No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

A record 84 percent of Americans polled by mortgage giant Fannie Mae in September thought it was a bad time to buy a home, and most didn’t think their biggest concern — elevated mortgage rates — will be alleviated anytime soon.

“Mortgage rates persistently over 7 percent appear to be deepening the malaise consumers feel about the home purchase market,” Fannie Mae Chief Economist Doug Duncan said in a statement Monday. “In fact, high mortgage rates surpassed high home prices as the top reason why consumers think it’s a bad time to buy a home, a survey first.”

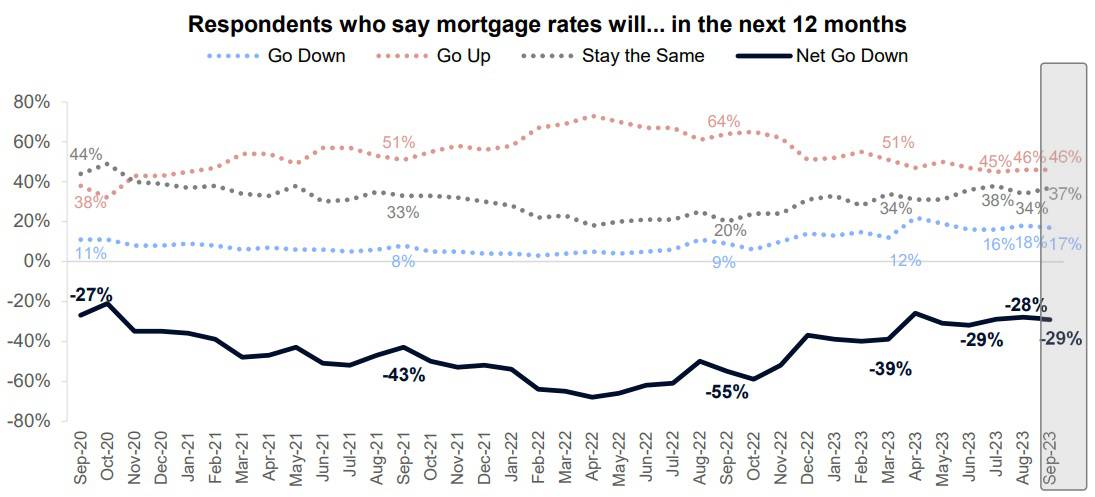

Only 17 percent of households polled for Fannie Mae’s latest National Housing Survey thought mortgage rates would come down in the next 12 months, and fewer than one in four (23 percent) said they expected home prices to come down during the same period.

Doug Duncan

Consumers “also indicated that their personal economic situations are showing signs of strain, including lower year-over-year household incomes and a reduced sense of job security,” Duncan said. “In our view, all of this points to home purchase affordability remaining a problem for the foreseeable future, which we forecast will keep home sales sluggish into next year.”

In their latest forecast, Fannie Mae economists said they expect home sales to shrink by 17.4 percent this year, to 4.8 million, and bounce back by less than 1 percent in 2024 with the U.S. looking to be headed for a “mild recession” in the first half of next year.

Source: Fannie Mae National Housing Survey, September 2023.

Fannie Mae takes six questions from the monthly National Housing Survey and distills them into a single number, the Fannie Mae Home Purchase Sentiment Index (HPSI).

With five of the index’s six components decreasing from August to September, the HPSI dipped by 2.4 points, to 64.5, but was still up by 3.7 points from a year ago.

Source: Fannie Mae National Housing Survey, September 2023.

Fannie Mae’s National Housing Survey of 1,045 household financial decision-makers between Sept. 1 and Sept. 18 found 84 percent thought it was a bad time to buy. That’s up from 82 percent in August and 75 percent a year ago, representing a new high in survey records dating to 2010.

The percentage of respondents who said it was a good time to buy dropped from 18 percent to 16 percent, matching all-time survey lows seen in October and November of 2022 when mortgage rates climbed to their highest level of the year.

Source: Fannie Mae National Housing Survey, September 2023.

While a scarcity of listings can make for a seller’s market, the percentage of respondents who said it was a good time to sell dipped from 66 percent in August to 63 percent in September. The share of consumers who thought it was a bad time to sell also climbed to 37 percent, up from 34 percent in August. With those changes, the net share of those who said it was a good time to sell decreased by seven percentage points from August to September.

“On the sell side, respondents also listed unfavorable mortgage rates as the top reason why they believe it’s a bad time to sell a home,” Duncan said. “This indicates to us that many homeowners are probably not eager to give up their ‘locked-in’ lower mortgage rates anytime soon, but it also may reflect the worry of some homeowners that sale values might be suppressed slightly if the pool of qualified homebuyers is constrained by elevated mortgage rates.”

Source: Fannie Mae National Housing Survey, September 2023.

Many forecasters expect mortgage rates will ease next year as the economy cools. But fewer than one in five (17 percent) consumers surveyed by Fannie Mae in September expect to see any relief on that front. Close to half (46 percent) said they expect mortgage rates to go up over the next 12 months, and so far they’ve been right.

Rates on 30-year fixed-rate conforming mortgages, which averaged 7.08 percent on Sept. 1, have climbed more than half a percentage point since then, to a new 2023 high of 7.63 percent on Friday, Oct. 6, according to rate lock data tracked by the Optimal Blue Mortgage Market Indices.

Source: Fannie Mae National Housing Survey, September 2023.

In addition to rates, consumers are also increasingly worried about their ability to qualify for a mortgage. Six out of 10 consumers (60 percent) surveyed in September thought it would be difficult to get a mortgage, up from 56 percent in August and 45 percent a year ago.

A recent report by the Mortgage Bankers Association that tracks mortgage credit availability showed even though lenders eased their standards slightly in August, access to mortgages remains close to “very low levels” last seen in January 2013.

“Industry capacity continues to decline as lenders reduce staffing and simplify their product offerings to reduce costs and raise profitability,” MBA Deputy Chief Economist Joel Kan said in a statement when the report was released last month.

Source: Fannie Mae National Housing Survey, September 2023.

While elevated mortgage rates and tightening credit conditions could eventually undermine home prices, only 23 percent of consumers polled by Fannie Mae in September said they expected to see price declines in the next 12 months. That’s down from 26 percent in August and 35 percent a year ago.

With the share of respondents who said they expect home prices will go up in the next 12 months increasing from 41 percent to 42 percent, the net share of those who say home prices will go up in the next 12 months increased by 4 percentage points from August to September, and was up 22 percentage points from a year ago.

Source: Fannie Mae National Housing Survey, September 2023.

While three in four of those surveyed (75 percent) in September said they weren’t concerned about losing their job in the next 12 months, that’s down from 78 percent in August. With the percentage who said they were concerned about losing their job increasing to 23 percent, the net share of those who say they are not concerned about losing their job decreased 3 percentage points from August to September.

Source: Fannie Mae National Housing Survey, September 2023.

The net share of those who reported “significantly higher” household income in September compared to a year ago decreased 5 percentage points from August to September. Fewer than one in five (18 percent) said their household income was significantly higher than it was a year ago, down from 22 percent in August and 26 percent a year ago.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Credit: Source link