Bitcoin plunged 5% to $65,000 after yesterday’s $300 million in GBTC outflows.

After ending March on a high note, crypto markets are ringing in the new month with a bout of volatility.

Bitcoin is down nearly 9% in the past two days, selling off sharply after staging its highest monthly close ever on March 31.

Meanwhile, Ether has plummeted 11% from yesterday’s high of $3,650 and currently changes hands for $3,225. Overall, crypto’s market capitalization is down 5.3% to $2.6 trillion, according to Coingecko.

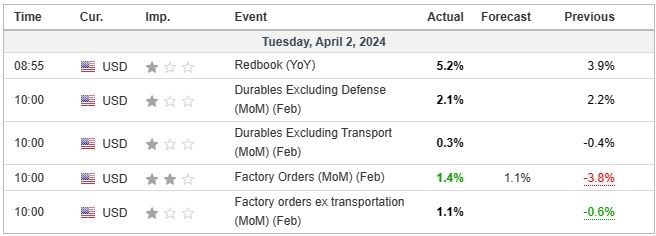

Global markets turned lower as the Dollar Index (DXY) hit a six-week high earlier today, driven by better-than-expected U.S. manufacturing data. Notably, gold spiked to an all-time high of $2,260 per oz. before retreating.

Strong economic signals decrease the likelihood of the Fed cutting interest rates, which in turn dampens investors’ risk appetites. The S&P 500 and the Nasdaq are down more than 1% on the day.

With the majority of the top 100 digital assets down in the past 245 hours, Bittensor, Core and Litecoin have managed to post gains of 5% or more.

Layer 1 blockchains Aptos and Sui are the day’s biggest losers, dropping 11% and 12%, respectively. Meanwhile, popular memecoins Dogecoin, Bonk, and Pepe are down 8% or more.

Credit: Source link