Market volatility will stay elevated for years to come, Bank of America says.

The firm recommends avoiding the urge to buy the ongoing dip in tech stocks.

BofA instead said to look for high-quality names, as well as dividend-paying utility and real estate stocks.

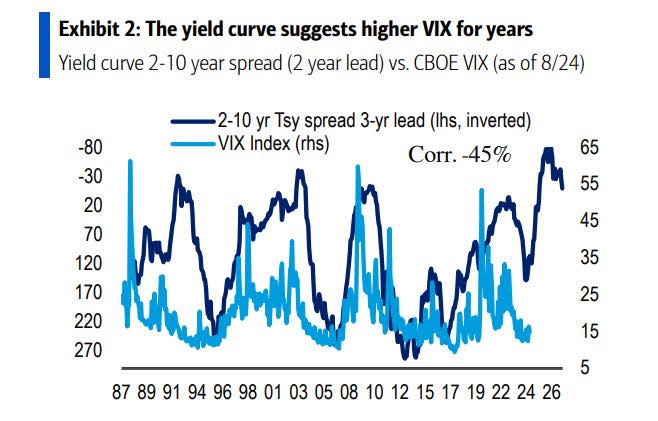

The market is getting more volatile, and stocks will stay choppy for years ahead, according to Bank of America.

The firm says that in the near term, election-related policy uncertainty will keep the market swinging. Looking further out through the end of 2027, the yield curve is signaling more volatility ahead, as shown by the chart below:

Further, a proprietary BofA “regime indicator” has swung into downturn territory.

With those elements in play, the firm is recommending defensive stocks that generally outperform in times of uncertainty or weakness.

“Quality, stability and income have protected investors in prior volatile markets. We recalibrate our sector calls to augment these characteristics,” analysts wrote on Monday.

On the flip side, investors should avoid boosting exposure to the popular tech sector, the bank warned.

Even if price swings help cheapen mega-cap industry names, several qualities still make this cohort an unfavorable investment, the bank said.

“Don’t buy the tech dip,” analysts said. “We remain underweight Information Technology despite arguments that it has gotten so beaten up.”

The bank cited record highs in the sector’s enterprise-value-to-sales ratio, a signal that these firms remain overvalued. Meanwhile, tech funds could soon face passive selling pressure as the S&P 500 prepares new index-cap rules.

Specifically, the index is planning to lower the weightings of stock funds with $350 billion in assets, Bloomberg reported. In this event, passive investment vehicles would have to restructure their holdings at the upcoming quarterly rebalance.

As volatility picks up for the long term, quality and income should play a larger role in portfolios, analysts wrote.

Although growth stocks made sense when borrowing costs were low through the 2010s, this is changing — in the next years, the bank expects single-digit returns.

Quality exposure also makes sense in the more immediate term, according to Savita Subramanian, BofA’s head of US equity and quant strategy.

“Don’t be a hero,” she told CNBC on Friday. “Just to park in safe total return type vehicles where you get paid to wait.”

In a note last week, Subramanian noted that today’s quality stocks are not expensive, and those rated B+ or better are trading at a slight premium to their lower-quality peers.

Meanwhile, utilities and real estate dividends should attract investor attention as Federal Reserve interest-rate cuts leave them hunting for yield opportunities.

“Real Estate dividends are likely more sustainable than during prior cycles, given that since 2008, the sector has doubled its proportion of high quality (“B+ or Better”) market cap to a whopping 70%,” analysts wrote.

Read the original article on Business Insider

Credit: Source link