For many people, investing $5,000 in a single stock is a big decision that shouldn’t be taken lightly. Depending on one’s personal finances, a $5,000 investment could represent a significant percentage of one’s net worth.

If a single stock is going to be a meaningful percentage of a person’s net worth, it’s crucial for the investment to have a high chance of long-term positive returns. And that’s a big problem for investors looking to buy growth stocks: Many represent unproven businesses and could indeed lose money for their shareholders.

As an alternative, let’s look at two young companies that are already producing solid results: Latin American e-commerce powerhouse MercadoLibre (NASDAQ: MELI) and image-sharing platform Pinterest (NYSE: PINS). I believe the chances for long-term positive returns are stronger for these two businesses than for many other growth stocks. Here’s why.

1. MercadoLibre

According to the market researchers at Insider Intelligence, e-commerce in Latin America is expected to grow at a double-digit annual pace through 2027. Overall retail sales aren’t expected to grow that much, which implies that e-commerce sales will comprise a larger percentage of overall retail. And since most e-commerce transactions are digital, that implies growth in financial-technology (fintech) solutions as well. This is all great news for MercadoLibre.

E-commerce and fintech are set to grow like crazy in Latin America in the coming years. These two things are MercadoLibre’s core competencies. And there’s good reason to believe that the company can go toe-to-toe with its rivals.

For starters, MercadoLibre has an impressive logistics network that can get 80% of orders to buyers within 48 hours. That’s a rare service in Latin America. Moreover, three-quarters of the company’s payment volume is processed outside of its e-commerce platform. In other words, people are using its fintech solutions in a variety of ways for multiple purposes, which speaks well of its adoption.

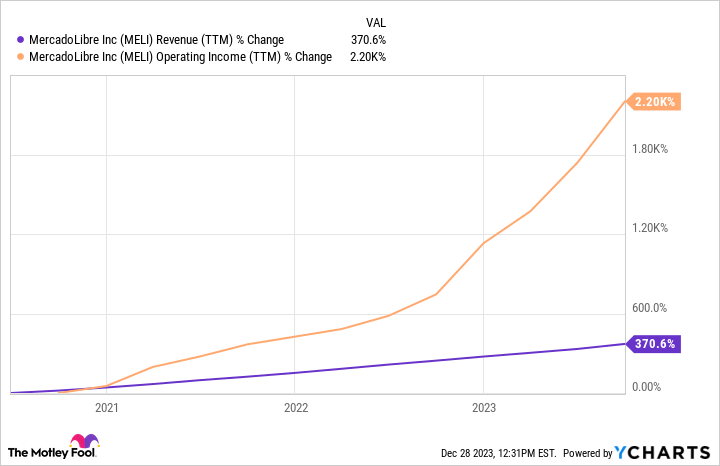

MercadoLibre has invested profits into its business and will continue to do so. But it’s absolutely paying off. Growth for the company’s operating income is far outpacing revenue growth, which points to good times ahead for shareholders.

2. Pinterest

For a growth stock, Pinterest’s growth has been lackluster. Revenue through the first three quarters of 2023 increased only 8% from the comparable period of 2022. Perhaps some believe that it’s risky to bet on better growth down the line for Pinterest.

It’s true: Better growth might not materialize. But Pinterest stock is a low-risk investment. The company is debt-free; has $2.3 billion in cash, cash equivalents, and marketable securities; and had an operating loss of just $5 million in the third quarter of 2023.

In other words, Pinterest has financial flexibility and isn’t burning through cash. That greatly reduces the riskiness of the investment and allows investors to take a chance on the upside potential.

Pinterest generates revenue from displaying advertisements. Its future is looking brighter because it’s partnering with Amazon, one of the biggest and fastest-growing ad players around. By opening its platform up to advertising from this enormous third party, Pinterest can stimulate revenue growth while reducing its costs if things go right.

Pinterest CEO Bill Ready says the “most meaningful revenue” from its Amazon partnership will start in early 2024. That outlook partly explains the 43% gain for Pinterest stock in just the past three months. Investors anticipate good things. And I believe further gains are likely if the Amazon partnership lives up to its potential, which is why I believe Pinterest stock is still worth buying today.

Keeping things in perspective

A good stock portfolio will hold shares of dozens of companies. So don’t bet everything on just two promising ideas. But for investors who keep important investing principles in mind, it’s OK to build a portfolio around some core holdings. And I believe MercadoLibre and Pinterest could be two worthy growth-stock candidates to do that job.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has positions in MercadoLibre and Pinterest. The Motley Fool has positions in and recommends Amazon, MercadoLibre, and Pinterest. The Motley Fool has a disclosure policy.

Got $5,000? These Are 2 of the Best Growth Stocks to Buy Right Now. was originally published by The Motley Fool

Credit: Source link