Dollar firms as Powell strikes balanced tone

George Vessey – Lead FX Strategist

The US dollar extended its rebound from 3-week lows as investors digested the not-so-dovish comments from Federal Reserve (Fed) Chair Jerome Powell’s testimony before the US Congress. GBP/USD slipped back under $1.28 whilst EUR/USD lingered around the $1.08 handle. The bigger gains were made against the Japanese yen, with USD/JPY inching closer to fresh 38-year highs.

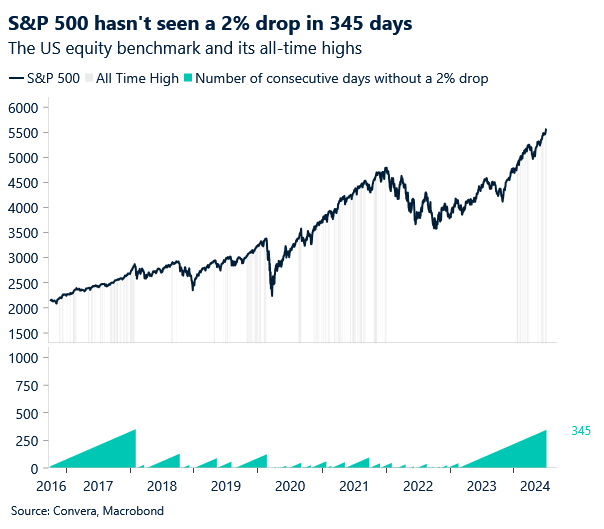

Powell emphasized that the Fed would not consider reducing interest rates until it is confident that inflation is moving sustainably toward 2%, noting that first-quarter data did not provide such confidence. US Treasury yields rose after the comments, with the 10-year note edging back above 4.3%. Nevertheless, the S&P 500 and the Nasdaq held at record levels on Tuesday, the former not having experienced a 2% drop in 345 days, the longest streak since 2017-2018. Despite the less dovish tone from Powell, equity markets continue to cheer the prospect of lower rates on the horizon, but the data needs to be there to justify it. Although Powell characterized the US labour market as in better balance, he also said the Fed is concerned enough about the upward trajectory in the unemployment rate that it could pull forward rate cuts.

Inflation remains the key question mark for now though and we expect softening price pressures will give the Fed enough confidence to begin cutting in September, thus weighing on US yields and the dollar. Conversely, markets could react badly if the print on Thursday comes in above expectations.

Euro loses momentum as Powell testifies

Ruta Prieskienyte – Lead FX Strategist

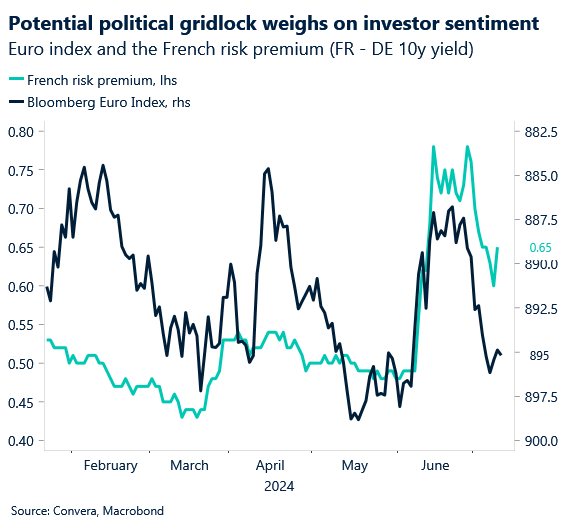

The euro inched lower, European yields trended higher and equity indices retreated on the back of Fed’s Chair Powell’s congressional testimony. EUR/USD touched a session low of $1.0806, before slightly rebounding. Meanwhile, the CAC 40 amplified its losses by dropping a further 1.6% on Tuesday, its largest single daily drop in over 3-weeks, to decline for a fourth consecutive sessions as the impact of a potential political gridlock continues to weigh on investor sentiment.

To add to the worries, Moody’s issued a warning of a possible downgrade on France’s outlook if fiscal condition worsen. A weakening commitment to fiscal consolidation, specifically the prospect of a larger deterioration in debt affordability compared to ratings peers, would increase downward credit rating pressures. The way ahead for France remains opaque, with outcomes ranging from a minority left-wing government to a grand coalition of moderate parties, or even a technocratic government. In the short term, the election of the president of the National Assembly on 18 July will provide a first glimpse of the new political equilibrium. But no matter what the compromise, the fiscal consolidation started by the current government is now unlikely to continue, despite France’s deteriorated fiscal metrics. Public deficit reached 5.5% of GDP in 2023 and public debt standing at 111% of GDP. A divided Parliament will find it hard to agree on politically difficult spending cuts, more so given the fact that public finance sustainability issues took a back seat during the campaign. While the euro did not react to the warning issued by the credit rating agency, the OAT-Bund 10-year spread widened to 66bps (+4.5bps). French CDS, the cost of insuring against France defaulting on its sovereign debt, increased by a negligible value, but remains in a downtrend since June 28th. The release of the next French credit rating by Moody’s is scheduled for 25th October.

The European calendar is largely absent of domestic data releases. The ECB’s Nagel is scheduled to speak shortly this morning, but we do not anticipate this to be a market moving event. While the attention once again shifts to the US, the round two of Powell’s testimony in front of House Financial Services is unlikely to deliver surprises as the Chairman is likely to stick to the script from yesterday. As a result, the FX volatility is expected to subside further as markets remain in wait-and-watch mode ahead the US CPI print tomorrow.

Why the pound could climb higher

George Vessey – Lead FX Strategist

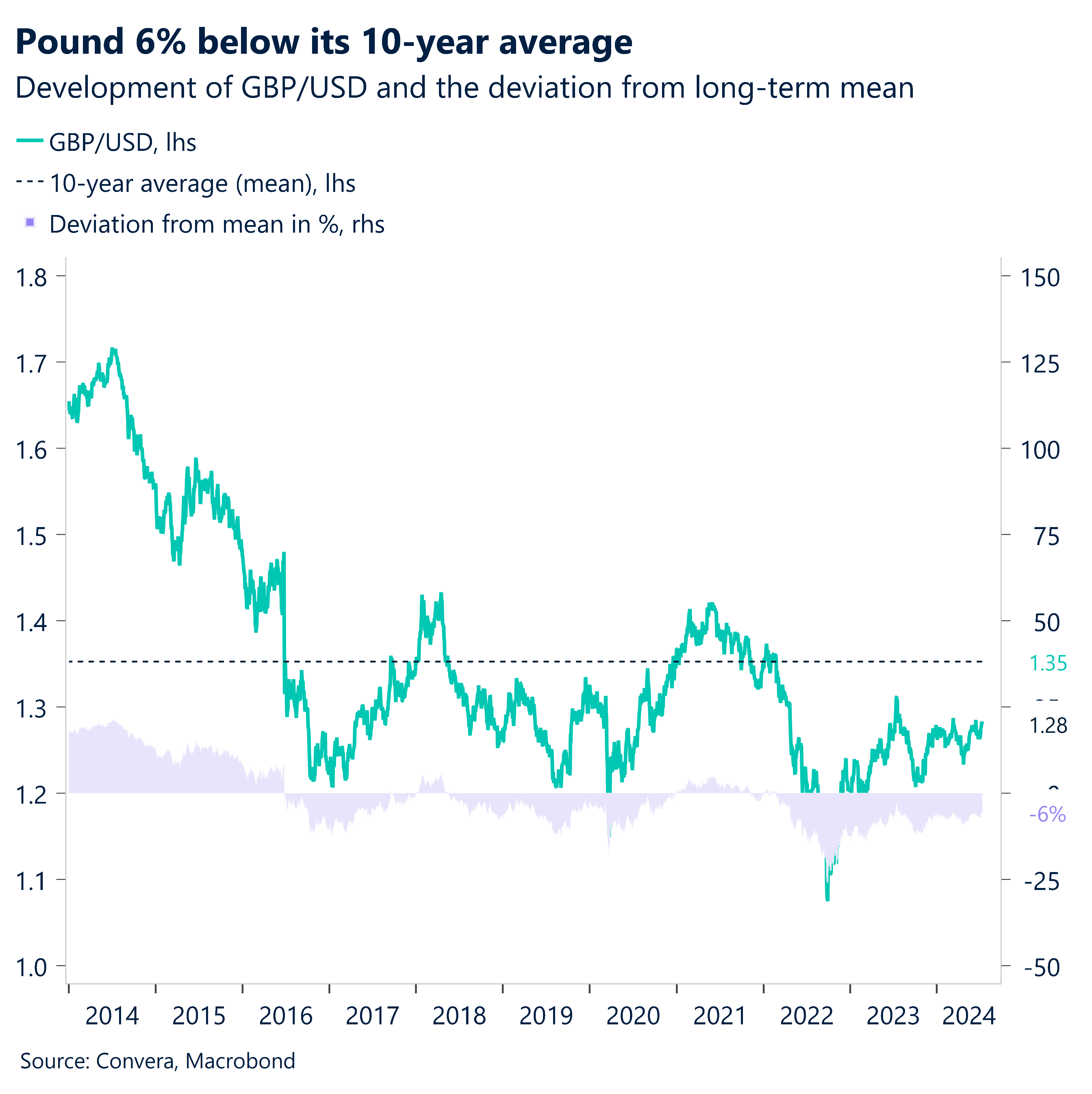

The pound continues to lack enough momentum to push past its 200-week moving average versus the US dollar – a resistance level that’s been in place for a year now. However, if the US exceptionalism narrative continues to moderate and the UK’s economic recovery gains momentum, via a boost in real household incomes from a sharp fall in inflation and lower interest rates, we think the pro-cyclical pound can trend higher through year-end.

Sterling was the strongest G10 performer in the first half of 2024 and with bullish short-term cyclical and political dynamics holding for now, the case for further upside in GBP/USD remains compelling. Positive economic momentum should support the pound despite inflation falling below 2% and the BoE to cut interest rates two (or more) times this year. The stable UK political backdrop, especially amid elevated uncertainty in Europe, the US and beyond, could bode well for risk premiums and GBP, further boosted by Labour’s desire for deeper ties with the EU. PM Keir Starmer has said work has already begun to improve the UK’s Brexit deal.

We estimate that sterling is currently undervalued against the dollar on most measures. GBP/USD is trading more than 6% below its 10-year average ($1.35) and 17% below its 20-year average ($1.52). We do expect it to close this gap, but the process will be gradual due to the high levels of external debt and a wide current account deficit in the UK.

Brent crude slips past $85 as supply concerns subside

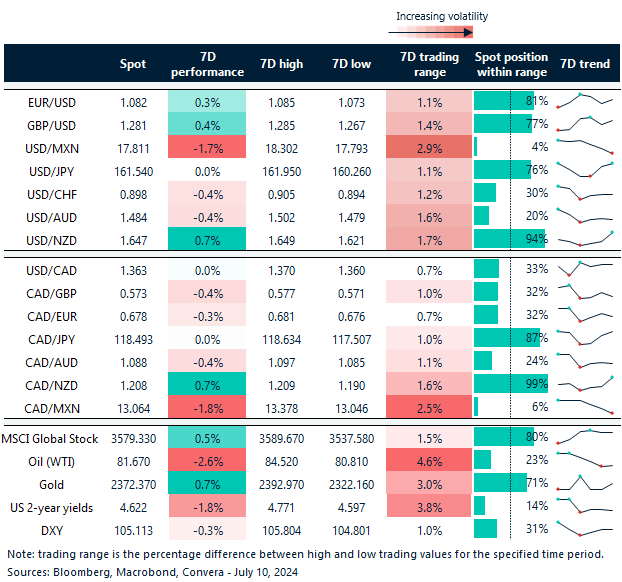

Table: 7-day currency trends and trading ranges

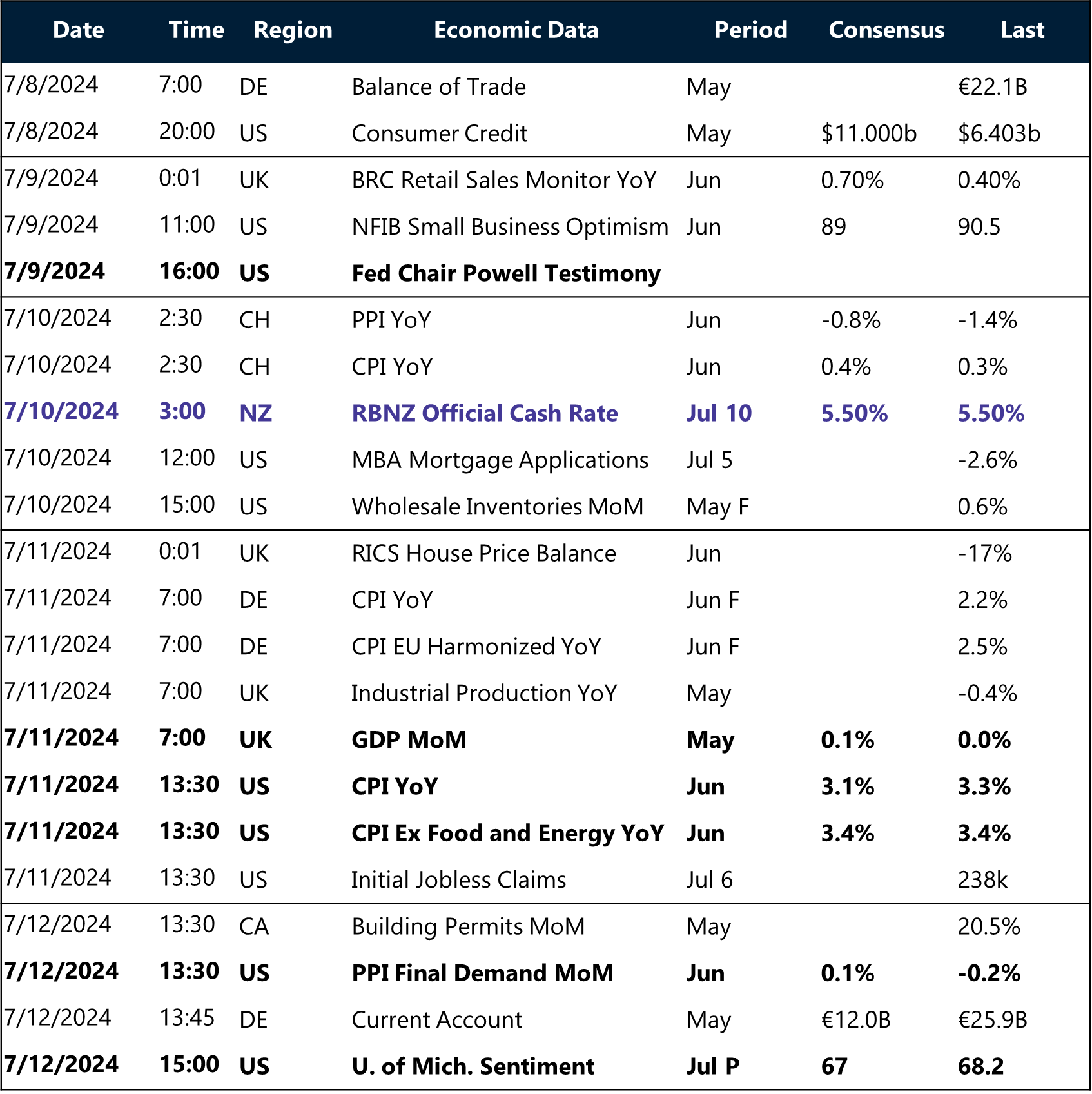

Key global risk events

Calendar: July 08-12

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Credit: Source link