Investor Insight

Falco Resources presents a compelling investment opportunity with its high-margin Horne 5 gold project, strong partnerships, and advancing path to construction in Quebec’s prolific Rouyn-Noranda mining camp.

Overview

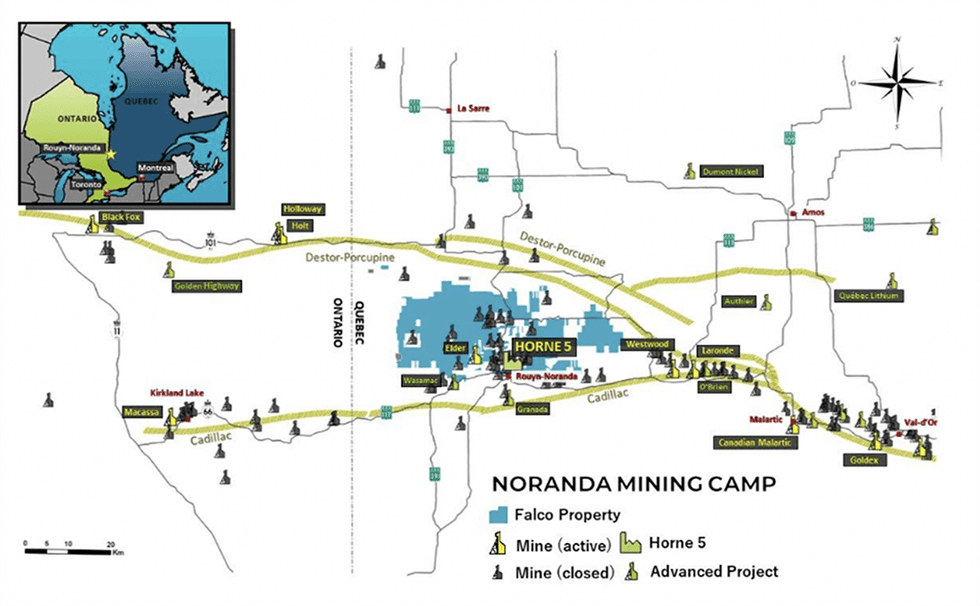

Falco Resources (TSXV:FPC) is a Canadian company focused on developing gold and base metal projects in the Rouyn-Noranda region of Quebec. Rouyn-Noranda is an established mining camp with a long history of exploration and development. The Noranda mining camp has historically produced 19 million ounces (Moz) of gold and 2.9 billion pounds (Blbs) of copper, and yet it is still under-explored for gold.

Falco’s principal property, Horne 5 project, holds 67,000 acres or nearly 67 percent of the total area of the entire mining camp and is located under the former Horne mine which produced 11.6 Moz of gold and 2.5 Blbs of copper. The 2021 feasibility study on the Horne 5 project suggests strong project economics with a total mine life of 15 years, after-tax NPV at 5 percent of US$761 million, and a payback period of 4.8 years, assuming gold prices at $1,600/oz. At the current gold prices of over $2,500/oz, the project economics will be even better.

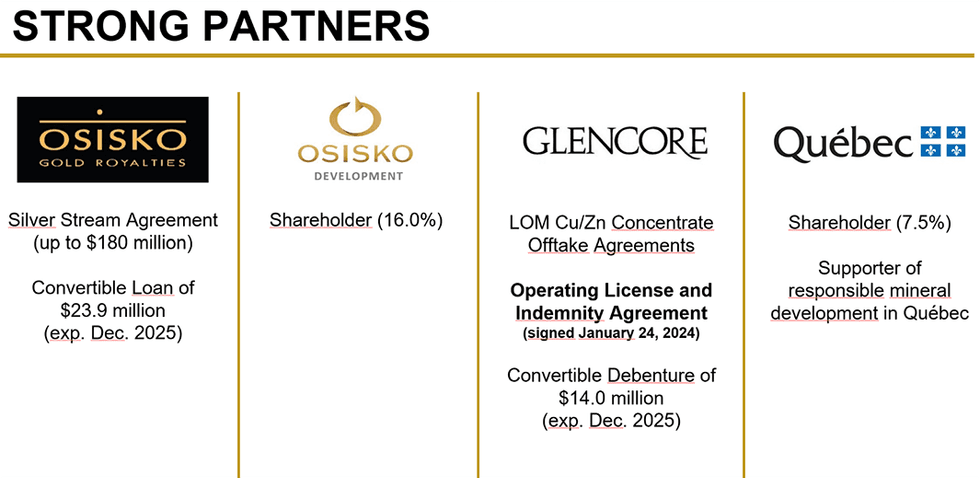

In 2024, significant milestones for the company include the operating lease and indemnity agreement (OLIA) with Glencore (LON:GLEN) and the Horne 5 project’s environmental impact assessment (EIA) admissibility. Falco Resources’ operating license and indemnity agreement (OLIA) with Glencore Canada will enable Falco to utilize a portion of Glencore’s lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore canl nominate one representative to join Falco’s board of directors.

The successful completion of the OLIA, coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore, positions Falco to advance its Horne 5 project towards construction. The company is currently advancing with the permitting process for the project.

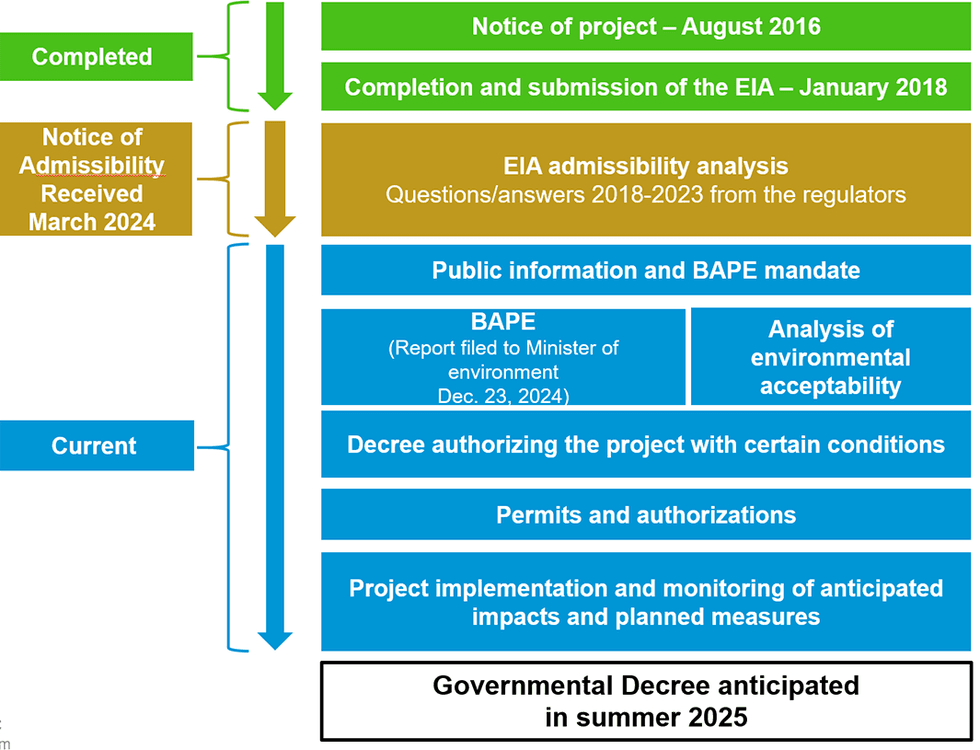

Falco is continuing with the next steps related to obtaining government permits and financing for its Horne 5 project after the report filed by the Bureau d’audiences publiques sur l’environnement (BAPE). The BAPE examined the Falco Horne 5 mining project from a sustainable development perspective, requesting additional studies and analyses. More than 90 percent of the commission’s opinions related to the project have already been considered, planned or initiated.

Company Highlights

- Falco Resources is a Canadian explorer of base and precious metals focused on developing its mineral properties in the Rouyn-Noranda region in Quebec, Canada.

- The company holds 67,000 acres of mining claims in the Rouyn-Noranda mining camp, accounting for nearly 67 percent of the entire mining camp.

- Rouyn-Noranda has a long history of mining and exploration. The area has established infrastructure and has been host to 50 former producers, including 20 base metal mines and 30 gold mines.

- Falco’s principal asset is the Horne 5 project which is a gold project with significant base metal by-products. It is located under the former Horne Mine which produced 11.6 Moz of gold and 2.5 billion pounds of copper from 1926 to 1976.

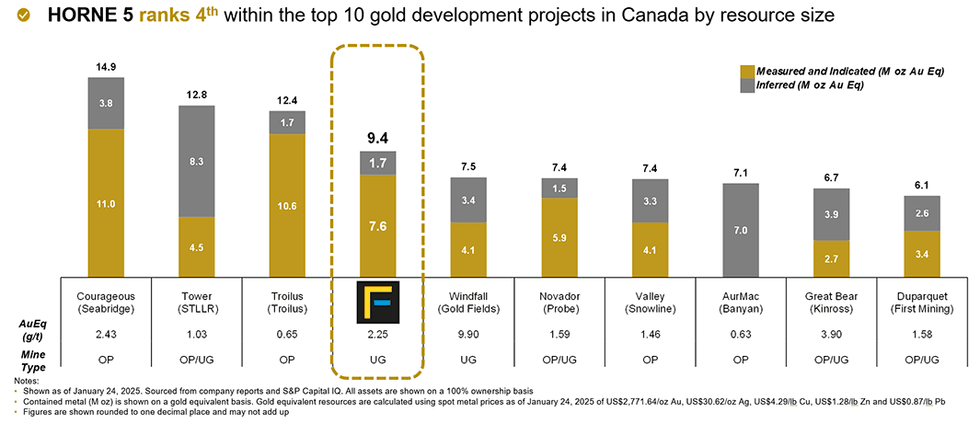

- The Horne 5 is a world-class deposit containing 7.6 Moz gold equivalent in measured and indicated resources and 1.7 Moz gold equivalent in inferred resources, making it a top 5 gold development project in Canada by resource size.

- The Horne 5 project represents a robust, high-margin, 15-year underground mining project with attractive economics. The 2021 feasibility study indicates after-tax NPV at 5 percent of US$761 million and after-tax IRR of 18.9 percent.

- The operating lease and indemnity agreement (OLIA) with Glencore coupled with EIA admissibility receipt from the government body positions Falco to advance its Horne 5 project towards construction.

Key Project

Horne 5 Project

The Horne 5 project is a world-class deposit located beneath the former Horne mine in the Rouyn -Noranda mining camp. Horne mine was operated by Noranda from 1926 to 1976 and produced 11.6 Moz of gold and 2.5 Blbs of copper. The Rouyn-Noranda mining camp has a rich exploration history having produced 19 Moz of gold and 2.9 Blbs of copper. The camp has hosted 50 producers including 20 base metal mines and 30 gold mines.

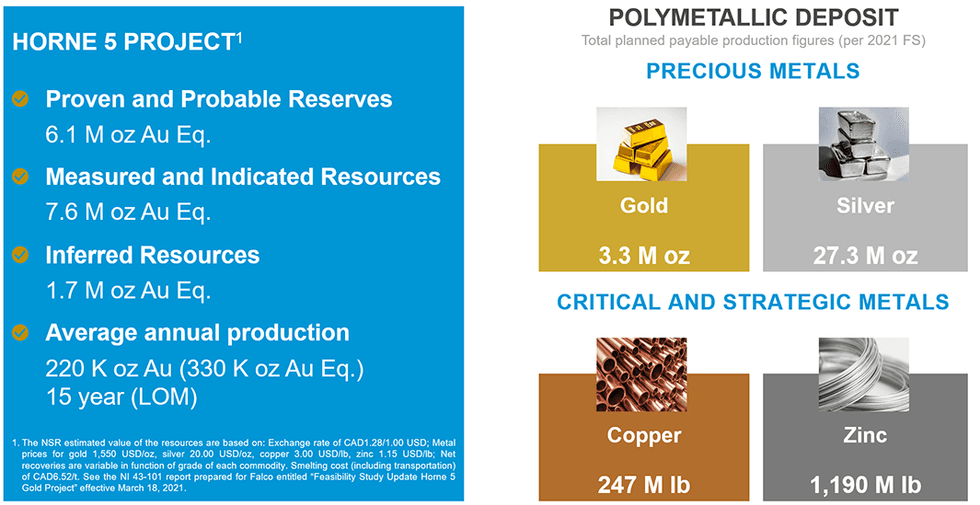

The Horne 5 is a world-class deposit containing 6.1 Moz gold equivalent in proven and probable reserves, 7.6 Moz gold equivalent in measured and indicated resources, and 1.7 Moz gold equivalent in inferred resources making it a top 5 gold development project in Canada by resource size.

The project boasts strong partners including Osisko Development, Osisko Gold Royalties, Glencore, and the Quebec Government. Osisko Development is a major shareholder in Falco Resources with a 16 percent stake, and the Quebec Government holds close to 7.5 percent stake in Falco.

Aside from gold, Horne 5 has significant base metal by-products. As per the feasibility study, precious metals (gold + silver) account for 75.6 percent of the mining revenue, while base metals (copper and zinc), account for 24.3 percent of the total mine revenue.

The 2021 updated feasibility study on the Horne 5 project indicates robust project economics. The feasibility study shows the project would generate an after-tax NPV at 5 percent of US$761 million and an after-tax IRR of 18.9 percent over the 15-year mine life. The production profile would average annual production of 220,300 oz gold over the life of the mine. Further, the study suggests significant copper and zinc by-product credits from the copper and zinc production, as well as the highly automated modern operations resulting in a low projected all-in sustaining cost (AISC) of $587/oz. Horne 5’s AISC is among the first quartile of global low-cost operations.

Recent news flows including the OLIA with Glencore and the Horne 5 project’s EIA admissibility are significant milestones in the advancement of the project towards development.

Falco Resources’ OLIA with Glencore Canada enables Falco to utilize a portion of Glencore’s lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore can nominate one representative to join Falco’s board of directors.

The successful completion of OLIA coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore positions Falco to advance its Horne 5 project towards development. Further, the receipt of confirmation of the admissibility of its EIA for the Horne 5 project from the Ministry of the Environment, the Fight Against Climate Change, Wildlife and Parks is a significant milestone. It provides a path forward for the development of the project.

Management Team

Luc Lessard – President, Chief Executive Officer and Director

Luc Lessard brings over 30 years of experience in the design, construction, and operation of mines. Before joining Falco, he held senior executive positions at Osisko Gold Royalties, Canadian Malartic GP (a joint venture of Agnico Eagle Mines and Yamana Gold), and Osisko Mining Corporation. At Osisko Mining Corporation, he oversaw the design, construction, and commissioning of the Canadian Malartic gold mine. Lessard has been involved in numerous surface and underground mining projects throughout his career. Lessard holds a bachelor’s degree in mining engineering from Laval University.

Anthony Glavac – Chief Financial Officer

Anthony Glavac has 25 years of experience in financial reporting, including over 15 years in the mining industry. Before joining Falco, he served as the director of financial reporting and internal controls at Dynacor Gold Mines and as the interim chief financial officer at Alderon Iron Ore. Glavac was previously the senior manager at KPMG, where he worked with a diverse portfolio of public and private companies, offering services such as audit, taxation, strategic advisory, and assistance with public offerings. Glavac is also engaged with other public companies within the mining sector.

Helene Cartier – Vice-president Environment, Sustainable Development and Community Relations

Helene Cartier possesses over 20 years of expertise in the environmental field. She began her mining career as part of the Cambior team before transitioning to the role of vice-president of environmental services and sustainable development at Osisko Mining. There, she played a pivotal role in the development and commissioning phases of the Canadian Malartic gold mine. She has served on the board of directors of several public and private companies.

Mireille Tremblay – Vice-president Legal Affairs and Corporate Secretary

Mireille Tremblay possesses more than 25 years of experience in business law, primarily in securities, mergers and acquisitions, corporate finance, and governance. Before joining Falco in January 2021 as the director of legal affairs, Tremblay served as a legal advisor to clients across diverse industries, including the mining sector. She advocated for companies and investors involved in mining transactions in Africa, notably during the construction of a gold mine in Burkina Faso and in negotiations with the Ivorian government. Additionally, she has represented numerous companies, underwriters, and investors in various contexts, including public offerings and private placement financings, both domestically and internationally. Tremblay holds a law degree from the University of Montreal.

Mario Caron – Independent Chair

Mario Caron is a mining executive with over 40 years of experience in the mining industry in senior executive and board positions. His experience was gained nationally and internationally in both underground and open pit operations. As CEO of public companies, he secured mining licenses and various permits in numerous jurisdictions. From 2016 to 2023, he was the Chairman of New Moly LLC. (formerly known as Alloycorp Mining), a privatized company since August 2016 with a molybdenum deposit in British Columbia. Caron received his Bachelor of Engineering, Mining at McGill University and is a retired member of the Association of Professional Engineers of Ontario and of the Ordre des ingénieurs du Québec.

Alexander Dann – Non-independent Director

Alexander Dann is a chartered professional accountant with over 30 years of experience leading financial operations and strategic planning for multinational public companies, primarily in the mining and manufacturing sectors. In February 2021, he was appointed chief financial officer and vice president, finance of Osisko Development. Before that, Dann served as chief financial officer of The Flowr Corporation from November 2017 to March 2020, where he successfully guided such corporation from a small private company to a TSX Venture Exchange publicly traded corporation. Prior to that, he was chief financial officer of Avion Gold and Era Resources until their acquisitions by Endeavour Mining Corporation and The Sentient Group, respectively. Dann also held senior finance roles with Falconbridge. (now part of Glencore Canada Corporation), Rio Algom Limited (now part of BHP Billiton) and Litens Automotive Partnership (a group within Magna International Inc.). Dann is the nominee of Osisko Development on the Corporation’s Board of Directors pursuant to the Investor Rights Agreement entered into between the Corporation and Osisko Development on November 27, 2020 (the “Investor Rights Agreement”). Dann obtained his Chartered Accountant designation in 1995 and holds a Bachelor’s degree in Business Administration from Université Laval in Québec City.

Paola Farnesi – Independent Director

Paola Farnesi is a senior financial professional with over 30 years of experience in corporate finance, financial reporting, M&A and risk management. She is currently vice president and treasurer of Domtar Corporation, responsible for negotiating and arranging $2.5 billion in corporate financings, overseeing an insurance portfolio of $50 billion in insurable values and managing the investments of pension fund assets of $8 billion. From 1994 to 2008, Farnesi held several other leadership positions at Domtar Corporation, including vice president of internal audit, where she was responsible for the implementation and subsequent compliance efforts related to Sarbanes-Oxley. Prior to joining Domtar Corporation, Farnesi worked at Ernst & Young for the assurance group in Montréal. Farnesi holds a Bachelor of Commerce and a Graduate degree in Public Accountancy from McGill University, is a member of the Chartered Professional Accountants of Québec and obtained the ICD.D designation from the Institute of Corporate Directors.

Chantal Sorel – Independent Director

Chantal Sorel is a corporate director. She has over 35 years of experience in general management with full profit and loss responsibility, project financing, project management, operations, strategic development, business development, mergers and acquisitions, in the industries of mining and metallurgy, power, infrastructure, industrial facilities, rail and transit. Sorel held the position of Vice President, Airport Infrastructures at Aéroports de Montréal from April 2023 to February 2024, after being an adviser to the airport from 2020 to 2023. Previously, she was executive vice president and managing director of capital at AtkinsRéalis (formerly known as the SNC-Lavalin Group) from 2016 to 2019 where she was responsible for the project financing and asset management of a $20 billion infrastructure and industrial asset portfolio. Sorel holds a degree in architecture from Université de Montréal and a master’s degree in project management from Université du Québec à Montréal and completed the Director Education Program jointly offered by the Institute of Corporate Directors, the McGill Executive Institute and the Rotman School of Management at the University of Toronto.

Credit: Source link