Overview

Cosa Resources (TSXV:COSA, OTCQB:COSAF, FSE:SSKU), is a Vancouver-based uranium exploration company with a portfolio of highly prospective assets in Saskatchewan’s Athabasca Basin region.

Cosa’s portfolio of uranium projects comprises more than 160,000 hectares of land within or proximal to Saskatchewan’s Athabasca Basin. Each project captures portions of highly prospective northeast trending uranium corridors and district-scale structural corridors, such as the Cable Bay and Grease River Shear Zones and the Larocque Trend.

The Athabasca Basin region is well known for hosting some of the world’s largest and highest-grade uranium deposits within these prominent and continuous magnetic low corridors; examples include Cameco’s McArthur River mine and IsoEnergy’s Hurricane deposit. Cosa’s projects are considered underexplored and boast strong potential to host world-class uranium deposits.

Supported by a team of technically focused and successful geologists and mining executives, Cosa believes that a combination of new ideas and aggressive exploration in underexplored areas has the potential to yield the next Tier 1 uranium discovery.

Left to Right: Steve Blower, Andy Carmichael, Craig Parry, and Justin Rodko.

Recipients of the AME Colin Spence Award for 2022.

Cosa has strategically assembled a management team with a history of success in the Athabasca Basin. With well over a century of combined uranium experience, Cosa’s management team has been involved with several uranium discoveries in recent years. Chairman Steve Blower was part of the discovery team behind 92 Energy’s Gemini zone, IsoEnergy’s Hurricane deposit, and Denison’s Gryphon deposit. For his role in the Hurricane discovery, he was co-recipient of the AME 2022 Colin Spence Award for excellence in global mineral exploration, alongside fellow Cosa team members Andy Carmichael, Justin Rodko and Craig Parry.

Uranium Markets

With the world’s shift away from fossil fuels, nuclear power has been gaining popularity in recent years. As of now, there are around 440 nuclear reactors globally, consuming roughly 62,500 tonnes of uranium (tU) per year, and the demand for the metal is only growing as more reactors come online. This has created a consistent and growing need for new sources of uranium to keep up with the increasing demand.

This rise in long-term demand for uranium has resulted in a growing spot price, reaching US$53.20 in September 2023, an increase of 14.72 percent from the previous month and 29.92 percent from last year. Given the current geopolitical climate in pursuit of cleaner power and reduced carbon emissions, nuclear power has become increasingly popular as an alternative to fossil fuels. It’s clear that new sources of uranium are necessary to meet the growing demand for the metal, which is now included as one of the Canadian Government’s 31 critical minerals.

In addition to a strong focus on uranium exploration and commitment to ESG practices, Cosa Resources also prioritizes strong corporate governance. The company believes that effective corporate governance is essential for building and maintaining trust with investors and stakeholders, as well as ensuring the long-term success and sustainability of their business. To support this goal, Cosa Resources has established a strong board of directors with diverse backgrounds and expertise. The board provides oversight and guidance on key strategic and operational decisions, and they are responsible for ensuring that the company operates in compliance with all relevant laws, regulations, and ethical standards. Cosa has additional support from Inventa Capital Corporation, a privately held merchant bank that specializes in financing and supporting companies that explore for and develop mineral deposits to fuel and support global energy and technology needs.

Company Highlights

- Over 160,000 hectares of underexplored uranium assets within the Athabasca Basin region – the heart of the Canadian uranium mining sector.

- Projects near to or within highly prospective uranium corridors and district-scale structural corridors such as the Cable Bay and Grease River Shear Zones, and the Larocque Trend.

- 100-percent-owned Ursa property covers 65 kilometers of the fertile and highly underexplored Cable Bay Shear Zone uranium corridor.

- More than 10 high-priority target areas identified by airborne surveying and comprehensive conductivity modelling at Ursa and Orion.

- Recent project acquisitions resulted in the addition of Solstice, Polaris, Eclipse to the company’s portfolio, and further expansion of the Ursa, Orion and Astro projects.

- The company acquired the Aurora Project in the Athabasca Basin, Saskatchewan adding more than 16,800 hectares to Cosa’s 100 percent owned exploration portfolio.

- A management team comprised of technically focused and successful geologists and mining executives with a proven track record of discovery and development in the Athabasca Basin.

Key Projects

Cosa’s uranium projects comprise over 160,000 hectares of land between several properties located within or proximal to Saskatchewan’s Athabasca Basin. These projects capture portions of highly prospective northeast trending uranium corridors and district-scale structural corridors such as the Cable Bay and Grease River Shear Zones and the Larocque Trend. The Athabasca Basin is well known for hosting some of the world’s largest and highest-grade uranium deposits within these prominent and continuous magnetic low corridors; examples include Cameco’s McArthur River mine and IsoEnergy’s Hurricane deposit.

Cosa’s projects have seen only 18 historical drill holes, with 15 of them conducted on the Ursa project. This project, featuring over 60 kilometers of strike length of the Cable Bay Shear Zone, is still considered significantly underexplored. Notably, Ursa has not undergone drilling since 2002, and the most recent drilling across any Cosa project occurred on the Helios grounds in 2007. All of Cosa’s uranium projects are fully owned by the company.

In 2023, Cosa Resources expanded its uranium portfolio with the acquisition of the Astro and Orbit uranium exploration properties in the Athabasca Basin region. Orbit covers four kilometers of the interpreted strike extension of a reactivated graphitic structural trend. The 6,669-hectare project was acquired by low-cost staking. Astro is a 40,025-hectare project covering a 20-kilometre strike length of electromagnetic (EM) conductors which are untested by drilling.

Further to the company’s expansion efforts, it has also acquired the Polaris and Eclipse uranium exploration properties in the Athabasca Basin. Polaris covers 3,290 hectares and 9 kilometers of prospective magnetic low zones near the southwestern Athabasca Basin and Eclipse covers 1,622 hectares in the Eastern Athabasca Basin with thin sandstone cover.

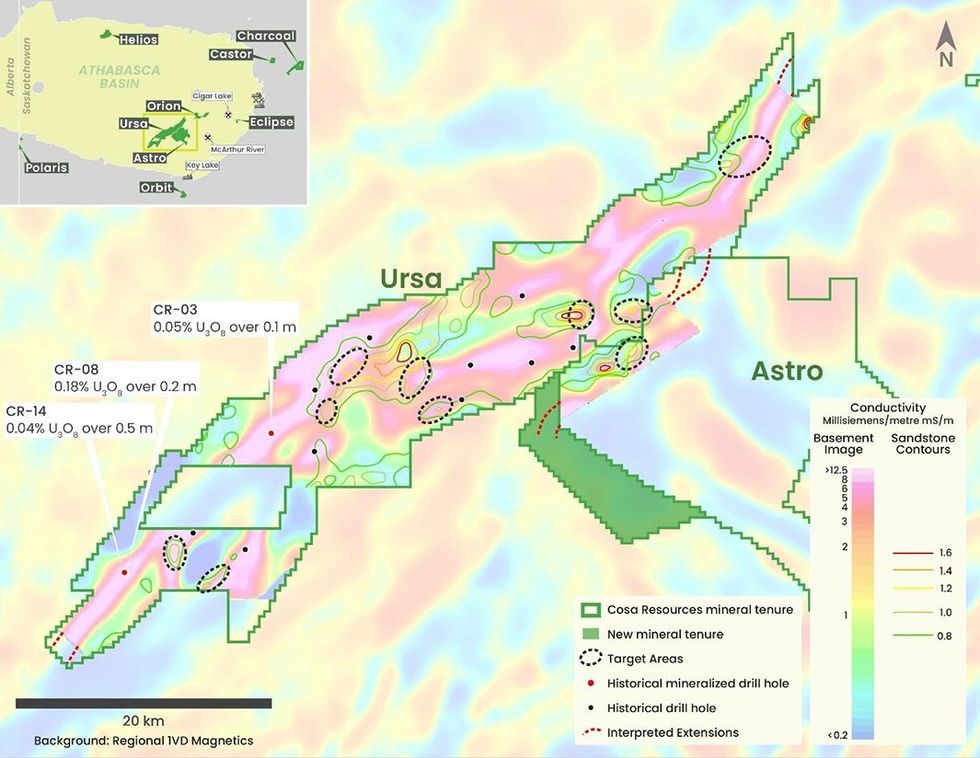

Ursa

Ursa property

Ursa covers 65 kilometers of strike length of the Cable Bay Shear Zone, a highly prospective and underexplored geological analogue to the setting underpinning major current- and past-producing eastern Athabasca uranium mines. At Ursa, the sub-Athabasca unconformity is estimated to be between 850 and 1,000 meters below surface. Cosa’s 2023 MobileMT survey covered more than 90 percent of this expansive project with the objective of defining and prioritizing conductive strike for follow up exploration and avoiding costly systematic drilling of the entire project.

The survey mapped more than 100 kilometers of basement conductive trend strike-length within Ursa. The property-scale conductivity model has greatly improved Cosa’s understanding of the project’s basement geology and allowed the identification of bends, splays and interpreted stepovers along basement conductive trends, all of which suggest favorable structural complexity.

The Ursa conductivity model includes numerous zones of anomalous sandstone conductivity. Interpretation has identified 10 initial target areas consistent with Cosa’s criteria, which cover an aggregate basement conductive trend length of approximately 24 kilometers. Importantly, none of the 15 historical drill holes within the project, including the three weakly mineralized drill holes, are proximal to the initial target areas identified by Cosa.

Confidence in the conductivity model is gained from its consistency with historical drilling results. Drilling at Ursa largely failed to intersect broad, strong zones of sandstone-hosted clay enrichment and the model contains no significant zones of enhanced sandstone conductivity proximal to historical drill holes. Historical drill holes which intersected broad intervals of pervasively silicified sandstone are located within a zone of extremely low sandstone conductivity in the 3-D model, suggesting variations in conductivity related to alteration are detectable by the survey system and accurately represented in the conductivity model.

Cosa is highly encouraged by the survey results at Ursa and will prioritize follow-up of top priority targets with target refinement through industry-best ground EM surveying in advance of diamond drilling in 2024.

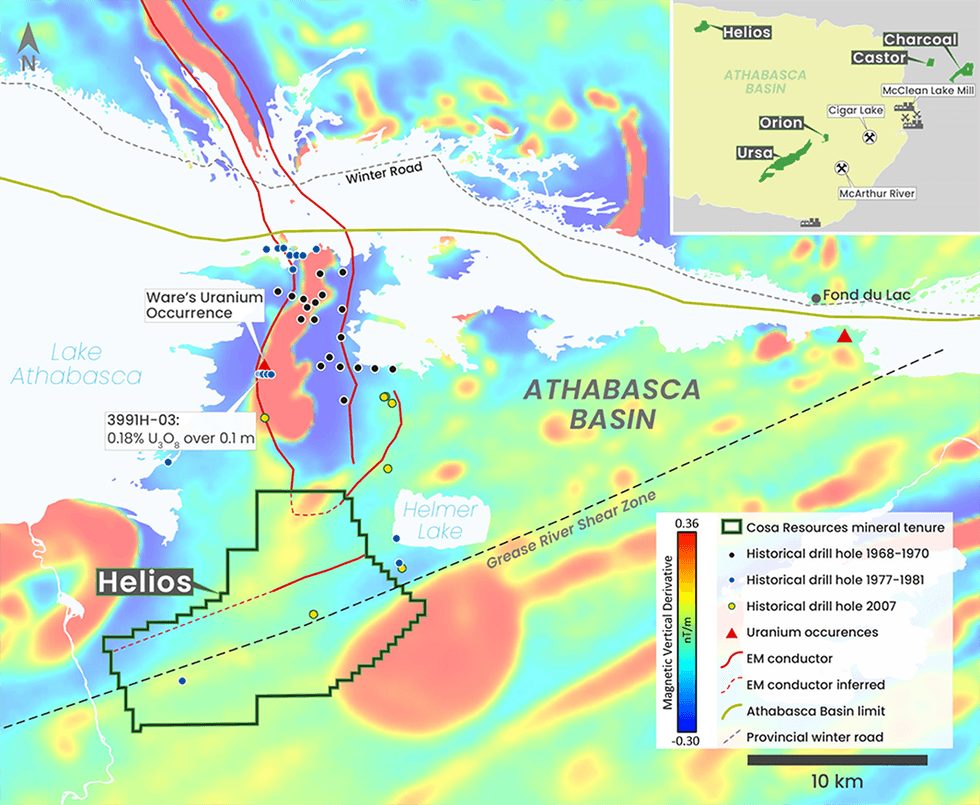

Helios

The 12,835-hectare Helios project is located 14 kilometers south of the northern rim of the Athabasca Basin. The project comprises two target areas:

- The northern target area covers the extension of two sub-parallel conductive trends flanking a central magnetic high as indicated by a 2005 airborne electromagnetic survey. The Ware’s Uranium Occurrence, located roughly six kilometers on strike and to the north of Helios, is a zone of outcropping sandstone cut by uranium-bearing fracturing. Limited follow-up drilling determined that fracturing penetrated the full thickness of the Athabasca sandstone which indicates the potentially significant structural corridor. No drilling has tested this system on the Helios project, though a 2007 drill hole was completed roughly four kilometers north of Helios which intersected favorable illitic and chloritic clay alteration signatures. Depth to the unconformity at the northern target area is expected to be between 375 and 500 meters.

- The southern target area covers 15 kilometers of the Grease River Shear Zone (GRSZ), a major east-northeast trending basement structure corridor; the Fond du Lac uranium deposit, located 29 kilometers northeast of Helios, is interpreted to be related to this corridor. Drilling immediately east of Helios had identified a sub-Athabasca unconformity offset of up to 30 meters. Only two drill holes have been completed on the property, yet historical electromagnetic and DC-resistivity surveys have defined approximately five kilometers of basement-hosted conductivity associated with the GRSZ, with the potential for another 10-kilometer extension to the west-southwest. The depth of the unconformity at the southern target area is interpreted to be between 445 and 850 meters.

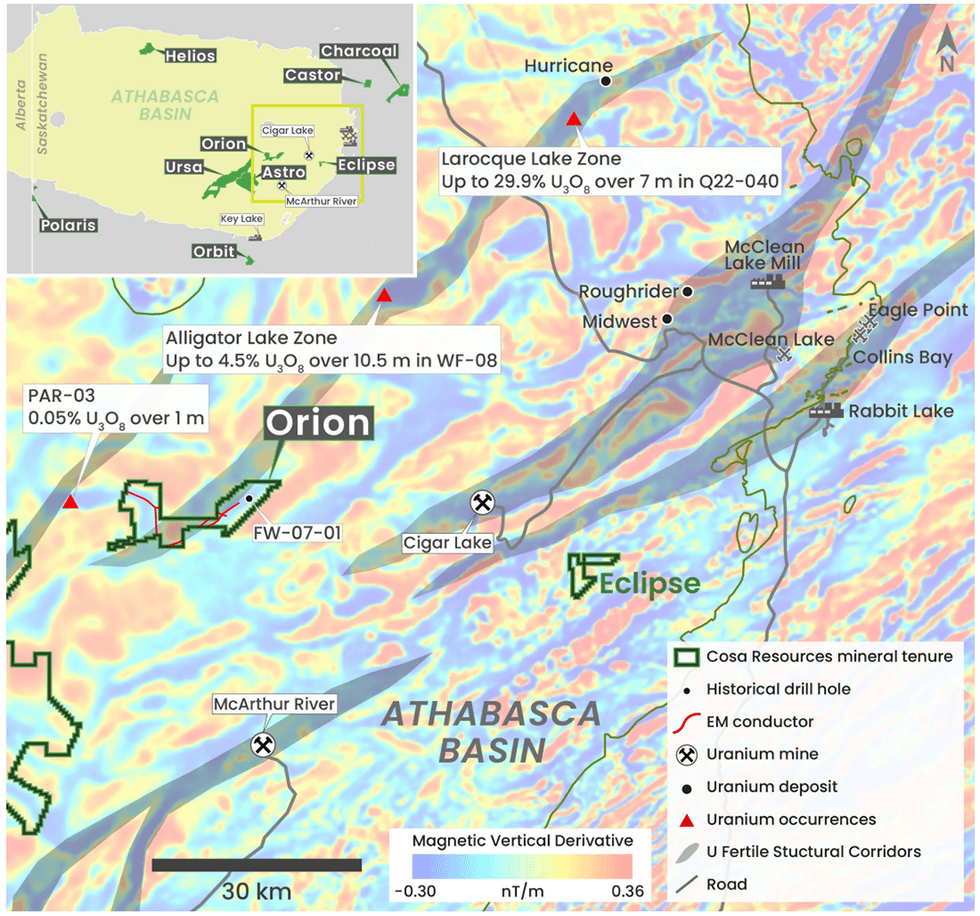

Orion

The western portion of Orion covers 8 kilometers of curvilinear magnetic low strike length containing historical EM conductors and flanked by magnetic highs. One drill hole has been completed within the project outside of the survey area and the depth to the unconformity is estimated to be between 750 and 900 meters.

The 2023 MobileMT survey mapped more than 10 kilometers of basement conductive trend strike length at Orion. Basement conductive trends at Orion are complex, with bends and splays evident. An additional 1.5 kilometers of conductive strike length is inferred to extend beyond the surveyed area to the western property boundary and beyond to Orano’s Parker Lake Project. Historical drilling at Parker Lake intersected positive results including graphitic basement beneath sandstone structures with illitic alteration and elevated uranium geochemistry.

A prominent, northwest-trending zone of anomalously high sandstone conductivity is centered above where an east-west trending basement conductive zone bends to the northwest. The 4-kilometer-long, 1.4-kilometer-wide feature is the highest-amplitude sandstone-hosted anomaly in the Ursa and Orion conductivity models. Northwest-trending topographic features partly coincident with the anomaly suggest post-Athabasca structural reactivation may have occurred.

As at Ursa, follow up work at Orion will include industry-best ground EM surveying for target refinement followed by drill testing. Additionally, Cosa will consider expanding MobileMT coverage over the eastern portion of the project which was acquired after the 2023 survey was completed.

Astro

Cosa’s 100-percent-owned Astro project spans more than 40,000 hectares and is located 28 kilometers west of Cameco’s McArthur River uranium mine and 13 kilometers north of the Millennium deposit. Historical geophysical surveys have defined 20 kilometers of conductor strike length while modern geophysical surveys indicate a potential to increase conductive strike length significantly.

Orbit

Also 100-percent-owned by Cosa, the Orbit property spans 22 kilometers south of the Key Lake Mill and historical mine. The project captures 4 kilometers of inferred strike extension of a prospective, reactivated graphitic structural trend. Weak mineralization has been intersected to the southwest but drilling 10 kilometers southwest along trend intersected 0.07 percent uranium over 0.2 meters within strongly altered graphitic faulting.

Eclipse

The Eclipse property comprises three claims totalling 1,622 hectares in the eastern Athabasca Basin. With only two drill holes and limited geophysical surveys completed historically, the property is underexplored. Historical drill logs indicate drill hole 4633-1-79 intersected bleached zones and a metre-scale zone of lost core within the sandstone above faulted basement, while drill hole 4633-2-79 intersected bleached zones in the sandstone. Both drill holes intersected metasediments in the basement and were terminated less than 25 metres below the unconformity.

Polaris

The Polaris Property comprises five mineral claims in two blocks totaling 3,290 hectares in the southwestern Athabasca Basin region. Polaris is located 8 kilometers south of the Smart Lake uranium occurrence, 25 kilometers southwest of the JR Zone, 35 kilometers west of the Triple R uranium deposit, and 39 kilometers west of the Arrow uranium deposit. The project covers 9 kilometers of magnetic-low strike length located between 4 and 22 kilometers outside the present-day extent of the Athabasca Basin.

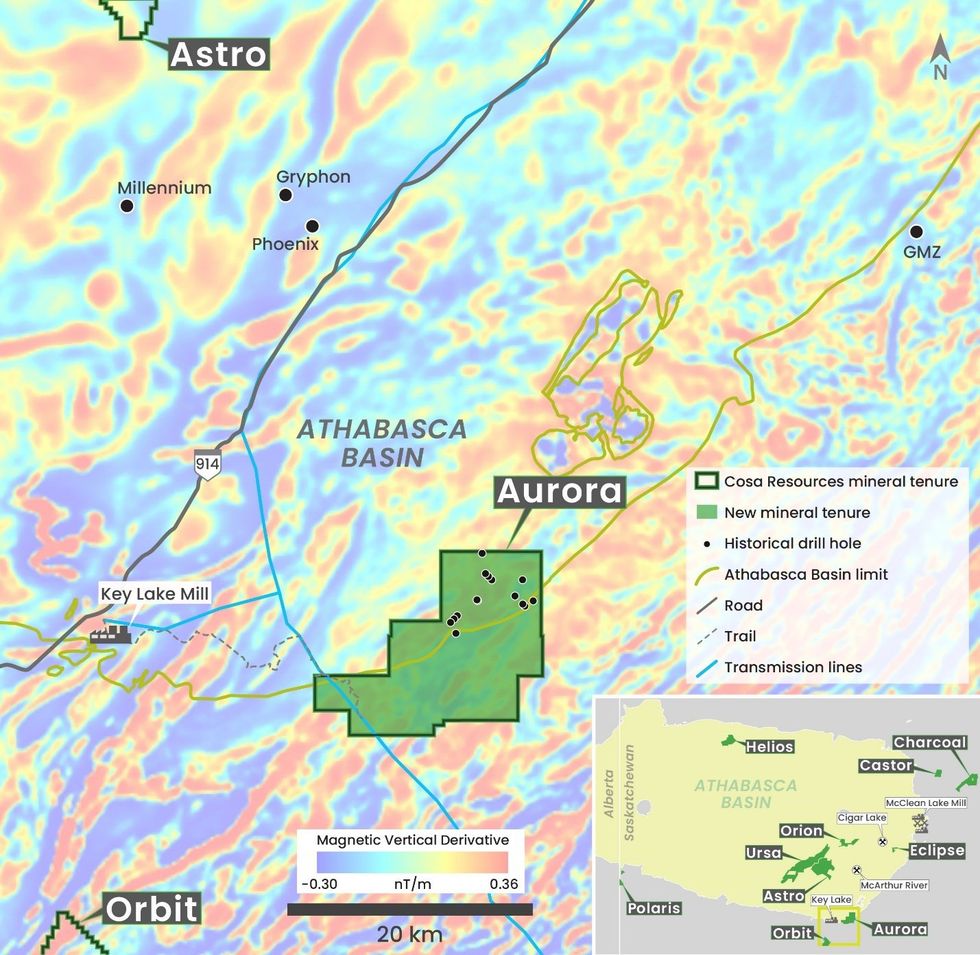

Aurora

The Aurora Property covers 17 kilometers of the southeastern rim of the Athabasca Basin between Key Lake and the GMZ uranium discovery. Aurora comprises seven contiguous claims totaling 16,896 hectares which cover 17 kilometers of the Athabasca Basin’s southeastern rim. Between 1983 and 2002 the Key Lake Mine produced 209.8 million pounds of U3O8 at an average grade of 2.3 percent U3O8.

Aurora covers a prominent, complex zone of low magnetic susceptibility with its northern edge generally coincident with the current edge of the Athabasca Basin. Aurora is underexplored and initial work by Cosa in Q2 and Q3 2024 is expected to include airborne EM, radiometric, and/or gravity surveys to generate target areas for follow-up.

Management Team

Keith Bodnarchuk – President, CEO and Director

Keith Bodnarchuk is a professional geoscientist with more than 15 years of experience in exploration, mining and capital markets. He led strategy and corporate development for IsoEnergy and was responsible for the acquisition and divestment of several projects. Bodnarchuk has previously worked as project geologist at Denison Mines with a focus on uranium exploration in North America and Africa.

Steve Blower – Chairman

Steve Blower is a geologist with over 30 years of experience in the minerals industry including mine geology, resource estimation, and exploration for a variety of commodities. For the past 17 years, as president and CEO of Pitchstone Exploration., VP of exploration for Denison Mines, VP of exploration for IsoEnergy., and a consultant/director of 92 Energy, he has been involved in three uranium discoveries in the Athabasca Basin. Earlier in his career, Blower was a mine geologist at the Huckleberry and Similco open-pit copper mines in British Columbia. Blower holds a BSc in geological sciences from the University of British Columbia and an MSc in geological sciences from Queen’s University.

Andy Carmichael – VP of Exploration

Andy Carmichael has nearly 20 years in mineral exploration, most of which focused on uranium exploration and resource delineation in the Athabasca Basin, Hornby Basin, Colorado Plateau and Namibia. Carmichael has served as VP of exploration for IsoEnergy, where he was a key member for the discovery and completion of the initial mineral resource for the Hurricane deposit, currently the world’s highest grade indicated mineral resource in uranium. Carmichael has worked at the Triple R, Phoenix, Gryphon and J-Zone deposits, and has a BSc with honours in geology from Saint Mary’s University.

Darren Morgans – Chief Financial Officer

Darren Morgans is a Canadian CPA and Australian CA, and has been a practicing finance professional since 1995. He has worked with Canadian and Australian publicly listed resource companies for 25 years. Morgans is currently CFO of Velocity Minerals, a gold explorer and developer with assets in Bulgaria. Prior to Velocity, Morgans was the CFO of Perpetua Resources, (formerly Midas Gold . At Perpetua, he assisted with its IPO in 2011 and subsequently raised over C$200 million in equity, convertible debt and royalty financings, to advance the Stibnite Gold Project from a small resource to a Feasibility Study with almost 5 million oz in reserves.

Wes Short – Executive VP and Director

Wes Short has worked in the natural resources sector for the past eight years and was a founding member of the IsoEnergy team as manager of corporate affairs and corporate secretary until 2021, and previously held the role of corporate secretary with NxGold from 2018 until 2020 as well as its successor, Consolidated Uranium, until 2021. Short holds a Bachelor of Commerce in finance from the University of Northern British Columbia.

Justin Rodko – Corporate Development Manager

Justin Rodko is a professional geoscientist with nearly a decade of uranium exploration experience in Saskatchewan and Nunavut. Rodko is an original member of the IsoEnergy exploration team where he played a critical role in the discovery and completion of the initial mineral resource for the Hurricane zone. Rodko was previously a senior geologist at IsoEnergy and has worked at Orano’s (Areva) Kiggavik project in Nunavut as well as the Waterbury Cigar and Waterbury UEM projects, and at NexGen’s Arrow deposit in the Athabasca Basin.

Craig Parry – Advisor

Craig Parry has over 20 years in the resource sector and is a co-founder and partner of Inventa Capital, a private natural resources investment company. Parry also serves as chairman of Vizsla Silver, director (formerly chairman) at Skeena Resources, executive chairman at Vizsla Copper, and has previously served as CEO of IsoEnergy. Parry is a founding member of both IsoEnergy and NexGen Energy and has also led exploration teams exploring iron core, copper, diamonds, coal and bauxite in Australia. He was principal geologist for the Kintyre uranium project pre-feasibility study, holds an Honours Degree in geology, and is a member of the AusIMM.

Ted Trueman – Director

Ted Trueman serves as a director of Cosa and is a professional engineer with over 50 years of diverse experience in mining. Trueman has led several exploration teams that have made discoveries in uranium, gold and silver. He previously served as CEO of Pitchstone Exploration prior to being acquired by Fission Energy..

Janine Richardson – Director

Janine Richardson serves as a director of Cosa and is a CPA with over 30 years of finance experience in the mining industry. Richardson previously served as chief financial officer of IsoEnergy and CFO of Consolidated Uranium. She graduated from McMaster University with a Bachelor in Economics and has a diploma in accounting from Wilfrid Laurier University.

* Disclaimer

The scientific and technical information on this website has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved by Andy Carmichael, VP Exploration for Cosa Resources Corp. and a “qualified person” as defined by NI 43-101. This profile refers to neighboring properties in which the Company has no interest. Mineralization on those neighboring properties does not necessarily indicate mineralization on the Company’s properties.

Credit: Source link