Beginner’s Guide

Photo credit: classicexhibits.com

When you first have your SSN with no credit history, you should definitely start building your credit history. Yet, you are probably not qualified for most credit cards with best rewards. But don’t be worry, there are some great rewards cards that are designed for people (especially students) with no credit history. Here are the most recommended credit cards for newbies with no credit history.

Application Link

Features

- $200 offer: earn $200 after spending $1,000 in first 3 months. Note that you can only get this sign-up bonus if you apply online, you won’t get it if applying in branch. The highest offer on this card is $200.

- Earn 3% cash back in the category of your choice:

- online shopping + cable/streaming/internet/phone plan

- dining

- travel

- gas + EV charging

- drug stores

- home improvement/furnishings

I recommend you to choose the “online shopping” category because it covers a very broad range of purchases (see this official webpage about which merchants count). And earn 2% cash back at grocery stores and wholesale clubs (e.g. Sam’s Club). Earn 1% cash back on other purchases.

- BoA Preferred Rewards program: If you have checking/savings/brokerage account in BoA or Merrill Edge, you can earn additional cashback based on the amount of asset. Earn additional 25% rewards if you are in Gold tier ($20k or more in balance); 50% if Platinum tier ($50k or more in balance); 75% if Platinum Honors tier ($100k or more in balance).

- No credit history needed, as long as you have certain amount of deposit in Bank of America (BoA) Checking Account. If you have no credit history, you need to go to the branch to apply.

- No annual fee.

Disadvantages

- Foreign Transaction Fee.

Summary

The 3% cashback on online shopping is decent, because the range is very wide. The cap of 3% cashback is a bit small. However, it’s still worth applying if you have zero or very limited credit history. You have to go to a branch to apply if you do not have any credit history, note that you will not get any sign-up bonus applying in branch, but don’t care about the bonus for your first credit card. You could switch to other credit cards with better rewards once you have enough credit history.

Application Link

Features

- $25 offer: earn a $25 statement credit after signing up for automatic payments within the first 3 months.

- Earn 1.5% cash back on everything.

- Although this card is advertised as a cash back card, it actually earns Ultimate Rewards (UR) points. We estimate that Ultimate Rewards (UR) points are worth about 1.6 cents/point, see the post for a brief introduction. So the 1.5x UR earning rate is worth about 2.4%!

- No annual fee.

Disadvantages

- It has foreign transaction fee, so it’s not a good choice outside the US.

Summary

This is a card designed for people with no credit history by Chase. Although sign up bonus is not great, this card has a decent earning rate as your first credit card. I guess after one year you can also convert it to better cards such as Chase Freedom Flex (CFF) or Chase Freedom Unlimited (CFU).

Application Link

- Discover it. Through this link, you might see the application page for either Discover it or Discover it for Students. Actually these two are equivalent: no matter which application page do you use, if you choose “College Student” as employ status, you will get Discover it for Students; if you choose other employ status, you will get regular version Discover it.

Features

- Earn $50 after first purchase within 3 months. You have to use our link or you friend’s referral link to get the $50, the official application link has no sign-up bonus.

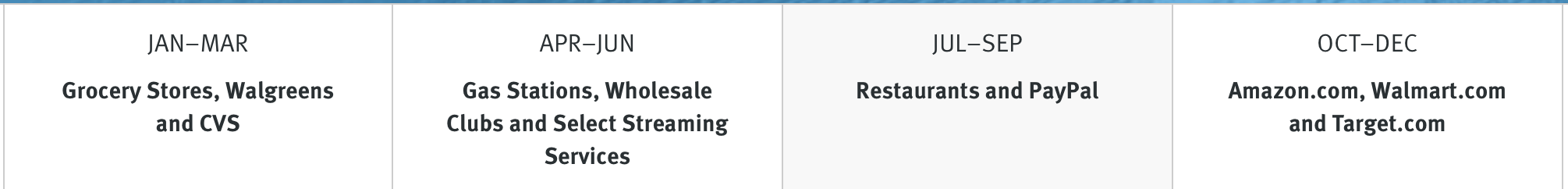

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter, 1% cash back on all other purchases. You need to activate the 5% cash back beforehand each quarter. New categories every quarter. The 5% bonus categories for 2021 are:

- Double Cash Back: Double all cash back you’ve earned at the end of your first year, including the 5% bonus category, sign-up bonus, Discover Deals, refer bonus! The double part will be credited to you after the first year.

- No credit history needed.

- There are some pretty good discounts if you shop online through Discover Deals, such as 5% cash back at Apple Store.

- Refer a friend: You can earn $50 for every approved account you refer, up to a maximum of 10 approved referrals ($500) per calendar year. Considering the Double Cash Back promotion in the first year, you can actually get $100 for every approved referral, and up to a maximum of $1000 per calendar year!

- No foreign transaction fee.

- No annual fee.

Disadvantages

- Only first $1,500 purchases per quarter on bonus categories can earn 5% cash back, after that you can only earn 1% cash back.

- This is a Discover card, which is not as widely accepted as Visa or MasterCard.

- Credit limit for Discover it for Students may be VERY low, and it’s hard to get the limit increased.

- 5% bonus categories may not be correctly identified abroad when using some partner networks like UnionPay.

Summary

This card is a nice card. Everyone should get it for its 5% cash back in rotating categories and no annual fee. Besides, Discover Deals sometimes have pretty good discounts.

Conclusion

| BoA Cash Rewards | Chase Freedom Rise | Discover it | |

|---|---|---|---|

| SSN required? | No | Yes | Yes |

| Required to go to a local branch if no SSN? | Yes | Yes | No |

| Cashback rate? | Good | Normal | Very good |

| Has foreign transaction fee? | Yes | Yes | No |

| Acceptance? | Everywhere | Everywhere | A little limited |

BoA Customized Cash Rewards (SSN not required), Chase Freedom Rise, or Discover it are all good choices as your first credit card. If you are a foreigner and can’t obtain SSN in a short time, then BoA Customized Cash Rewards is the one for you. If you don’t want to go to a local branch and only want to apply online, then Discover it is the main choice. As your first credit card, you don’t need to pay too much attention on sign up bonus. The purpose of the first card is to start building your credit history. Note that you shouldn’t apply for ALL of the cards above. You only need one, and then use it regularly and wait for a year or so, then the whole credit card world will be open for you.

Let’s start the journey of credit cards!

If you like this post, don’t forget to give it a 5 star rating!

Credit: Source link