As the primary component of the anode material in lithium-ion batteries, graphite plays a crucial role in North America’s push to establish a secure supply chain in support of the growing electric vehicle (EV) industry.

But the resource also has a diverse set of applications beyond the battery space, from pencils and greases to refractory products and fire-retardant building materials. As such, graphite may be a compelling investment opportunity for many.

By gaining a deeper understanding of graphite’s supply and demand dynamic, along with its many industrial applications beyond batteries, investors can more readily identify promising investment opportunities with this critical mineral.

Key resource for electrification and sustainability

In recent years, graphite has become a key EV battery material. Experts believe that it will likely remain so for at least a decade. This is because the majority of modern EV batteries contain between 40 and 60 kilograms of graphite.

Consequently, Benchmark Mineral Intelligence predicts that graphite demand from the battery sector will increase at least 250 percent by 2030, particularly as companies like Tesla (NASDAQ:TSLA) seek to construct megafactories and gigafactories. Failure to expand current graphite supply chains will result in a significant deficit, the analyst firm notes.

In light of this looming shortage, cross-commodity price reporting agency Fastmarkets expects graphite’s market price to increase, driven by mounting underlying costs.

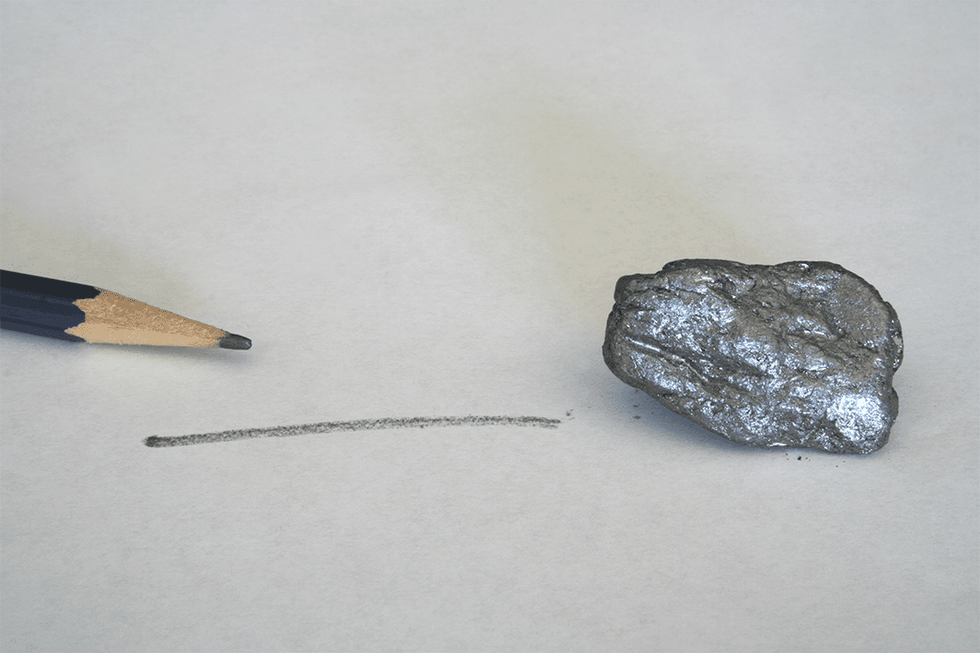

While graphite has received considerable attention for its role in EV batteries, its uses extend far beyond, spanning industries such as electronics, automotive, aerospace and industrial machinery. Common applications of graphite include pencils, polishes, electric motor brushes and to create graphene sheets, a material 10 times lighter and 100 times stronger than steel. Graphite is also used as a liner for crucibles and ladles and plays a key role in steel production.

This versatility means that even if one has little interest in the battery sector, the resource is still worth considering as an investment — particularly given that graphene could potentially replace steel, carbon fiber and a range of other materials in the near future.

Types of graphite

Graphite can be produced in one of two ways. Natural graphite, as the name suggests, is mined from existing graphite deposits. These deposits can occur in three different forms: flake, amorphous and crystalline vein graphite.

A seam mineral formed through contact metamorphism, amorphous graphite’s high heat tolerance means it’s well suited for industrial processes such as steel production. The mineral is also used to make brake linings, gaskets, clutch materials and pencil lead.

Flake graphite forms when carbon is subjected to both high temperature and high pressure. The largest buyer and consumer of flake graphite is the automotive industry, as the material is used in multiple vehicle components. Flake graphite is also a key component in EV batteries and nuclear reactors.

Crystalline vein graphite is known for its incredibly high purity. It also has a higher thermal and electrical conductivity than the other types of natural graphite. As such, it can be used for all the same applications as flake graphite.

Synthetic graphite is typically made from superheated petroleum coke with additional materials added to promote bonding — the overall process is known as calcination. Graphite produced synthetically is denser, more conductive and more pure than natural graphite. However, it is also expensive and energy-intensive to produce. Synthetic graphite is primarily used for energy storage and to produce electrodes, making it a key resource for solar and sustainable energy.

Investments in North America

In light of China’s export restrictions, graphite exploration and development companies will play a critical role in establishing a stable alternative supply of the resource. Following the October 2023 announcement of said restrictions, graphite companies in both North America and the European Union began working to secure government funding for their projects. Investors can expect partnerships between the public and private sectors to become increasingly common as governments continue to push for both decarbonization and supply chain stability; collaboration between mining companies, electronics companies and automotive manufacturers are also expected to increase.

There are several recent investments in North America that investors may find worth looking into.

Metals Australia (ASX:MLS)

Metals Australia owns one graphite and several battery metals projects in Canada and Australia.

The company’s flagship project, Lac Rainy, is situated in a major graphite province in Eastern Quebec. In addition to exceptionally high-grade and widespread graphite sampling results, Lac Rainy has easy access to both transportation and energy infrastructure, including hydroelectric power.

MLS is progressing development studies and undertaking key measures to advance the Lac Rainy graphite project including a prefeasibility study for a 100,000 metric ton per annum flake graphite concentrate plant, a metallurgical and laboratory services agreement with SGS Laboratories, assessing a downstream battery-grade spherical graphite concentrate purification option and scoping study, as well as engaging a contractor for drilling and full-service support.

Metals Australia is very well funded to complete all planned studies. Given its resource size, grade and potential for significant growth it’s also likely to come onto the radar of governments supporting development of critical minerals projects in North America.

Syrah Resources (ASX:SYR,OTC Pink:SYAAF)

Syrah Resources produces graphite from its Balama / Nicanda Hill property in Mozambique.

In effort to supply US markets, it recently completed its Vidalia active anode material plant, a large-scale facility with an initial production capacity of 11.25 kilotonnes per annum. Established with funding and support from the US government, the facility began operations in the first quarter of 2024. Syrah is currently working to further develop the plant and secure offtake agreements to ensure Final Investment Decision Readiness.

The company aims to be the first major non-Chinese integrated producer of natural graphite active anode material.

Nouveau Monde Graphite (TSXV:NOU,NYSE:NMG)

Nouveau Monde owns several graphite assets throughout Quebec. The company has secured significant funding from Panasonic Holdings (TSE:6752) and General Motors (NYSE:GM) through multi-year offtake agreements totaling $50 million, and an additional $275 million commitment for the construction of the downstream battery anode plant, subject to final investment decision. The company’s key selling point is its green business model, which uses natural graphite to produce components for EVs, renewable energy storage and consumer electronics.

Investor takeaway

Graphite has made headlines in recent years due to its pivotal role in enabling the clean energy transition. However, the applications and potential of this critical mineral are far more comprehensive than batteries and energy storage. Graphite has long been important to the manufacturing and automotive sectors, while emerging applications such as graphene hulls and plating show incredible promise for the future. Experts believe the future is bright for graphite, supported by the announcements of funding from the private and government sectors, particularly in North America.

This INNSpired article is sponsored by Metals Australia (ASX:MLS). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by [add link to company profile][in order to help investors learn more about the company. Metals Australia is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Metals Australia and seek advice from a qualified investment advisor.

Credit: Source link