Nvidia’s (NVDA) ultra-bullish trend in the first half of the year has paused, with the stock failing to reach new peaks over the past few months. Following the highly anticipated Q2 earnings report at the end of August, Nvidia stock experienced a pullback due to elevated investor expectations for hypergrowth, despite the strong results it posted. I believe this price correction offers a compelling opportunity. In this article, I will outline five reasons for my bullish view on Nvidia, focusing on strong revenue growth (despite tough comps), AI dominance, valuation, technical indicators, and Wall Street analyst consensus.

Let’s dive in.

1. Nvidia’s Strong Revenue Growth Despite Tough Comparisons

The first point supporting a prolonged bullish thesis for Nvidia is the solid revenue growth demonstrated in its Q2 results, despite challenging comparisons.

Nvidia posted 122% year-over-year growth in the most recent quarter, reaching revenues of $30 billion—a remarkable achievement given the company’s already substantial revenue base. Although this growth rate is lower than the 200% surge from the previous quarter, the absolute triple-digit top-line growth remains impressive. This underscores Nvidia’s ability to scale its revenue significantly even when set against it’s prior performance.

While the post-Q2 stock pullback can be attributed to expectations being set too high, it’s crucial to note that Nvidia continues to deliver sequential quarterly revenue growth, signaling robust demand for its products, especially in AI and data centers. This level of sustained growth at such a large scale highlights Nvidia’s capacity to capture market share and drive long-term revenue expansion. Nvidia’s Q3 sales guidance of $32.5 billion further reflects the company’s confidence in maintaining its growth trajectory.

2. Nvidia’s Dominance in AI and Data Center Market

The second bullish point is Nvidia’s continued dominance in the data center GPU space, where it holds a 98% market share in this rapidly growing sector, according to HPCwire.

Demand for AI-driven solutions is booming across industries, with Nvidia’s H100 Hopper GPU becoming crucial for enterprise cloud applications that require massive computing power. Beyond hardware, Nvidia dominates AI through its software ecosystem, including CUDA and cuDNN, offering a comprehensive AI solution. As highlighted in Nvidia’s earnings call, the company aims to transform the $1 trillion data center market by shifting from traditional to accelerated computing using advanced data processing libraries.

Looking ahead, Nvidia plans to launch its Blackwell architecture in Q4 of Fiscal 2025, offering greater power and efficiency than Hopper. Designed to meet the demands of hyperscalers and AI developers, Blackwell will provide comprehensive solutions, including chips, systems, networking, and software. This release is a key catalyst that will further solidify Nvidia’s leadership in AI.

3. Nvidia Appears Attractively Priced When Adjusted for Growth

The third point concerns Nvidia’s valuations. At first glance, its P/E ratio of 54.7x and forward P/E of 42.5x may seem high, especially compared to the semiconductor industry average of 23.7x. However, my bullish stance is strengthened by Nvidia’s growth prospects, with the company expected to achieve 106% revenue growth and 119% EPS growth this year.

Furthermore, analysts expect Nvidia’s EPS to grow at a CAGR of 36.6% over the next three to five years. This impressive growth rate, combined with the current forward P/E, results in a reasonable forward price-to-earnings-to-growth (PEG) ratio of 1.16.

Traditionally, undervalued stocks have a PEG ratio below one, yet NVIDIA’s PEG ratio is more favorable than those of all other Magnificent 7 stocks. Among this group, Alphabet (GOOGL) and Meta (META) have the next lowest PEG ratios at 1.28 and 1.48, respectively. While this doesn’t necessarily mean NVIDIA is undervalued compared to its Big Tech peers, it does suggest that, according to this metric, the stock doesn’t appear overly expensive.

4. NVDA’s Moving Averages Suggest a Bullish Trend

The fourth point reinforcing the bullish thesis is closely tied to the sentiment surrounding Nvidia’s stock performance. Despite recent fluctuations, the company’s triple-digit revenue growth indicates that it is still in a hypergrowth phase. However, with a staggering 2,700% stock price surge over the past five years, concerns about a potential bubble remain.

In this context, I believe that focusing on long-term moving averages is essential for gauging momentum. This provides a clearer view of Nvidia’s trend amid daily volatility, especially given the stock’s 48% annualized volatility. NVDA stock’s upward trend is supported by a current trading price above its 200-day moving average of $92.80.

5. Wall Street Remains Overwhelmingly Bullish on NVDA

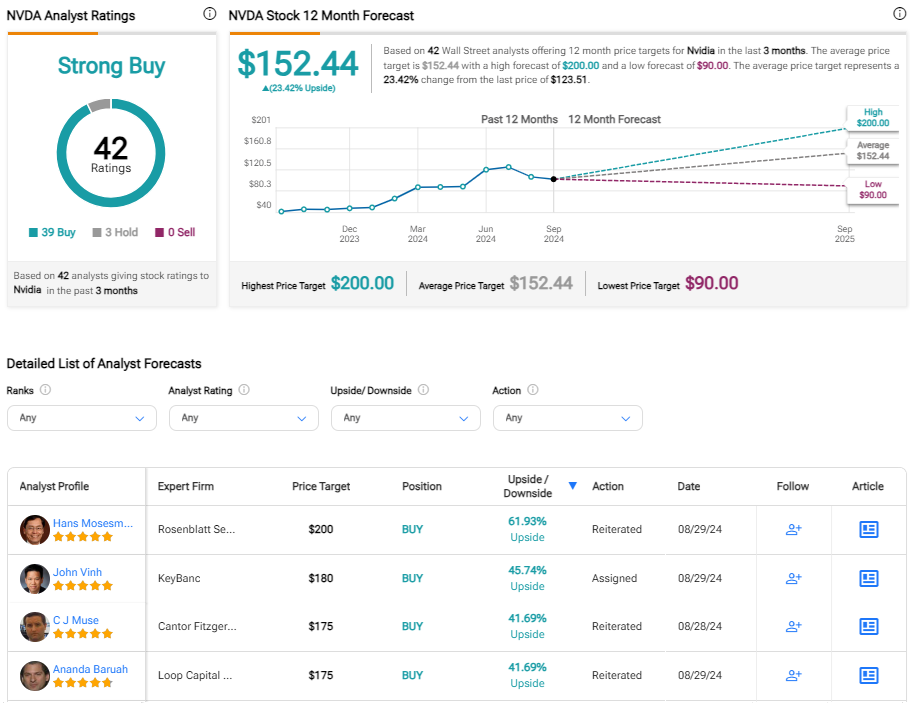

Finally, the fifth point contributing to my favorable outlook for Nvidia is the overwhelmingly bullish consensus among Wall Street analysts. Of the 42 analysts covering the stock, 39 have issued Buy recommendations, while the remaining three have a Hold rating. Moreover, the average price target among these analysts is $152.44, indicating potential upside of nearly 25%.

A standout is Rosenblatt analyst Hans Mosesmann, who has the highest price target on Wall Street for Nvidia at $200 per share. His optimism persisted after the Q2 results, which he deemed strong, driven by growth in Hopper AI and networking. Although gross margins dipped slightly due to updates on Blackwell chips aimed at improving yields, Mosesmann remains confident. He highlights that despite potential short-term weakness in the share price, the bullish sentiment is supported by a 44x P/E multiple based on Fiscal 2027 EPS.

Conclusion

In this article, I’ve outlined five key points supporting my Buy stance on Nvidia. I believe that the stock’s recent weakness presents an attractive buying opportunity for investors eager to capitalize on its strong growth trajectory.

While some short-term hiccups may persist, Nvidia’s Q2 results suggest that its growth story is set to continue robustly as the company consolidates its market dominance and prepares for the upcoming release of the Blackwell architecture. Given the potential for further growth in the coming years, the current rich valuation can be justified, and Wall Street believes the same.

Disclosure

Disclaimer

Credit: Source link