Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The Bitcoin futures market has recently witnessed a significant liquidation event — a $2 million short position was wiped out, signaling a sharp and sudden rise in Bitcoin’s price. This event, part of a larger $71.15 million liquidation across various cryptocurrencies in 24 hours, could be a precursor to a bullish trend.

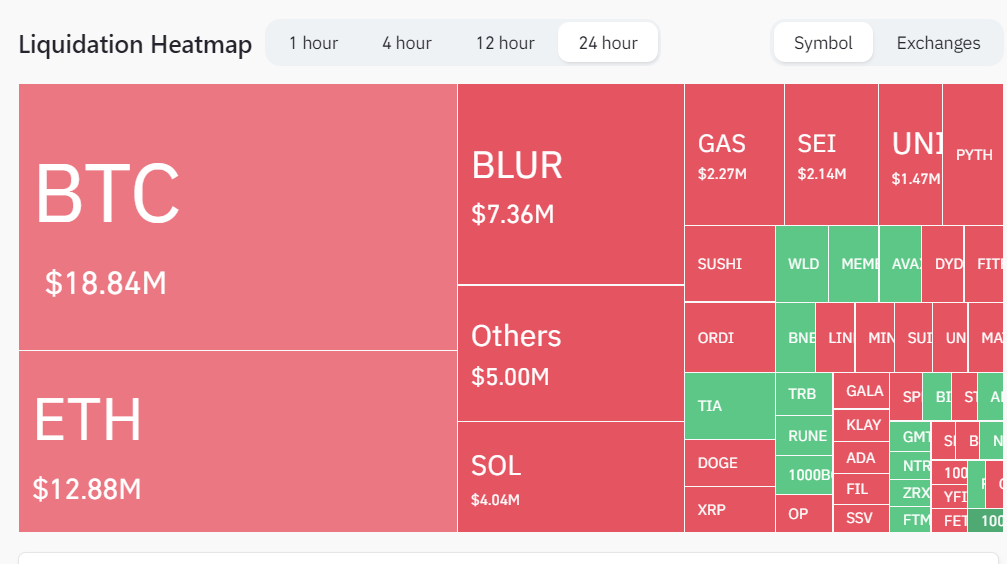

On the liquidation map for Bitcoin, we see that BTC and ETH hold the lion’s share of liquidations, with Bitcoin leading at $18.84 million. This suggests a high level of trading activity and volatility on the market, with traders taking aggressive positions that are susceptible to market movements.

Turning to the Bitcoin price chart, we notice that the cryptocurrency is trading near a potential breakout point. The local resistance level, evident at around $37,780, has become a focal point for traders. If Bitcoin can surpass this level, it might confirm bullish sentiment that could encourage further buying. The support level, meanwhile, seems to be solidifying around $31,491, a foundation that, if held, could strengthen traders’ confidence in maintaining their positions.

The possibility of a breakthrough at $37,780 is significant. Such a move would not only reverse the recent trend of liquidations but could also potentially ignite a rally. However, whether this rally could mirror the monumental climbs seen in Bitcoin’s golden years is still up for debate. Market dynamics have evolved, and while the sentiment can be swayed by such impactful liquidations, the conditions that led to historical bull runs may not be entirely replicable.

Nevertheless, the current momentum should not be ignored. A convincing break above this level could entice sidelined capital back into the market. This influx of investment could support sustained upward movement.

Credit: Source link