DAYTONA BEACH SHORES, Florida – Tom Baker lives in a retirement dream building: A spacious three-bedroom beachside condo with unobstructed morning sunrises, waves marking the time and the soft sand of comfort.

The retired Marine and Army veteran and his wife Joan moved here from the Tampa Bay area. She had a Daytona Beach timeshare they regularly visited. Ten years ago they moved to their retirement home: a fourth-story condo on the Atlantic Ocean.

“I absolutely love Daytona Beach,” he said. “I absolutely love where I live, and I love this building.”

So why does he seem so angry? Two words: Property insurance.

For Baker and many other Florida condo owners, the very concept of insurance – to ease worries during times of distress – seems lost, especially after the 2021 collapse of the Champlain Towers South in Surfside and the two-punch combo of the 2022 hurricane season: Ian and Nicole.

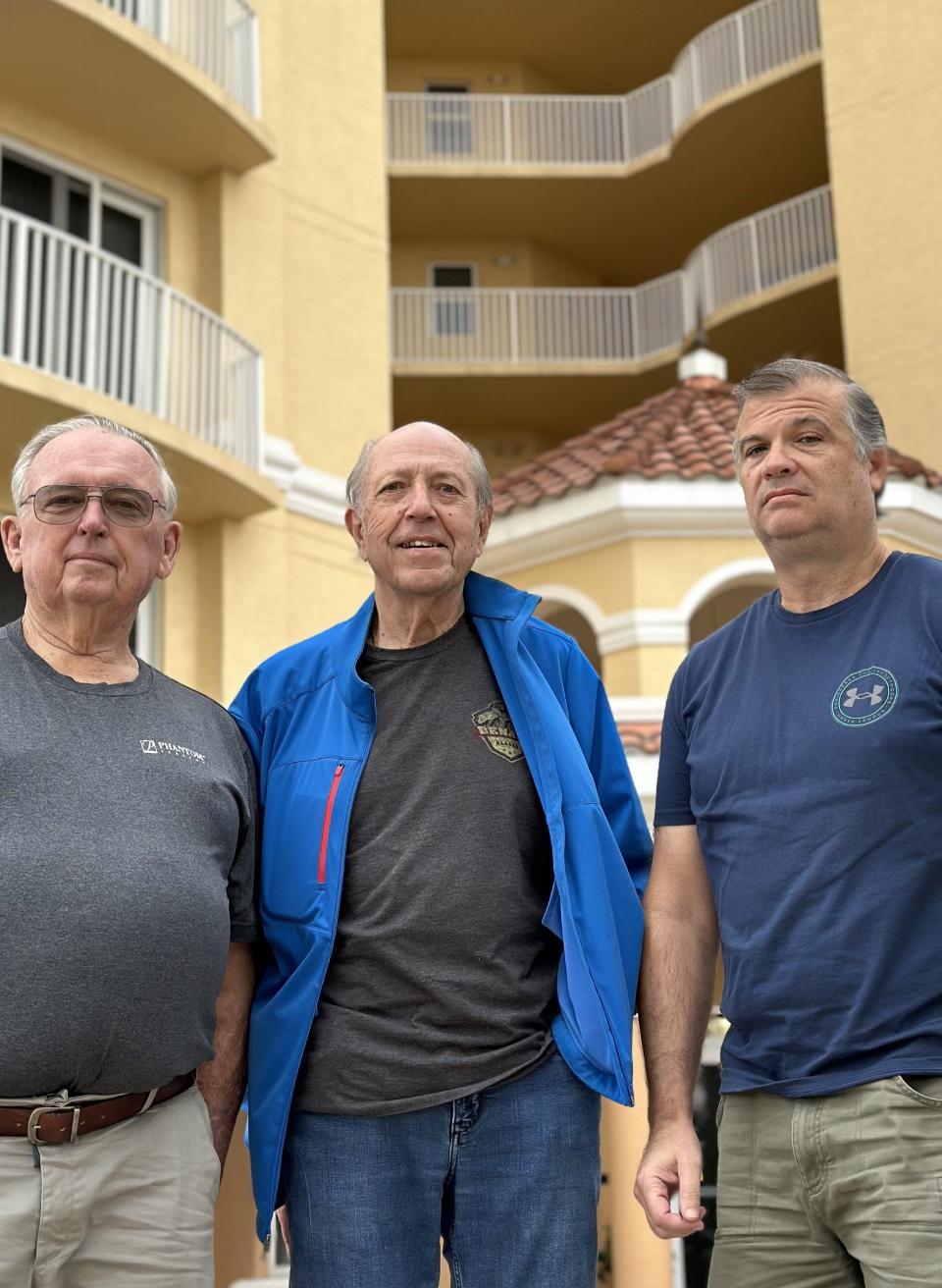

The latter storms just over a year ago pounded a seawall outside the Marbella Condominiums, then destroyed a pool and deck area. And the Surfside disaster, which killed 98 people, shined a light on structural safety, delayed maintenance and the need for the state to enact more strict regulations to prevent future collapses.

As bad as all of that was, for Baker, the real disaster arrived in December 2022: the property insurance bill for Marbella, where he serves on the condo association’s board.

For the 24-unit building, property insurance jumped from $40,534 for 2022 to nearly $269,000 – a 563% increase. And Rob Lasch, another Marbella board member, said he’s expecting another increase when the policy offer arrives, which could be any day now.

And the increase came in spite of a history of Marbella, which was built in 2007, never having filed a claim, Lasch and Baker said. There was no claim filed for the $2 million damage on the condo’s ocean-facing deck.

“Nothing got paid out for the damage outside because it was the seawall, and nobody was insuring the seawalls,” Lasch said.

So Marbella residents are getting hit hard on both sides of the hurricane. They’re having to come up with the full amount to fix the damage, while also bearing the burden of increased rates.

Baker said his wife wants to move, leaving him to contemplate simply not buying property insurance for the building – something his fellow board members don’t support because it violates Florida law and would leave the board members personally exposed to lawsuits.

“In a minute, I wouldn’t pay another dime in property insurance, because it is illegal, it is immoral, and it’s wrong. You can’t justify this payment. This is out-and-out stealing. Theft,” he said. “And excuse me for being passionate. I am pissed.”

Other condo owners also see exponential rate hikes

Marbella isn’t alone. Many condo associations across the state have said they, too, have faced astronomical property insurance rate hikes.

Right next door, the 109-unit Grand Coquina Condo went from paying $207,000 for property insurance in 2022 to $680,000 for 2023, a 228% increase, said Jeff Sussman, the association’s treasurer.

That amounted to a $2,331 additional assessment per unit this year, while Sussman projects another assessment of between $3,000 and $6,000 per unit will be required in 2024.

Grand Coquina filed a claim seeking reimbursement for water damage its board members contend was caused by wind during the storms. The claim was denied, said Marro Porcelli, president of the Grand Coquina Condo Association Inc.

Grand Coquina hired an attorney and a structural engineer to challenge the denial. Board members expect they will receive a settlement offer.

“There’s a lot of fight left in us,” Porcelli said. “We’re not giving in to the criminals.”

Marbella is relatively new, built 15 years ago under strict building codes. As a result, it stands on 42 pylons that are 40 feet long and reach down to the hard core beneath the sand, Smith said.

In other words, residents there are confident if the building itself could withstand Ian and Nicole, it’s unlikely to crumble anytime soon.

And Smith said the deductible for any disaster is $1 million.

That leads Baker to question what the insurance is actually covering.

‘We don’t have insurance. We have an insurance bill’

“If a tornado came across this building and ripped the roof completely off, our deductible is more than the repair. If an atomic bomb goes off downtown, and blows this building down, we don’t collect because of the war clause,” Baker said.

“There is no way this building can collect,” he said. “This is a concrete building with sprinklers. You couldn’t burn the damn thing down if you built a bonfire inside. We do not have insurance. We have an insurance bill.”

Baker has written to all 160 state lawmakers as well as 15 news organizations about the plight of condo owners. He went to Tallahassee during this year’s session.

“I learned something a long time ago in the military,” he said. “If you make a complaint, have a suggestion on how to fix it, OK?”

He’s proposed dropping the requirement that condos purchase insurance. And he’s also talked about condos finding a way to self-insure.

Mostly, Baker said his pleas have been ignored.

Baker met with Rep. Tom Leek, R-Ormond Beach, who was receptive to at least one of his ideas. The office of Sen. Jason Pizzo, D-Sunny Isle Beach, responded to a packet of information Baker mailed to all lawmakers. But otherwise, he’s heard nothing.

Baker said he’s most disappointed in Sen. Tom Wright, R-New Smyrna Beach, who represents Daytona Beach Shores.

“For one year, I’ve been trying to get an appointment with Sen. Wright,” Baker said. “I even went to his office. He walked right past me. He didn’t extend me the courtesy of shaking my hand.”

Wright did not respond to a request for comment.

Leek, whose district includes Daytona Beach Shores, likes at least one of Baker’s ideas.

Is self-insuring a good idea?

“We are actively finding ways to help the Florida consumer, and allowing condominium associations to self-insure is a good idea. In fact, measures that increase competition in the insurance market and drive more carriers into Florida will benefit consumers,” he wrote.

Mark Friedlander, Florida spokesman for the Insurance Information Institute, said Florida has long had a complicated relationship with property insurance, and it got more challenging with the Surfside collapse and the hurricanes of 2022.

Many of the insurers that offer condo coverage started to pull back from the Florida market due to increased risk at the older coastal properties, Friedlander said in an email.

“The insurers that remained enhanced their underwriting criteria. This began the trend of significant premium increases for master association coverage,” he said. “Insured losses incurred from substantial property damage generated by hurricanes Ian and Nicole last year further impacted the availability and cost of master condo insurance,” Friedlander wrote.

In addition to “master policy costs” shared among all condo unit owners, individual condo owners living in high-risk properties are seeing their condo unit policy premiums increase substantially – 50% to 100% on average, he added.

Over the past two years, the Florida Legislature has passed a flurry of changes with the goal of resolving the property insurance crisis, so far to no avail.

Some of those measures include tweaking regulations related to Citizens Property Insurance Corp, the state-run insurer of last resort, authorizing actions to be taken by the Florida Office of Insurance Regulation, and cracking down on bad-faith claims.

In an early November special session, lawmakers allocated $181.5 million to the My Safe Florida Home Program, which provides homeowners a wind-mitigation survey and grant funds to make homes more sturdy.

Leek said he’s confident that what lawmakers have been doing has been done is working.

“The Legislature’s insurance reforms are taking hold,” Leek wrote in response to questions. “New carriers are entering the Florida insurance market for the first time in years. Just this month, a new carrier entered the Florida condo association insurance market.

“It’s happening and it does take time, and we will continue to work to provide a climate of competition and choice,” he wrote.

Friedlander also referenced the new carrier as a positive sign: “Last week, Florida’s insurance regulator announced that a new insurer, the Condo Owners Reciprocal Exchange, will be entering the state’s market in 2024 and provide master condo policy coverage to associations. We hope this will be a first step toward stabilizing the market for this coverage.”

Condo owners socked with $64,000 in assessments

As a result of both sides of the property insurance problem – high rates and being awarded no claims for the damage, Marbella condo owners have each paid approximately $64,000 in HOA fees and assessments in 2023, said board President Jim Smith.

Baker acknowledges beachside condo owners – particularly those who have thus far been able to absorb the high insurance bills and the assessments to pay for damages – probably don’t attract much sympathy in Florida.

“Now us rich son-of-a-bitches, pardon me, we can manage somehow and get away with it,” he said.

But other condo owners have had their retirement dreams dashed, moving because of the high costs, while an exodus awaits if the problem isn’t contained, association board members say.

They appreciate what Baker has done to raise awareness of the problem.

“He’s taken this on, and he’s very passionate about it,” said Jim Smith, the Marbella Condo Association Board president.

Baker said: “People who moved down here on fixed incomes and bought themselves their final place now find themselves with an impossible bill.”

Answers: What’s going on with the stalled condo high-rise on A1A in Daytona?

This article originally appeared on The Daytona Beach News-Journal: Daytona Beach Shores condo owners call 563% insurance increase ‘theft’

Credit: Source link