Semiconductor stocks have been some of the biggest winners from the red-hot artificial intelligence (AI) race. Among higher-profile chip companies is Intel (NASDAQ: INTC), which recently won a deal worth up to $3 billion with the U.S. Department of Defense (DOD).

Let’s dig into this deal and how it’s playing a role in Intel’s growth right now. Moreover, after a thorough analysis of the stock, I’ll provide my views on whether now is a good time to buy Intel shares right now.

I’m beginning to notice a pattern with Intel

President Joe Biden has been busy over the last four years. In my opinion, one often overlooked piece of legislation from the Biden-Harris administration is the CHIPS and Science Act. One of the biggest initiatives from the CHIPS Act is to bring more manufacturing and research jobs in the semiconductor space to the U.S.

Back in September, Intel was awarded a deal worth up to $3 billion as part of the CHIPS Act’s Secure Enclave Program. According to the DOD’s website, the Secure Enclave project aims to “support the manufacturing of microelectronics and ensure access to a domestic supply chain of advanced semiconductors for national security.”

This is not the first time Intel has been a beneficiary under the CHIPS Act. Back in March, Intel and the Department of Commerce agreed to preliminary terms of an $8.5 billion funding aimed at helping the company build out additional manufacturing facilities in Arizona, Ohio, Oregon, and New Mexico.

While these deals are an important step in helping bring more chip investment to the U.S. from overseas, I do see some drawbacks to Intel’s government business.

Drawbacks with public sector business

Unpredictability is a risk with any type of deal. However, I see public sector business as far less predictable compared to the private sector. Government initiatives are sensitive to budget cuts, and oftentimes priorities change dramatically under different political administrations.

Despite their unpredictability, major government contracts can wind up being lucrative sources of steady business. However, focusing on renewing steady public sector deals can come with the opportunity cost of investing in new product development outside of these government deals. For these reasons, businesses that rely heavily on government opportunities run the risk of being seen as less innovative compared to peers.

Lastly, it’s natural for public sector deals to receive higher levels of scrutiny compared to opportunities in the private sector. Should a company fail to meet its deliverables or expected requirements, investors may start to view a company more negatively than is warranted, purely due to their knowledge of setbacks in higher-profile, reported deals.

Is Intel stock a buy right now?

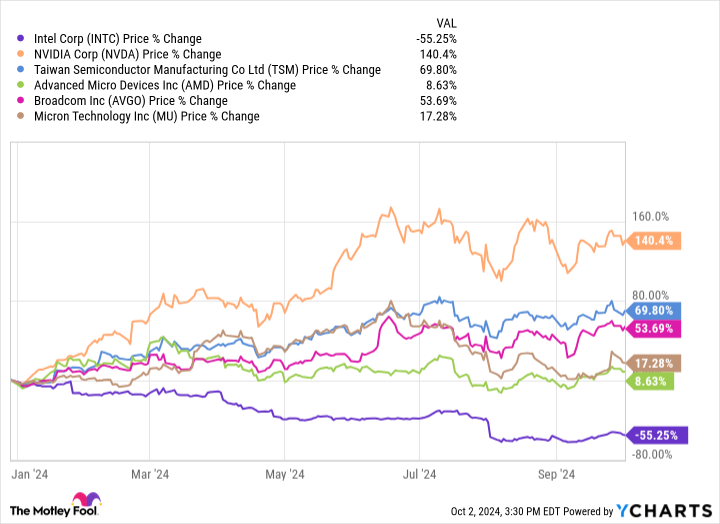

The chart below illustrates the returns so far in 2024 for a number of semiconductor stocks. The obvious outlier in the chart is Intel, and not in a good way. The company’s negative 55% return so far this year doesn’t exactly inspire confidence — especially with many other chip stocks outperforming the S&P 500 and Nasdaq Composite.

Perhaps billionaire investor Leon Cooperman summed it up best last week during his segment on CNBC’s Squawk Box when he said that Intel is on “government assistance.” That’s a harsh way to put it, but not necessarily untrue.

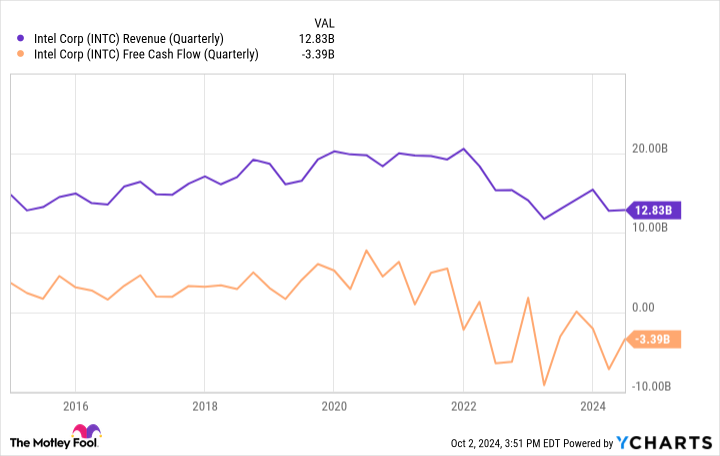

Despite some important work with the federal government, Intel can’t seem to get its engine into a new gear. Revenue and cash flow are continuing to trend in the wrong direction. Much of Intel’s stalled business performance can be traced to Taiwan Semiconductor Manufacturing, which continues to win more deals and lucrative opportunities from the tech sector’s biggest players.

While deals from the CHIPS Act receive notoriety, they have yet to translate into longer-term meaningful opportunities for Intel. I do not see Intel’s new $3 billion deal as a reason to buy the stock. In my eyes, Intel’s cratering share price is warranted and I would not be surprised to see it fall even lower.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Does Intel’s New $3 Billion Pentagon Deal Make the Stock a Buy? was originally published by The Motley Fool

Credit: Source link