The stock market has gotten off to a scorching start in 2024. About midway through the year, the S&P 500 has gained roughly 15% while the tech-heavy Nasdaq Composite is up nearly 18%.

One of the hottest sectors fueling the market to new heights is technology — primarily driven by euphoria surrounding all things related to artificial intelligence (AI). As stock prices continue to surge, some companies have resorted to stock splits in an effort to open shares up to a broader base on investors.

Semiconductor company Broadcom (NASDAQ: AVGO) is the most recent chip company to announce a stock split, joining its peers Nvidia and Lam Research.

Let’s dive into some important details regarding stock splits, and assess whether Broadcom could be a lucrative opportunity for long-term investors.

1. What are stock splits and how do they work?

A stock split is a financial engineering instrument during which a company’s stock price and share count change by the factor in the split ratio.

In early June, Broadcom announced that it will be completing a 10-for-1 stock split. This means that after the split occurs, Broadcom’s outstanding shares will rise by 10x while its share price will be divided by 10.

Let’s take a look at an example. In the table below, you can see Broadcom’s current share count, stock price, and market cap on both a pre- and post-split basis.

Item | Pre-Split | Post-Split |

|---|---|---|

Share count | 465 million | 4.6 billion |

Stock price | $1,698 | $169 |

Market cap | $790 billion | $790 billion |

Data source: Broadcom SEC filings and Yahoo! Finance.

If the split were to occur today, Broadcom’s outstanding shares would rise from about 465 million to 4.6 billion. At the same time, the company’s stock price would be reduced by a factor of 10 — dropping from $1,698 to $169. Given this dynamic, investors can see that a stock split does not change the market cap of a company.

2. Why might Broadcom be splitting its stock?

AI has been one of the biggest tailwinds in the capital markets over the last 18 months. Chip stocks in particular have benefited greatly from the hype around AI.

Since January 2023, shares of Broadcom have soared 204%. As of the time of this writing, Broadcom stock is hovering around $1,700 — close to its 52-week high of $1,851.

Since the stock is trading near record levels and boasts a four-figure price tag, many investors likely see Broadcom as expensive. However, this way of thinking is not entirely correct and can actually prevent retail investors from missing out on good opportunities.

What I mean by this is that investors should not base their decision to buy a stock purely on its price. A close analysis of valuation multiples, and benchmarking the company against a set of peers, are needed to determine whether a stock may be overvalued or undervalued.

3. How do stock splits get handled?

The nice thing about stock splits is that they are handled pretty seamlessly. If you currently own shares of Broadcom, your investment broker will handle all the mechanics in the background.

For example, let’s say that you currently own 10 shares of Broadcom at an average price of $1,500. Provided that you don’t buy or sell any additional shares prior to the split, your account will automatically reflect 100 shares owned at an average price of $150 once the split is complete.

4. Has Broadcom ever split its stock?

Broadcom originally went public in 1998 and traded under the ticker symbol BRCM on the Nasdaq stock exchange. During its time trading under the ticker BRCM, Broadcom completed three stock splits.

However, in 2016, Avago Technologies acquired Broadcom for $37 billion. As part of the transaction, Avago Technologies changed its name to Broadcom Inc. The BRCM ticker symbol was retired, and Broadcom now trades on the Nasdaq under the symbol AVGO.

Since trading under its new ticker as part of Avago Technologies beginning in 2016, Broadcom has not split its stock.

5. Is Broadcom stock a buy right now?

Valuing semiconductor stocks can be a bit of a daunting exercise. The chip space is highly cyclical, and right now companies across the board are witnessing outsize demand on the heels of the AI revolution.

Given the nature of the chip industry, metrics such as earnings and cash flow can quickly go south. For this reason, using the price-to-earnings (P/E) ratio or price-to-free cash flow (P/FCF) multiple isn’t overly useful, because each can be inconsistent over long-term time ranges.

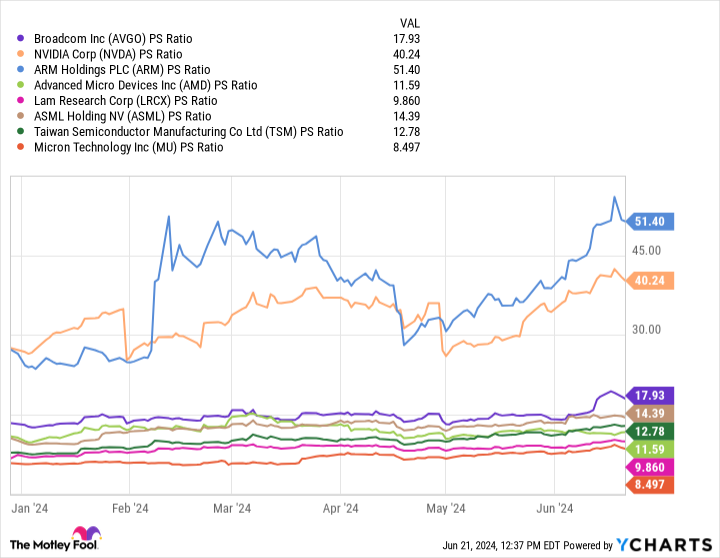

Using the analysis in the chart above, investors can see that Broadcom’s 17.9 price-to-sales (P/S) multiple sits squarely in the middle of this peer set. With that said, Nvidia and Arm Holdings are obvious outliers among this cohort. Excluding those two, Broadcom would be valued at a premium compared to most of its peers in the chip realm.

Despite its pricey valuation, I would advise against waiting until after the split to scoop up shares. As explained above, the lower price tag on Broadcom shares post-split does not mean it’s actually less expensive.

Moreover, stock splits generally fetch a lot of attention. Stock-split stocks can experience quite a bit of volatility and momentum around the time of the split, thereby pushing the share price higher after the split occurs. If this occurs, it technically means you’re buying Broadcom stock at a higher valuation as compared to before the split.

To me, investing in Broadcom should be rooted in long-term conviction around AI and the company’s ability to emerge as a leader. If you are looking to hedge other chip stocks in your portfolio or gain exposure to the long-term tailwinds in AI, Broadcom could be a good opportunity right now.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Lam Research, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Here Are 5 Things Smart Investors Should Know About Broadcom’s Upcoming 10-for-1 Stock Split was originally published by The Motley Fool

Credit: Source link