Ether briefly topped $4,000 for the first time since December 2021.

Bitcoin broke through its previous record high and traded above $70,000 early Friday.

The milestone was short-lived, however. BTC dropped from an intraday high of $70,168 to $67,045 in a matter of minutes – highlighting the notorious volatility that characterizes the asset.

Notwithstanding today’s roller coaster, Bitcoin has been on an unstoppable uptrend, driven by two main events: spot Bitcoin ETFs and the upcoming halving.

According to Bloomberg’s senior ETF analyst, Eric Balchunas, in 7 weeks, Bitcoin ETFs have captured inflows that took gold ETFs three years. The nine ETF providers cumulatively hold over $50 billion in assets under management and own 4% of Bitcoin’s total 21 million supply.

Bitcoin analyst Dylan LeClair noted today that by 11:00 am EST, BlackRock’s IBIT fund had already surpassed its Mar. 07 trading volume. “Patience, degens. They’re literally coming with tens of billions of dollars,” he wrote.

Balchunas echoes his views, highlighting a truly impressive number and claiming, “something is in the water again.” The ten Bitcoin ETFs are on pace to beat Tuesday’s $10 billion in volume, with BlackRock doing $1 billion an hour. “A billion a day is big boy level,” he said.

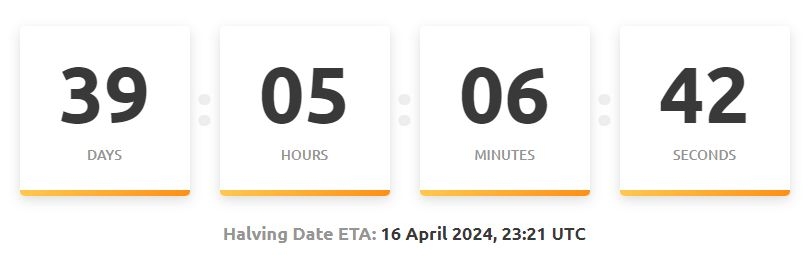

The second event is the halving, expected in mid-April. Usually, Bitcoin begins to run up prior to the event as market participants anticipate less supply available – although fuelled by the ETFs, the rally has been much more dramatic this cycle.

Notably, this is the first time Bitcoin has broken its previous all-time high before a halving.

“Quantitative hardening” as some call it, is set to occur around Apr. 16.

Start for free

Market-wide Volatility

Wild price swings were seen across most major digital assets.

Ethereum, the second-largest crypto, had its own brief time to shine today as it topped $4,000 for the first time since Dec. 2021. Surpassing the level by a few dollars, it dropped back down to $3,883 minutes later.

Ether has gained a whopping 65% in the past month, outperforming Bitcoin by nearly 10%.

Catalysts for ETH include the imminent Dencun upgrade and the potential approval of a spot ETH ETF, with financial firms lining up their applications with the SEC. Other indicators are also shining bright, with DefiLlama reporting that DeFi’s total value locked topped $100 billion for the first time since May 2022. It has since dropped to $96 billion.

Some might be suffering from bear market PTSD, but all signs indicate a healthy bull run. Since Feb. 1, the entire crypto market has gained $1 trillion in market cap, according to Coingecko.

Memecoins are another indicator of the sentiment in the crypto market. They have been popping off, with Solana-based tokens garnering the most attention from traders.

In fact, four of the top five categories with the most gains in the past seven days relate to memes. These include cat-themed tokens, dog-themed, fractionalized NFTs, and memecoins.

The bull run is clearly rolling on, but some are quick to point out how traders’ attitudes could stymie otherwise easy gains.

“Maybe if all these degenerates would stop getting long with historically high funding rates and 100x leverage we wouldn’t see a flush every time Bitcoin reaches a high,” posted Scott Melker, a popular crypto trader.

Credit: Source link