Crypto markets had a shaky start to the week ahead of US inflation data and potential asset sales by the failed FTX crypto exchange.

Most digital assets ranked among the top 20 by market capitalizations slumped between 2% and 4% on Monday, with Bitcoin dropping 2% to $25,000 and Ether tumbling 3.5% to $1,560.

Solana (SOL), the largest cryptocurrency on FTX’s balance sheet, shed 9% over the past seven days. Other notable FTX holdings Ripple (XRP), Aptos (APT), and BitDAO (BIT) are similarly down 6.7%, 8.7%, and 9.5% respectively. A U.S. court is expected to deliver a verdict on Sept. 13 regarding FTX’s proposed plans to begin selling assets.

For comparison, most top ten cryptocurrencies pulled back by between 4% and 5% over the same period. The US Bureau of Labor Statistics will release inflation figures for August on Wednesday morning, and investors will be looking at the data to try and predict the Fed’s next rate decision on Sept. 20.

On Monday, FTX submitted a court filing breaking down the crypto holdings of FTX, FTX.US, and its sister trading firm, Alameda Holdings, as of Aug. 31.

SOL is the largest position at $1.16B, followed by $597M worth of BTC and WBTC, $229M in ETH and WETH, $120 million in USDT, and $119 million of XRP. Holdings of $49M in BitDAO (BIT) and $46M of Stargate (STG) round out FTX’s ten largest positions — making up 72% of FTX’s $3.4B digital asset portfolio.

Fortunately for SOL investors, the massive tranche of tokens is subject to a vesting schedule, meaning the tokens will steadily enter supply over the coming years. Roughly 34.5M SOL will unlock monthly until 2028, with an additional 12M SOL unlocking each month until Sept. 2027, according to Xangle. A final tranche of 7.5M SOL can be sold in 2025.

DeFi Downtrend Persists

The combined capitalization of DeFi assets slumped 6.8% over the weekend, according to CoinGecko.

The majority of the sector’s top tokens by market cap lost value over the past seven days, including 12 assets with a loss of more than 7.5%. Five tokens bucked the trend with double-digit gains, including Tellor (TRB), Flamingo (FLM), and Perpetual Protocol (PERP) with rallies of more than 40%.

The total value locked (TVL) in DeFi assets also continues to decline, with TVL falling $2B to $36.5B over the past two weeks. DeFi TVL is now down 31% since mid-April.

Layer 2 Throughput Hits New Record

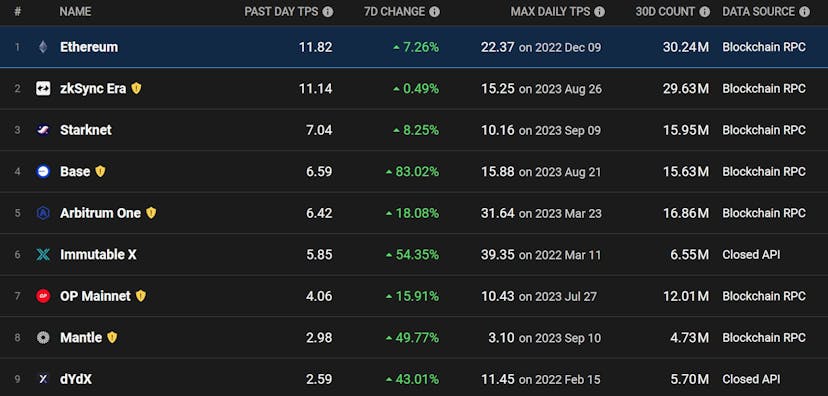

Ethereum’s L2 ecosystem continues to grow despite the downtrend, with combined Layer 2 throughput posting an all-time high of 55.4 transactions per second (TPS) on Sept. 10, according to L2beat.

While the milestone came one day after Starknet posted a high of 10 TPS amid renewed airdrop speculation, L2 activity is up across the board. The throughput of the top eight Layer 2s is each up compared to one week ago, with Base, Immutable X, Mantle, and dYdX all up more than 40%.

Credit: Source link