What to make of the markets today? It seems that no matter where we look, the currents are pulling in two directions simultaneously. Recessionary forces, both inflation and higher interest rates, are running headlong into a remarkably resilient economy – but according to earnings results, we actually saw a mild recession early last year, and are in a recovery period. The conventional wisdom is no longer calling for a steep ‘double dip’ recession, but is predicting that growth will slow down sharply in the near term.

In a recent note from Deutsche Bank, chief global strategist Bankim Chadha takes the measure of current conditions and outlines the likely main chances going forward. From an investor’s perspective, Chadha’s outlines offer hope of gains, and some reason for caution.

“With the dispersion of views on the economic outlook remaining very wide, we evaluate the implications of 3 sets of views for equities; our house view of a widely anticipated mild short recession points to a quick selloff and rebound leaving the S&P 500 close to current levels and our year-end target of 4500; a continued muddle through as growth surprises to the upside but the cloud of uncertainty remains, supports a choppy grind up to 4750; signs of a clear sof t landing and pricing in of a new growth upcycle would see a stronger rally to 5000. The muddle through scenario best describes the rally this year and is likely to continue near term,” Chadha opined.

For investors, the main question remains: which equities are best positioned to thrive against this backdrop? Deutsche Bank analysts have an idea about that and have tagged two names with up to 120% upside potential.

In fact, it’s not only Deutsche Bank who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Hilton Grand Vacations (HGV)

First up is Hilton Grand Vacations, formerly a subsidiary of Hilton, Inc. that spun off as an independent public entity. HGV operates brand-name, quality vacation timeshares, offering customers ownership shares in vacation destinations. The company promotes its high standard of service, in line with the Hilton hotel chain’s reputation, and claims more than 520,000 club members, who have access to exclusive services and world-wide destinations.

As economies reopened in the aftermath of the pandemic-era shutdowns, vacation and resort stocks saw gains. People had accumulated savings and wanted to spend them, and travel boomed.

However, weather conditions and natural disasters can impact vacation destination companies, and Hilton Grand Vacations, which has regional offices in Hawaii, has taken a hit from the recent wildfires on the island of Maui. Of the company’s 13 Hawaiian properties, two are on the affected island – although neither suffered physical damage. HGV’s main hit came from reduced travel to Maui.

The company saw some modest growth numbers in its financial results for 2Q23. These included a 2.8% increase in consolidated net owner growth (that is, contract members), which reached 522,000 as of June 30. The firm’s top line for the quarter was up approximately 6.5% at $1.01 billion, beating the forecast by $11.4 million. At the bottom line, HGV’s adjusted diluted EPS, the non-GAAP measure, came to 85 cents per share. While down from 88 cents in 2Q22, the current EPS was 1-cent better than had been expected.

For Deutsche Bank’s Chris Woronka, this adds up to stock that’s worth investors’ time. Woronka liked the shares’ relatively low cost of entry and believes that the company will rebound well from the disruptions in the Hawaiian business. He writes, “We view HGV as an inexpensive stock on any relevant metric at (or near) its recent levels. Specifically, we are intrigued by single digit forward year P/E multiples and double digit free cash flow yields for all periods presented (2023E-2025E). We believe multiples at these levels suggest that investors do not necessarily agree that the Street’s published estimates are likely to be achieved…”

Woronka gave deeper detail on the Hawaiian situation, adding, “While disruptions from the recent wildfires in Hawaii are likely to result in flattish EBITDA in FY23 (as opposed to expectations for 3% to 6% growth prior to the outbreak of the fires), we see the impact as being quite manageable for HGV and will ultimately produce easier comps as travel to the island of Maui recovers.”

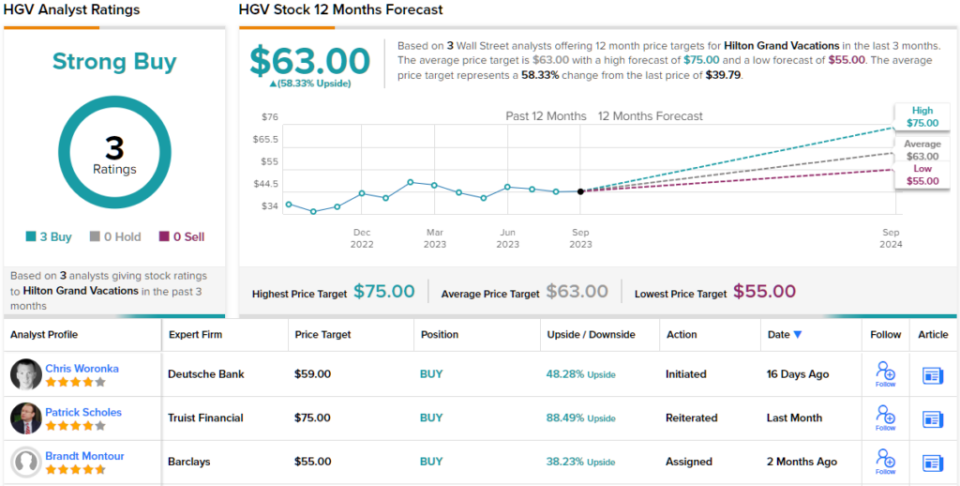

In the analyst’s view HGV well deserves its Buy rating, and his $59 price target implies a one-year upside potential of 48%. (To watch Woronka’s track record, click here)

Overall, HGV holds a Strong Buy rating from the analyst consensus, and it is unanimous, based on 3 recent positive reviews. The shares are trading for $39.81 and boast a $63 average price target that suggests a 58% gain lying ahead for the stock. (See HGV stock forecast)

BlackSky Technology (BKSY)

For the second Deutsche Bank pick, we’ll move to BlackSky Technology, a commercial satellite firm in the geospatial intelligence niche. The company provides real-time intelligence data from a network of small satellites positioned in low earth orbit, where they can capture images in a manner that is both highly efficient and cost-effective. The company includes analytic services, using its Spectra AI software platform for data processing and integration of third-party sensors. BlackSky counts US and international governmental organizations among its customer base, as well as global commercial businesses.

The foundation of BlackSky’s business is a constellation of small satellites, with can give the company’s customers a fast pace of space-based intelligence coverage. Reconnaissance products can usually be delivered within 90 minutes, images can be revisited by a satellite within 60 minutes, and the company can provide up 15 daily satellite revisits. BlackSky can also provide customers with direct satellite downlinks, for ground-based and maritime operations.

In a move that bodes well for BlackSky’s ability to continue offering high-end satellite intelligence service, the company announced in August an agreement with the launch company Rocket Lab USA (RKLB) to purchase an additional 5-launch block. The launches, which will use Rocket Lab’s Electron vehicle, will ensure that BlackSky can continue to offer the wide ranging, real-time coverage its customers expect and need.

In its 2Q23 financial results, BlackSky reported a solid year-over-year increase in revenue, although the top and bottom lines both missed analyst expectations. Revenues came in at $19.3 million, up 28% from 2Q22 but $1.22 million below the forecast. Bottom line earnings, reported as a 24-cent loss per share, was 12-cents deeper than the estimates had called for.

The misses didn’t prevent Deutsche Bank analyst Edison Yu from taking a bullish stance on the stock, however. He sees BlackSky in a sound position to post going forward, and writes of the company, “Although the growth trajectory is proving to be lumpier than expected due to the timing of new contracts and renewals, we believe BlackSky’s core defense & intelligence business remains robust (vs. commercial markets seeing adoption/ wallet headwinds). Management signed multiple new contracts with international defense ministries this year and should close several large deals in the back half. Furthermore, the margin inflection remains on track with positive Ebitda in 4Q23, even if sales come in at lower end of guidance, demonstrating a high incremental margin (80-90%) and prudent cost execution.”

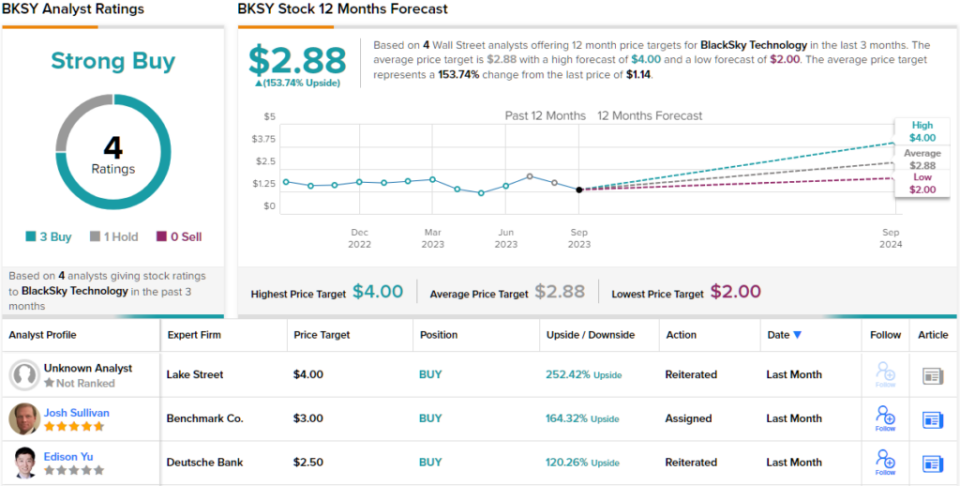

To this end, Yu places a Buy rating on BKSY, along with a $2.50 price target that points toward a robust upside potential of 120% for the next 12 months. (To watch Yu’s track record, click here)

The Street is generally sanguine about BlackSky, as shown by the Strong Buy consensus rating supported by 4 reviews with a 3 to 1 breakdown favoring Buy over Hold. The shares are selling for just $1.14, and their $2.88 average price target suggests ~154% upside for the coming year. (See BlackSky stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link