It’s hard to look past Nvidia (NASDAQ:NVDA) these days, but it’s important to remember that there are also plenty of other great semiconductor (chip) stocks out there. The VanEck Semiconductor ETF (NASDAQ:SMH) enables investors to gain exposure to both Nvidia and other attractive opportunities within the semiconductor space.

I’m bullish on SMH based on its strong portfolio of top semiconductor stocks, which are performing well and harbor significant long-term growth potential, as well as its incredible track record of generating strong returns for its holders. We’ve covered SMH previously; it has performed well since then and continues to look like a compelling opportunity for the long term.

What Is the SMH ETF’s Strategy?

SMH is the largest dedicated semiconductor ETF. According to sponsor VanEck, SMH invests in the “MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is intended to track the overall performance of companies involved in semiconductor production and equipment.”

VanEck highlights the fact that these are highly liquid stocks, industry leaders, and companies with global scale.

Portfolio of Compelling Semiconductor Stocks

SMH owns 26 stocks, and its top 10 holdings make up 76.2% of the fund. Below, you’ll find an overview of SMH’s top 10 holdings using TipRanks’ holdings tool.

While the fund isn’t particularly diversified, it gives investors substantial exposure to Nvidia (which has a large weighting of 24.6%) and other top semiconductor stocks, including Taiwan Semiconductor (NYSE:TSM), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM) and more.

Were it not for Nvidia’s 209.6% gain over the past year, it’s likely that we’d be hearing more about Broadcom and its 111.8% gain. But the semiconductor and software infrastructure giant is now knocking on the door of becoming one of the world’s 10 largest companies and is worthy of plenty of attention on its own accord. The stock is a long-term winner that has generated an incredible total return of 3,168% over the past decade.

It’s also an underrated dividend growth stock that has increased its dividend payout for 13 straight years and grown this payout at an impressive 17.5% CAGR over the past five years. Additionally, like Nvidia, Broadcom has a stock split of its own coming up.

The company recently announced that it will execute a 10-for-1 stock split, which will go live on July 12th. While stock splits don’t necessarily make a fundamental difference, they can drive considerable interest and momentum in a stock, as we recently saw with Nvidia. They can also make the stock more accessible to smaller investors and retail investors.

In addition to Broadcom, Taiwan Semiconductor is another one of the many attractive chip stocks among SMH’s top holdings.

Taiwan Semiconductor is the world’s largest and most advanced chipmaker. Leading semiconductor companies like the aforementioned Nvidia, Broadcom, Qualcomm, and others go to Taiwan Semiconductor to manufacture the cutting-edge chips that they design and develop. This makes Taiwan Semiconductor an attractive picks-and-shovels play within the semiconductor space. The $786.1 billion company has seen its stock gain a cool 75.2% over the past year and hit a new all-time high.

Next, Qualcomm, which is up 93.8% over the past year, has made a name for itself, as the company is developing cutting-edge semiconductors for everything from smartphones to automobiles and Internet of Things devices.

Additional top 10 holdings, ASML (NASDAQ:ASML) and Lam Research (NASDAQ:LRCX), are among the few companies in the world providing the high-tech tools and equipment that are used in the semiconductor manufacturing process, making them crucial parts of the semiconductor value chain with wide moats (competitive advantages).

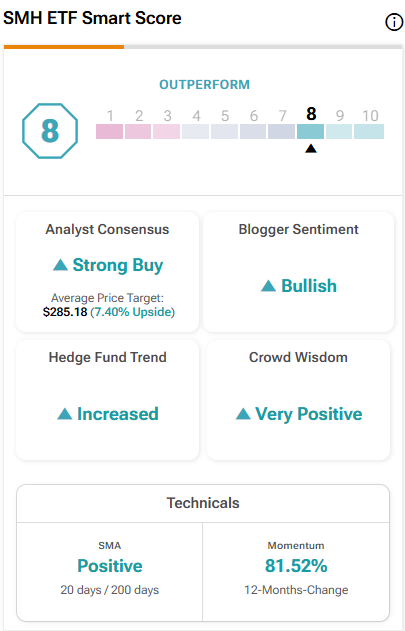

One thing that Broadcom, Taiwan Semiconductor, and Qualcomm all have in common is that they all feature “Perfect 10” Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Seven of SMH’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above.

Additionally, SMH boasts an Outperform-equivalent ETF Smart Score of 8.

Sensational Long-Term Performance

SMH owns a strong collection of highly-rated semiconductor stocks, and it has also generated excellent returns for its holders for a long time, giving it a track record that’s hard to beat.

As of May 31, SMH has delivered an enviable annualized three-year return of 25.5%. This stellar return easily trumps that of the broader market. The Vanguard S&P 500 (NYSEARCA:VOO) returned 9.6% on an annualized basis over the same time frame. It even beats the strong performance of the tech-focused Technology Select Sector SPDR Fund (NYSEARCA:XLK), which delivered an annualized return of 15.9% over the same time span.

Over a longer five-year timeframe, SMH has generated a scorching annualized return of 38.6%. This number again handily beats the broader market and XLK (VOO returned an annualized 15.8% over the same time frame, while XLK returned an annualized 25.2%). Note that these are both great returns, and SMH still beat them by a considerable margin.

Even going back 10 years, SMH has produced a phenomenal annualized return of 27.8%, again beating both the broader market and the tech-focused XLK. VOO returned an annualized 12.7% over the same time frame, while XLK returned an annualized 20.3%.

How High Is SMH’s Expense Ratio?

SMH features a reasonable expense ratio of 0.35%, meaning that an investor in the fund will pay $35 on a $10,000 investment annually. This isn’t the lowest fee out there, as many broad market index funds charge lower fees. However, it is on par with its peers and reasonable enough for a sector-specific ETF, especially one that is performing as well as SMH.

Is SMH Stock a Buy, According to Analysts?

Turning to Wall Street, SMH earns a Moderate Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average SMH stock price target of $285.18 implies 7.5% upside potential from current levels.

Investor Takeaway

In conclusion, I’m bullish on SMH because it provides investors substantial exposure to Nvidia and top semiconductor stocks like Broadcom, Taiwan Semiconductor, and others. Plus, its phenomenal returns over the past three, five, and 10 years give it an unassailable track record.

Disclosure

Credit: Source link