Bringing traditional financial assets onto public blockchains has long been a goal for many in the crypto space.

To that end, major players including Coinbase, Circle, and Aave Companies have formed the Tokenized Asset Coalition (TAC) to serve as a steward of the burgeoning space.

Lucas Vogelsang, CEO and co-founder of Centrifuge, a founding member, sees the coalition as an effort to accelerate what he sees as finance’s next evolution. “We’re trying to work together to make this technology mature faster,” he said. “Ultimately it’s [about] growing the pie.”

The move comes as real-world assets (RWAs) have been one of the few bright spots in the bear market.

While major digital assets like BTC and ETH are down substantially from their all-time highs, subsectors of the RWA space like tokenized Treasuries have grown nearly 500% to well over $600M this year.

The newly formed TAC will focus specifically on onboarding institutions into the tokenized asset space, reads a charter for the organization. According to Vogelsang, there will be a focus on education.

“Two years ago, the majority of people in finance thought about crypto as a crazy volatile asset class,” he said. “Over the last few years, the visionaries have understood that no, actually, this is the internet for finance.”

The TAC will hold its inaugural Real World Asset Summit on September 19 in New York. When asked about his hopes for the event, Vogelsang referenced early events in 2018 attended by the founders of now-influential protocols like Aave, Compound, and Maker.

“A lot of the ideas or key decisions that were set into motion back then ended up being hugely influential in what happened in DeFi Summer 2019,” the CEO said. Vogelsang has similar aspirations for TAC’s events — “I think we have this opportunity to innovate here together and push this forward.”

Other founding members of the coalition are Goldfinch and Credix, which are focused on credit markets, RWA.xyz, an analytics platform, and Base, the recently launched Layer 2 network from Coinbase.

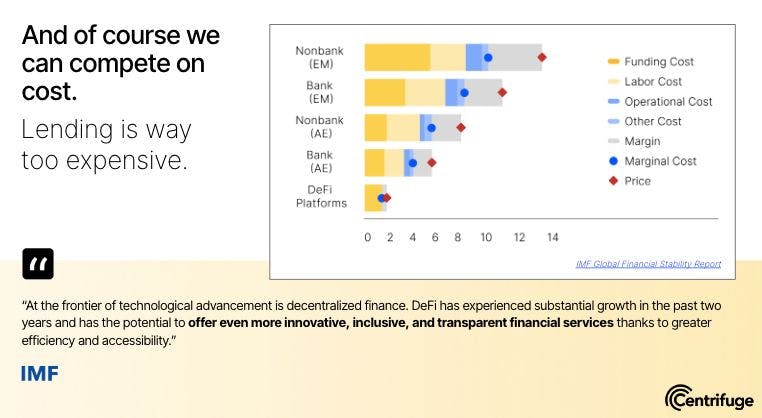

Cost Savings

Vogelsang thinks there’s a simple case of cost savings which the coalition can make to institutions.

He referred to a slide from the EthCC conference based on an IMF Financial Stability Report to make the case for the efficiency of DeFi lending.

The CEO emphasized the potential for increased liquidity across asset classes as an additional advantage of on-chain finance, which the coalition will promote moving forward.

“We have a pretty big dream and it’s becoming more real, but it’s obviously not something we’re going to do on our own,” Vogelsang said.

Credit: Source link