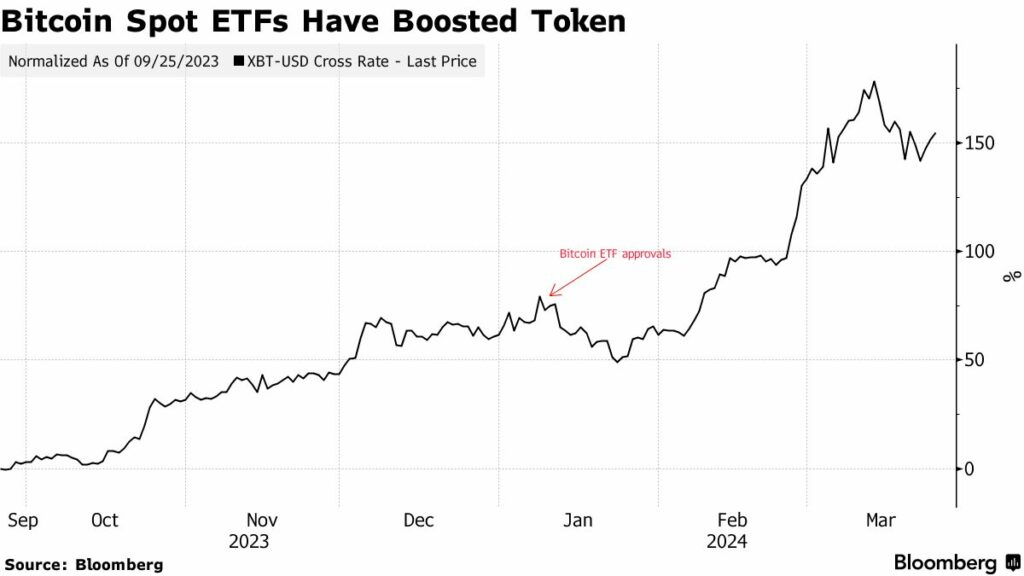

Goldman Sachs sees a surge in institutional clients gaining interest in crypto thanks to the Bitcoin ETF.

According to Max Minton, Goldman’s Asia Pacific head of digital assets, the approval of Bitcoin ETFs has significantly influenced this trend.

“The recent ETF approval has triggered a resurgence of interest and activities from our clients. Many of our largest clients are active or exploring getting active in the space,” Minton said in a release.

Goldman Sachs, which introduced its cryptocurrency trading desk in 2021, offers its clients various crypto-related services. These include cash-settled Bitcoin (BTC) and Ether (ETH) option trading and futures trading for these cryptocurrencies on the Chicago Mercantile Exchange. However, the firm does not directly trade the actual crypto tokens.

“It was a quieter year last year, but we’ve seen a pickup in interest from clients in onboarding, pipeline, and volume since the start of the year,” Minton said, considering the market trends.

The renewed interest primarily stems from Goldman’s traditional client base, which is predominantly hedge funds. Nonetheless, the bank is broadening its horizon to accommodate a diverse clientele, including asset managers, bank clients, and a select group of digital asset firms.

Goldman’s clients utilize crypto derivatives multifacetedly, encompassing directional bets, yield enhancement, and hedging strategies. While Bitcoin-related products remain the primary focus, the potential approval of Ether ETFs in the United States could shift the interest toward Ether-related products.

Beyond trading, Goldman Sachs is pioneering digital asset space by tokenizing traditional assets using blockchain technology. The bank has developed a digital asset platform, GS DAP, and has conducted pilot tests on a blockchain network to facilitate connectivity among banks, asset managers, and exchanges.

Goldman is also investing in startups aligning with its strategic vision for the digital asset market, particularly in blockchain infrastructure firms.

“We have a portfolio and will invest if or when it makes strategic sense,” Minton said.

Credit: Source link