If you’re fortunate to have money that you don’t need to cover your living expenses or pay down debt and are looking to invest it in the stock market, you’ve come to the right place. Here are two exceptional businesses that are set to deliver many years of handsome returns to investors who buy their shares today.

Visa

Economies all over the world are shifting from cash payments to digital transactions. As the operator of the leading credit and debit card network, Visa (NYSE: V) is perfectly positioned to profit from this global megatrend.

With 4.4 billion credit and debit cards accepted by over 130 million merchants spanning 200 countries and territories, Visa is a key enabler of global commerce. In its 2023 fiscal year, the financial services colossus facilitated 276 billion transactions and a whopping $15 trillion in payments volume.

Notably, Visa incurs no credit risk for these payments. Its banking partners are the credit issuers, so they take on the risk that borrowers might not repay their debt obligations. Visa simply processes the transactions. This makes Visa a relatively lower-risk financial stock and a prudent way for investors to profit from the growth of the global economy.

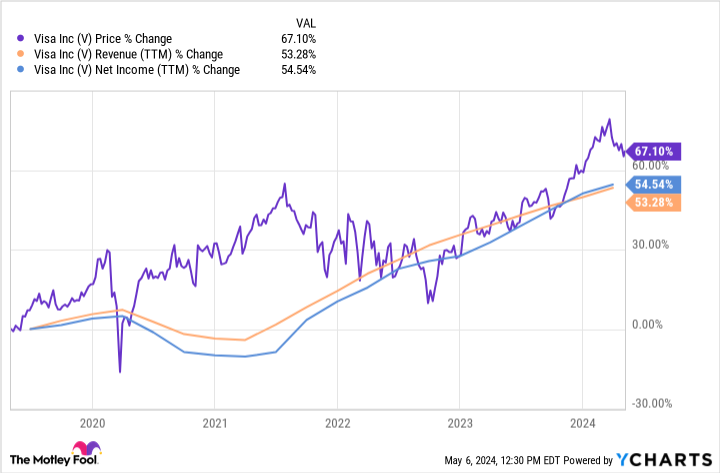

And profit they have. Visa’s stock price has risen along with its sales and earnings in recent years.

Investors can expect Visa’s share price to continue its ascent in the coming years. More than a billion people across the world remain unbanked, and cash is still used for more than half of all in-store transactions in many countries. Suffice it to say that Visa has plenty of room for further payment volume growth still ahead.

Moreover, the fintech titan is investing in promising new technologies, such as contactless payment solutions and open banking data-sharing initiatives. The company is also putting $100 million toward generative AI ventures to support e-commerce innovation. CEO Ryan McInerney believes these efforts will help to ensure that Visa’s dependable and secure payment network remains “the best way to pay and be paid” in the decades ahead.

Microsoft

From its humble beginnings in Albuquerque, New Mexico, in 1975 to its current status as a $3 trillion-dollar global superpower, Microsoft (NASDAQ: MSFT) has played a part in the evolution of countless technologies. Now, the tech titan wants to bring the awesome power of AI to its more than 1 billion users around the globe.

In the ’80s and ’90s, Microsoft’s Windows operating system accelerated the adoption of personal computers (PCs) by increasing their functionality. Today, the company is helping its customers make the most of the large language models and machine learning technology that underpin the most advanced AI applications.

Microsoft’s new AI-powered Copilot is enabling people to be more productive and efficient while completing work-related tasks. Better still, 68% of Copilot users said the generative AI technology — which can help users find files, analyze data, and write emails — improved the quality of their work.

Unsurprisingly, given these benefits, corporations are rushing to deploy Microsoft’s AI assistant. Already, almost 60% of the 500 largest companies in the U.S. are using Copilot within Microsoft’s popular productivity tools, such as Word and Excel. CEO Satya Nadella said during a conference call with analysts that Copilot is experiencing a “faster rate of adoption than anything we have seen in the past.”

The software giant’s cloud computing business is also benefiting from the torrid demand for AI solutions. Revenue for Microsoft’s Azure cloud infrastructure platform — which can be used to train AI models and run machine learning workloads — surged 31% in the quarter ended March 31. That helped to drive the company’s overall sales higher by 17% to $62 billion. Microsoft’s net income, in turn, jumped 20% to $22 billion.

Looking ahead, Microsoft is projected to grow its earnings by more than 16% annually over the next half-decade. Buy shares today, and you could profit alongside this AI leader.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Visa. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Got $5,000? 2 Elite Stocks to Buy and Hold Forever was originally published by The Motley Fool

Credit: Source link