- The dollar gained momentum ahead of Tuesday’s pivotal inflation report.

- Forecasts for the US inflation report show that annual inflation will likely come in at 3.8%.

- ECB’s Fabio Panetta noted on Saturday that the time for rate cuts is fast approaching.

The market painted a bearish picture for Monday’s EUR/USD outlook, with the dollar gaining momentum against the euro in anticipation of Tuesday’s pivotal US inflation report. Moreover, with no major reports on Monday, investors were awaiting Eurozone economic growth data on Wednesday.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

The release of the US inflation report will be a major event this week that will shape the outlook for Fed rate cuts. On many occasions, Fed policymakers have said they need more evidence that inflation is falling and will stay near the 2% target. Forecasts for tomorrow’s report show that annual inflation will likely come in at 3.8%.

Notably, the Fed’s Lorie Logan said on Friday that economic reports must show inflation is on a durable decline. Otherwise, she is in no rush to cut interest rates. This was yet another reason for investors to dismiss the possibility of a rate cut in March.

Meanwhile, in the Eurozone, the ECB’s Fabio Panetta noted on Saturday that the time for rate cuts is fast approaching. However, he did not comment on the exact timing. ECB policymakers slowly accept that the next policy move will be a rate cut. However, markets remain uncertain about when this might start. At the moment, there is a possibility that the ECB will implement the first rate cut in April. Still, there is a chance they might delay, following the trend among major central banks.

EUR/USD key events today

There won’t be any high-impact data from the US or the Eurozone. Therefore, the pair will likely drift as investors speculate on the upcoming US inflation report.

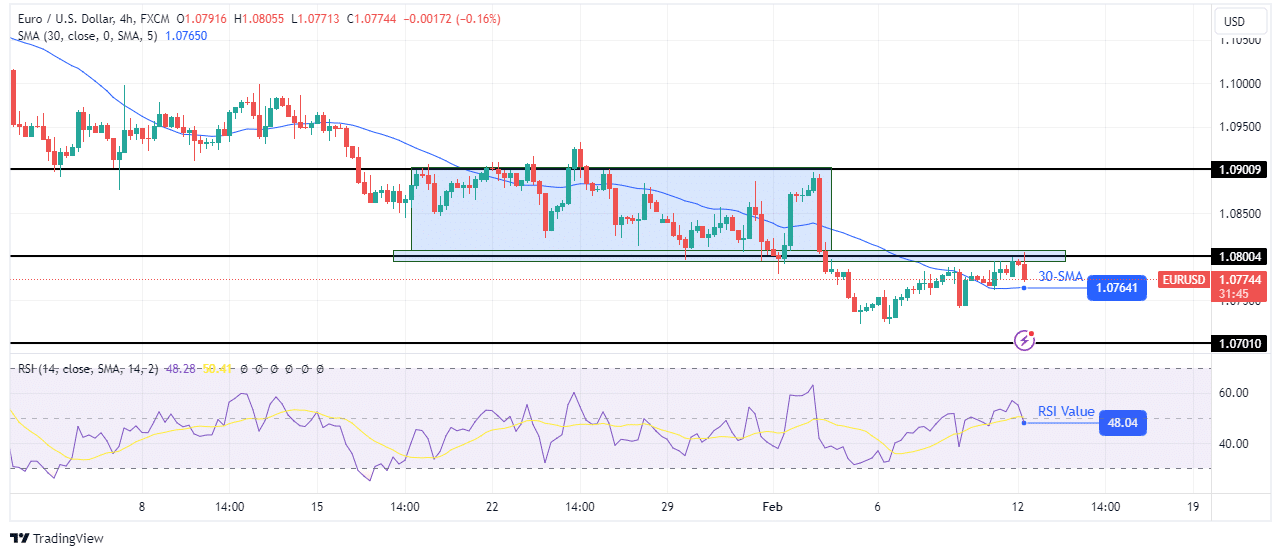

EUR/USD technical outlook: Bears resurface at 1.0800 resistance

On the technical side, the EUR/USD price is bouncing lower after retesting the 1.0800 key resistance level. Although the price occasionally chops through the 30-SMA, showing a shallow trend, it keeps making new lows, supporting a strong downtrend.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Recently, the price made a new low by breaking below the 1.0800 support level. Afterwards, it made a corrective move to retest 1.0800 as resistance. Moreover, price action at this level shows that bears were waiting to resume the downtrend. If the price breaks below the 30-SMA, it could make a new low at the 1.0701 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Credit: Source link