock’s IBIT brought in $295.63 million, followed by Fidelity’s FBTC, with an inflow of $210.48 million.

At the same time, Grayscale’s GBTC recorded outflows of over $60 million. Nevertheless, the $400 million in net inflows confirm the strong investor interest in the US spot BTC ETFs.

The total net assets under these ETFs have crossed $107.76 billion, which marks 5.65% of Bitcoin’s total market cap. More interestingly, these funds currently hold more Bitcoin than Satoshi Nakamoto.

In November, Bitcoin ETFs recorded $6.1 billion in inflows, the highest monthly influx since their launch in January. Total inflows in December are already nearing $4 billion, and if the momentum holds, the funds could hit a new record this month.

Ethereum ETFs did not disappoint either, as daily inflows crossed $305 million on Tuesday. But the same can not be said about the rest of the market.

Crypto Liquidations Soar to Billions

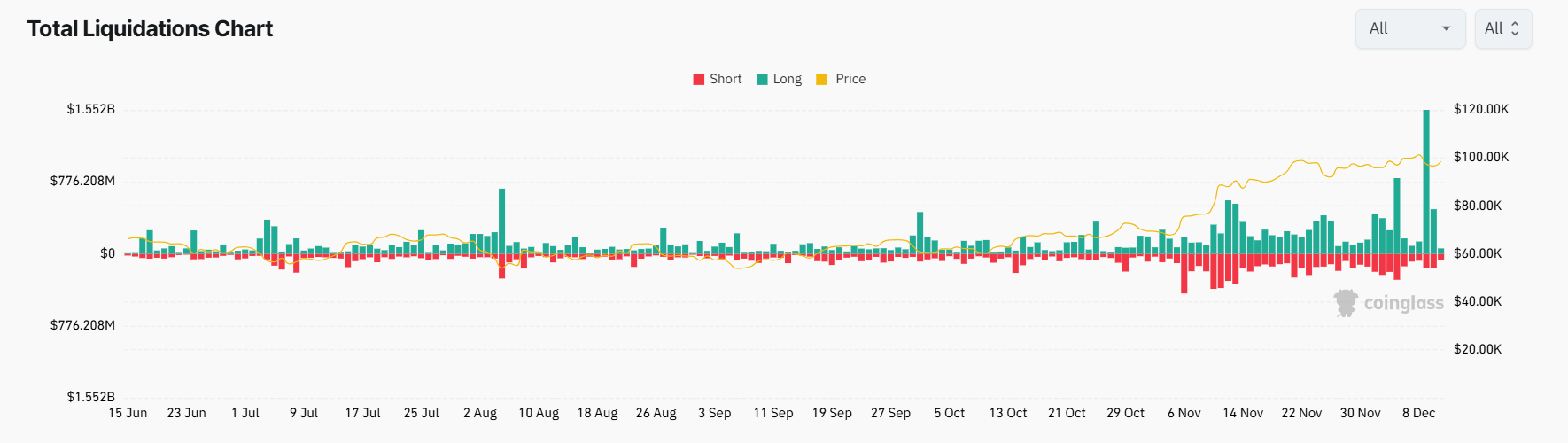

Despite the growth shown by the ETF market, the past couple of days saw mounting liquidations as Bitcoin could not hold firm above $100,000. Bitcoin dragged the rest of the market down with it as the total crypto market cap took a hit. Major altcoins like XRP and Solana also mirrored Bitcoin’s losses.

According to Coinglass data, the market recorded $1.7 billion in liquidations on December 9 alone as Bitcoin prices declined to around $97,000 after hitting $100,000.

The sell-off continued into the week, with the total liquidations over the past three days topping $2.5 billion.

However, Bitcoin recovered at press time and was trading around $100,555, up 5.06% over the past 24 hours. If Bitcoin manages to stay above the $100,000 mark, then the largest cryptocurrency can continue to cement its position in institutional portfolios.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link