Discussions of renewable energy are no longer limited to solar and wind power. Nowadays, hydrogen is emerging as a popular alternative to diversifying the energy landscape. Consequently, for forward-looking investors, hydrogen stocks like Plug Power (NASDAQ: PLUG) seem like compelling opportunities.

But Plug Power is far from a wise investment. The company has continuously hemorrhaged cash for years, and it’s still far from profitability. Instead, investors would do better to gas up their portfolios with other hydrogen names such as Air Products (NYSE: APD), Bloom Energy (NYSE: BE), and Linde (NASDAQ: LIN).

1. Air Products

Specializing in the production and distribution of industrial gases, Air Products is making a concerted effort to expand its hydrogen power operations. In 2023, Air Products took a major step closer toward developing the world’s largest green hydrogen (meaning no carbon emissions) production facility in Saudi Arabia after it completed financial arrangements for the $8.4 billion project. By 2026, Air Products expects the project to achieve daily hydrogen production of 600 metric tons.

Stateside, Air Products is partnering with AES to develop a $4 billion green hydrogen production facility in Texas. Expected to begin commercial operations in 2027, the Lone Star state facility will have a daily hydrogen production capacity of 200 metric tons, and it will be the largest facility of its type in the United States.

Unlike Plug Power, Air Products generates a massive amount of organic cash flow. This makes the stock a lot more appealing to conservative investors who are uncomfortable with Plug Power’s consistent need to raise capital through both debt and equity financing. Plus, Air Products is a leading dividend stock, offering investors an attractive 2.7% dividend yield, so shareholders can be paid while Air Products grows its hydrogen footprint.

2. Bloom Energy

Bearing a more direct resemblance to Plug Power, Bloom Energy is also a leading fuel cell manufacturer. The two companies, however, contrast in a very important way: profitability. Bloom Energy has consistently generated a gross profit over the past five years. During this period, it averaged an annual gross profit of 16.2%. On the other hand, Plug Power has reported gross losses in 2021 and 2022, and its average annual gross profit is negative 109% from 2018 to 2022.

Further down the income statement, the difference between the two companies is even more apparent. During its third-quarter 2023 earnings presentation, Bloom Energy reaffirmed its forecast that it’d generated positive adjusted operating income for 2023. Plug Power hasn’t provided any such guidance, and it’s quite possible that it will fail to report a gross profit again for 2023.

Of course, the discussion between Bloom Energy and Plug Power in terms of profitability means little if Plug Power ends up going bankrupt — an issue that management raised during its Q3 2023 earnings presentation when it stated its lack of confidence in the company’s “ability to continue as a going concern.”

3. Linde

Similar to Air Products, Linde is a leader in producing and distributing industrial gases, and it, too, has committed to advancing the development of the hydrogen economy.

Most recently, Linde expressed interest in partnering with Equinor to develop a blue hydrogen production facility in the Netherlands. The project is in the early stages of development, and financial details haven’t been disclosed, but the facility is expected to have a daily production capacity of more than 575 metric tons.

With respect to the company’s operations in the United States, Linde recently expanded hydrogen production at a facility in Alabama to 30 metric tons per day, and it’s developing a blue hydrogen production facility in Texas that’s slated to begin operations in 2025.

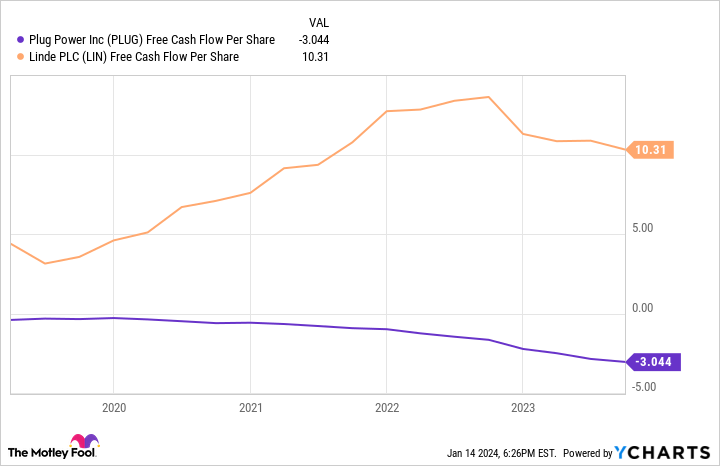

Financially, Linde is in a different league from Plug Power altogether — namely concerning its cash flow. Linde is a free cash flow machine, generating gobs and gobs of organic cash.

Considering Plug Power’s inability to generate even a semblance of organic cash flow, it’s clear that Linde is a much more sound choice for risk-averse investors.

Which hydrogen heavyweight is the best fit?

Plug Power may have a cult-like following, but its popularity belies the ample risk that surrounds the stock. Therefore, those who are eager to gain hydrogen exposure but would like to do so with a more judicious approach would be wise to power their portfolios with Air Products and Linde — two industrial gas stalwarts that also offer steady passive income through their dividends.

Those who are interested in a more robust growth opportunity and are comfortable with a higher degree of risk, however, would be better served to choose Bloom Energy.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 8, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Linde. The Motley Fool recommends Equinor Asa. The Motley Fool has a disclosure policy.

Forget Plug Power: Here Are 3 No-Brainer Hydrogen Stocks to Buy in 2024 was originally published by The Motley Fool

Credit: Source link