CRV holders breathed a collective sigh of relief yesterday when Curve’s founder, Michael Erogov, paid down the last of his debts on Aave.

On Sept. 27, Egorov deposited around $11M worth of USDT to Aave v2, paying down all of his outstanding debts to the protocol.

According to Debank, Erogov still has $42.7M in outstanding stablecoin debts across the Cream, Inverse, Fraxlend, and Silo lending protocols. However, the loans are currently backed by $132.5M worth of CRV, meaning CRV would need to lose around two-thirds of its value before threatening Erogov’s existing positions with liquidation.

CRV is down 2% in the past 24 hours, last changing hands for $0.51. The token is down 59% from its 2023 high in February.

CRV/USD chart. Source: CoinGecko.

In June, Erogov’s loans were flagged by Gauntlet, a risk management firm. Gauntlet advised that Aave v2 move to freeze its CRV market and prevent the token from being used as collateral for new loans taken out from the protocol.

While Gauntlet’s initial proposal was rejected by AAVE holders, a follow-up proposal passed in August as the crypto market downturn intensified the risks posed by Erogov’s position.

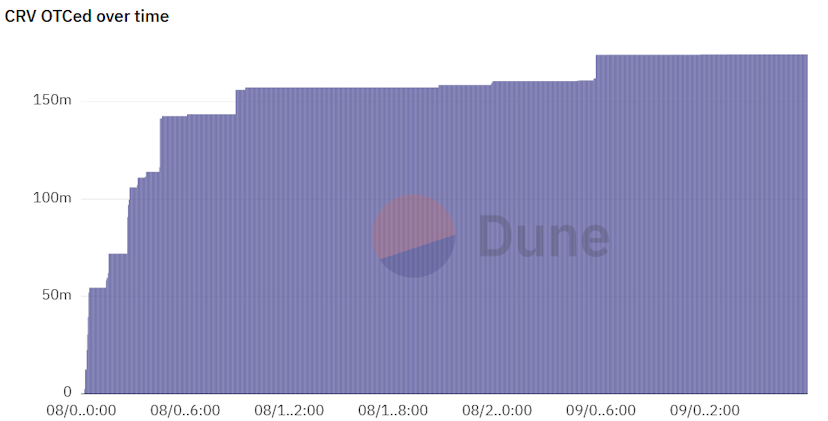

With Erogov’s loans set to face liquidation with a 40% drawdown, Curve’s founder began selling his collateral assets in large private deals in early August. Buyers took control of large CRV tranches subject to a vesting schedule in exchange for stablecoins, with Erogov using the funds raised to reduce his DeFi debts.

Following the latest sale on Sept. 1, Erogov had offloaded more than 174M CRV tokens.

Credit: Source link