Ethereum processed a record high of nearly 2M transactions on Jan. 14

Ethereum’s throughput surged to a record high as the network’s burn rate pushes the supply of ETH to new post-merge lows.

Data from L2beat shows activity on Ethereum jumping to a new all-time high of 22.7 transactions per second (TPS) on Jan. 14 after jumping 62% in a day. Nearly 2M transactions were settled over 24 hours amid the spike in activity.

For comparison, Ethereum’s throughput has predominantly trended between 11 TPS and 14 TPS since mid-2020, sans a brief spike to 19.9 TPS in May 2021 as the post-DeFi summer boomed peaked.

Despite on-chain activity rocketing to unprecedented levels, throughput on the Ethereum mainnet continues to be overshadowed by the booming Layer 2 ecosystem. Ethereum L2s processed more than 63 TPS on average during Jan. 14, down from an all-time high of more than 152 TPS on Dec. 16 amid surging inscriptions activity.

ETH’s supply hit new local lows

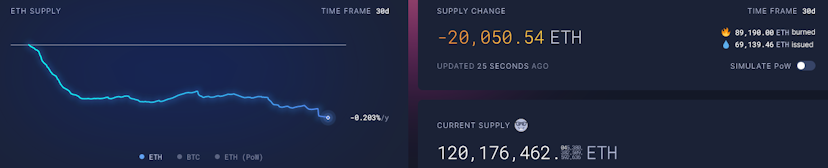

Ethereum’s throughput milestone coincides with a persistently high burn-rate pushing the supply of Ether to new post-merge lows. Ethereum’s Shanghai upgrade, also known as The Merge, reduced the rate of new Ether issuance by around 90% in September 2022. The upgrade paved the way for Ether to become deflationary as the network’s burn rate appeared poised to off-set new ETH entering supply.

The supply of ETH steadily fell throughout most of 2023, excluding two months of inflation as activity lulled during September and October, and again amid the New Year holiday week. Ether’s supply has fallen by 5,745.5 ETH over the past seven days to tag a new post-merge low of roughly 120.76M coins, according to Ultra Sound Money.

Uniswap was the leading source of burned Ether with 2,054 ETH destroyed over the past seven days, followed by token transfers with 1,480 ETH, and Tether with 1,033.8. Surgeon Layer 2s Arbitrum and ZkSync Era also accounted for a significant share of burned coins through sequencing fees.

ETH investors are also riding high after Ether held strong as BTC tumbled after the launch of the first spot Bitcoin ETFs manifested as a sell-on-the-news event for the pioneering cryptocurrency.

While BTC is down 12% from its local high on Jan. 11, ETH pulled back by 6% over the same period. With several firms filing applications for spot Ether ETFs, including the world’s largest asset manager, BlackRock, many speculators are tipping ETH will comprise the next crypto asset to underpin a spot exchange-traded fund.

Credit: Source link